Adani: US index major MSCI lowers weightage of 4 Adani stocks – Times of India

Earlier during the day, MSCI said that it had cut free float assessment of Adani Enterprises, Adani Total Gas, Adani Transmission and ACC. The move, effective from March 1, will reduce the combined weightage of the four Adani stocks in MSCI’s Global Standard Index. Market sources said about $60 billion worth of exchange traded funds (ETFs) are benchmarked to this index.

Adani stocks are in MSCI’s India, Asia, emerging markets and all-country world stock indices. As of January 30, the four Adani stocks had a combined weightage of 0.4% in the MSCI Emerging Markets Index.

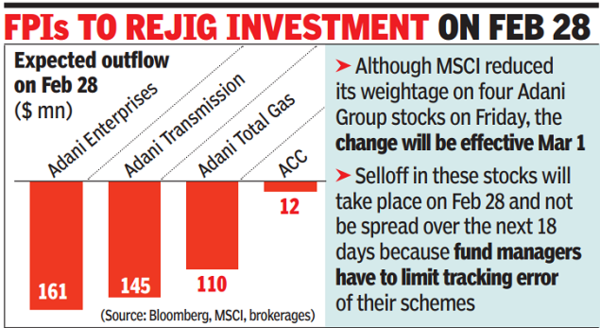

According to broking house estimates, foreign investors could pull out $430 million from the four Adani stocks following the lower MSCI weightage.

MSCI re-evaluated the weightage as the free float of the four Adani companies available for trading in public markets for international investors were lower than it had thought. On Thursday, MSCI had signalled it will change the weightage of Adani stocks in its indices. It had said certain investors in Adani stocks “should no longer be designated as free float” in accordance with its methodology and after receiving feedback from “market participants”.

On Thursday, an Adani Group spokesperson declined to comment on MSCI’s decision to review the free float factors of the group’s stocks in its indices.

While MSCI changed the free float size of four Adani stocks, it has made no change to the four others in the MSCI indices. These are Adani Green Energy, Adani Ports & Special Economic Zone, Adani Power and Ambuja Cements.

The MSCI cut has brought the Hindenburg Research report back into focus. The Ahmedabad-based ports-to-power group, whose stocks account for more than 3% of MSCI’s India index, has denied Hindenburg Research’s claims in the report.

Hindenburg founder Nathan Anderson, following MSCI’s move to review the weightage of Adani stocks, said on Twitter on Thursday, “We view this as validation of our findings on offshore stock parking by Adani.”

Hindenburg’s accusations have wiped off about Rs 9.7 lakh crore, or nearly $118 billion, from Adani Group’s market capitalisation. On January 24, a day before the Hindenburg Report was published, its total market cap was Rs 19.2 lakh crore. On Friday, the group lost nearly Rs 33,000 crore worth of its market value.

For all the latest business News Click Here