Why debt funds may work better for you than FDs – Times of India

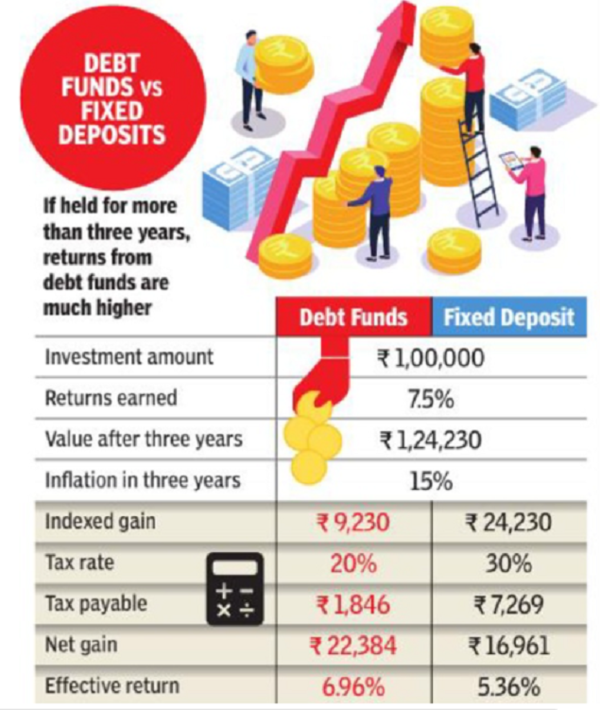

If your investment horizon is more than three years, debt funds are a better alternative. If debt funds are held for more than three year s, the gains are classified as longterm capital gains and taxed at 20% after indexation. Indexation takes into account the consumer inflation during the holding period and accordingly raises the purchase price of the asset to adjust for inflation. As a result, the effective tax rate for mutual fund investments ismuch lower than the outgo on fixed deposits.

Using Indexation Benefit

If held for longer periods, the indexation benefit is higher. If you invested in a debt fund in March 2020 and redeemed it in March 202 3, you would get the benefit of three years. But if you wait for a few days and redeem the investment after March 31 in the new financial year, you will get an additional benefit of one more year. This is why savvy investors stock up on debt funds and bonds just before the financial year ends.

Setting Off Gains Against Losses

The gains from these funds can be set off against shortterm and long-term capital losses on other investments. So, if you made losses in stocks or gold, you can adjust them against the gainsfrom debt funds.

No TDS On Redemption

There is also no TDS in debt funds. In fixed deposits, if the interest income exceeds Rs 40,000 in a year, the bank deducts 10% TDS. A taxpayer who is not liable to pay tax will have to submit eithe r Form 15H or 15G to escape TDS.

Greater Liquidity And Flexibility

Debt funds can be redeemed with the click of a mouse. When you redeem your investment, the money is in your bank account the next day. Fixed deposits can also be prematurely closed, but you g et a lower rate of interest. Also, debt funds allow partial withdrawals, unlike FDs, where the entire investment is closed.

For all the latest business News Click Here