These Are The Worst Offenders When It Comes To Helping Individuals Hide Wealth; US Tops List

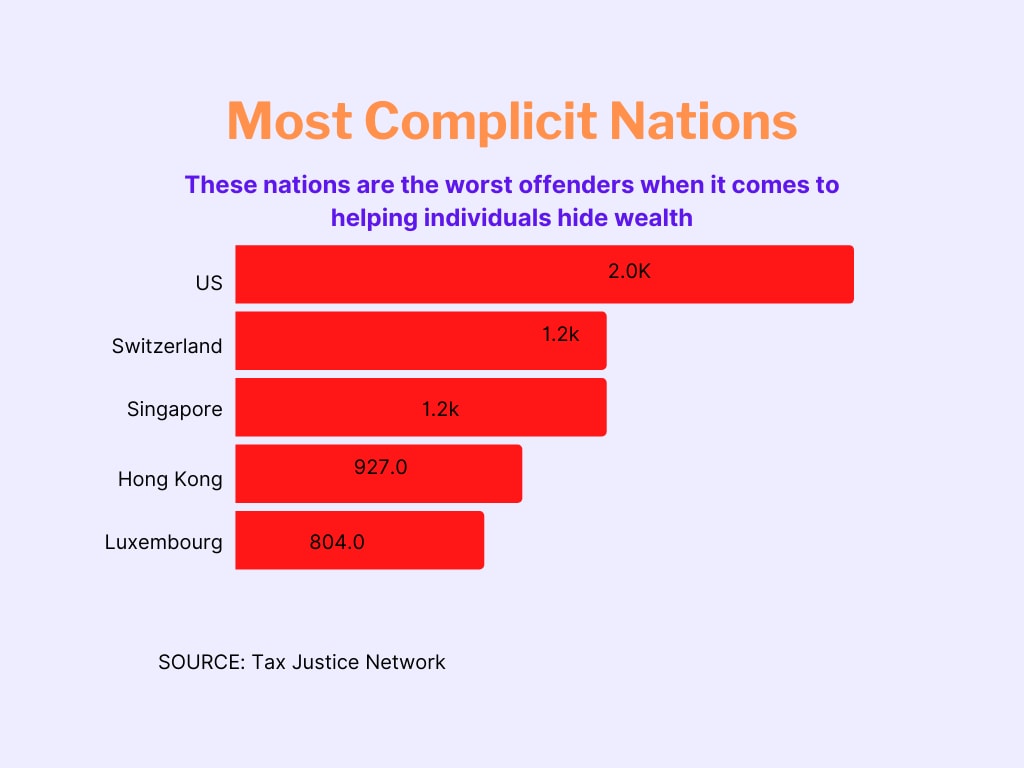

A research by the Tax Justice Network revealed that the United States is the most helpful for individuals who are looking to hide their wealth.

The Tax Justice Network ranked countries by extent of how much their financial and legal systems help individuals conceal their ownership of assets.

The research shows that the US has increased supply of financial secrecy to such individuals by a huge margin since 2020 earning it the worst rating in the Financial Secrecy Index.

Ian Gary, executive director at the US-based Financial Accountability & Corporate Transparency Coalition while speaking to news agency Bloomberg pointed out that the rankings highlight how these nations are helping corrupt individuals in weaponizing their financial systems against democracy.

“The US must support more reciprocal automatic information exchange between countries,” Gary was quoted as saying by news agency Bloomberg.

The Tax Justice Network uses metrics like FSI Value, Global Scale Weight, Secrecy Score and FSI Share. The FSI Value measures how much ‘financial secrecy the jurisdiction supplies’ and the US scored 1,951.

The US scored 67 out of 100 in Secrecy Score – higher secrecy score means the nation’s legal and financial systems allow huge scope for financial secrecy. The Global Scale Weight of the US was 25.8% – it is a percentage of all financial services globally provided by all jurisdictions to non-residents.

The FSI Share – where the US’ share is 5.74% – shows how much a country contributes to global financial secrecy.

The US ranks high in all these metrics, followed by Switzerland, Singapore, Hong Kong, Luxembourg, Japan, Germany, the UAE, British Virgin Islands, Guernsey and China.

The Tax Justice Network pointed out that the US scored worst because it refuses to exchange information with other countries’ tax authorities. The report said that if the US changed its rule it would then cut its supply of financial secrecy to the world by 40%

The Biden administration earlier last year accepted that the US is ‘the best place to hide and launder ill-gotten gains’ and US president Biden made transparency reforms one of main aspects of US foreign policy. He vowed to tackle tax evasion and money laundering but the report shows that a lot needs to be done.

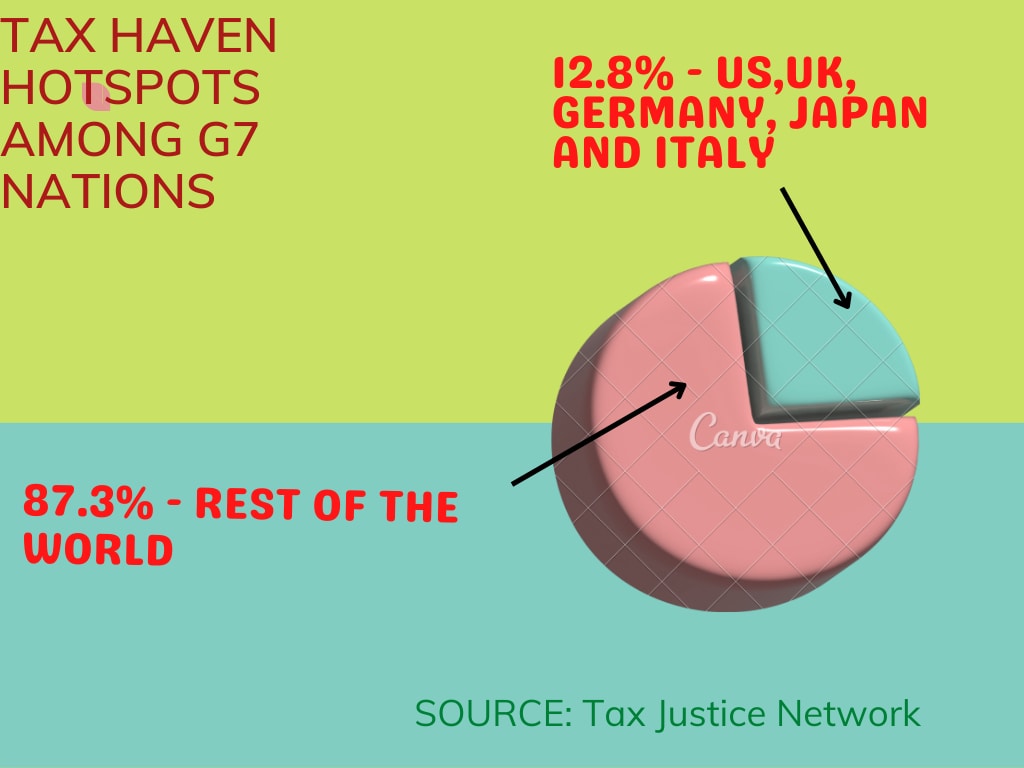

“Rich G-7 countries courted billionaires, oligarchs and corporate giants with secrecy loopholes and eyes-wide-shut-regulations for decades,” Moran Harari, the lead researcher at the Tax Justice Network, told news agency Bloomberg while pointing that this small club of rich countries are setting global financial and tax rules while facilitating tax abuse and financial secrecy.

The report also shows the UK and Italy in poor light as well. The report held these two nations along with Japan and Germany responsible for cutting global progress against financial secrecy. This also looks bad for Germany which will host the G-7 finance minister’s meeting later on Monday. It ranks 7th in the list.

The UK also faces a damning assessment if overseas territories and crown dependencies, like the British Virgin Islands and Jersey, are taken into account since they are responsible for 8.9% of all financial secrecy in the world, the research shows.

The Tax Justice Network revealed that an estimated $10 trillion of wealth is held offshore.

Read all the Latest News , Breaking News and IPL 2022 Live Updates here.

For all the latest world News Click Here