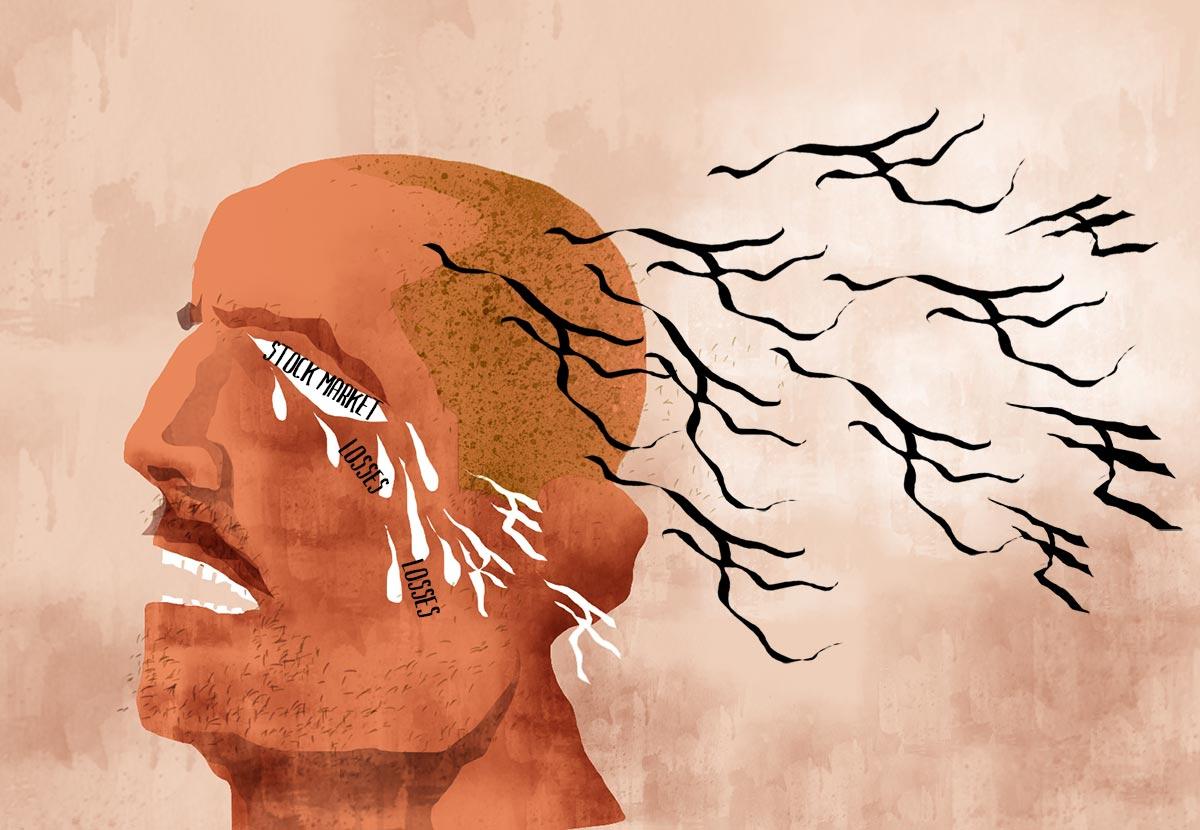

Will Markets Fool Majority Once Again?

There are overvaluation and excesses in many pockets of the market.

This is most obvious in the IPO market, where loss-making companies have inflicted large losses on investors, observes Debashis Basu.

Stock markets all over the globe have come a long way from the sudden crash in late March and early April 2020, when the pandemic brought the whole world to a standstill.

But the markets kept rising like a Phoenix, braving severe lockdowns, high unemployment, business closures, the migrant labour crisis, a complete shutdown in the travel and entertainment businesses, worries about the uncontrolled rise in bad debts, etc.

This miracle occurred partly due to stimulus packages unleashed by governments and partly because most businesses were allowed to resume operations in June 2020 and many saw their costs going down due to lower overheads and travel.

Then came the quarterly results, which dispelled any notions of a slowdown.

Indeed, by September 2020, India Inc. was displaying the kind of vim and vigour that had been missing for years.

In other words, everyone was fooled by the feared impact of the pandemic.

As the months progressed and one year since the hard, national lockdown rolled past, only armchair commentators, with no skin in the game, remained sceptics.

Some predicted another crash in prices, but professional investors got busy making money.

More importantly, a combination of factors unleashed a tsunami of retail participation in the Indian stock markets — from 40.8 million demat accounts opened in the two decades till 2019-20, the figure jumped to 74 million in 20 months at the end of November 2021.

A second pandemic wave with horrific stories of oxygen shortage dampened this speculative fervour only a little.

As the second wave receded, the markets rose again.

However, just when everyone seemed to be convinced that the markets were bound to keep rising every quarter and every year, as though it’s our birthright to expect this, they seem intent on fooling us again.

On October 19, the indices hit their all-time high and started to drop over the next two months.

A strong upmove in late December and early January ignited hopes of another rally to an all-time high but this time, it was met with massive selling from January 18 onwards.

The immediate cause is the sharp fall in the US markets, in turn caused by policy changes announced by the US Federal Reserve, which is worried by the steep rise in inflation.

The US consumer price index climbed 7 per cent in 2021, the largest 12-month gain since June 1982, according to the data released on January 12.

The US Fed has hinted it may raise rates this March, while Bank of America thinks there could be as many as seven hikes this year.

In addition, it is likely to start shrinking the central bank’s holding of over $8 trillion in US government bonds and mortgage-backed securities.

These two moves would reduce liquidity and increase interest rates.

The immediate fallout, according to conventional wisdom, is that money would move out of risky assets like stocks, with the riskiest stocks — small-cap, tech, and emerging markets — getting hit the most.

However, this is common knowledge among investors now, and the markets rarely do what is expected of them.

Besides, the reality of the marketplace is far more complex than the simplified one offered up for public consumption by media headlines and opinion pieces.

So, what could be the true impact of the major policy shift announced by the US Fed?

We are already witnessing the initial knee-jerk reaction in the form of indiscriminate selling of stocks over the past 10 days.

Even institutional investors tend to succumb to simplified correlations like: Fed hike, sell stocks.

This will certainly take some froth out of the market since in the 18-month bull market too many stocks have been pushed far beyond reasonable valuations.

Cyclical stocks have been valued as growth stocks, while small-cap stocks with slightly improved earnings have relentlessly risen.

Large-cap stocks, especially in consumer goods, with average growth prospects, have been pushed up to stratospheric heights.

There are overvaluation and excesses in many pockets of the market.

This is most obvious in the initial public offering market, where loss-making companies like Paytm, CarTrade, Zomato, and Nykaa have inflicted large losses on investors.

This is a cycle that plays repeats: A bull market induced by an easy money policy, indiscriminate valuations, excesses in adjacent markets (this time in new markets such as crypto-currencies, non-fungible tokens, private equity, and so on), and eventual big declines in asset values.

This is playing out all over again.

Depending on how things unfold, stock prices could head too far in the opposite direction.

This is not necessarily a given, as many market commentators are predicting, but is a possibility.

Unfortunately, the markets today have millions of new investors with no investing experience and behavioural fortitude to separate the wheat from the chaff, to ride out the declines, and possibly buy quality stocks if they are available at lower prices.

It is their actions, like that of newbie drivers on the road, that will determine the immediately trajectory of the markets, even as the markets try to fool the majority once again.

Debashis Basu is the editor of moneylife.in.

Feature Presentation: Aslam Hunani/Rediff.com

For all the latest business News Click Here