TCS, Infosys, Wipro Q3 results; delivery isn’t enough for Delhi eateries

Also in this letter:

- Many restaurants down shutters in Delhi, say delivery isn’t enough

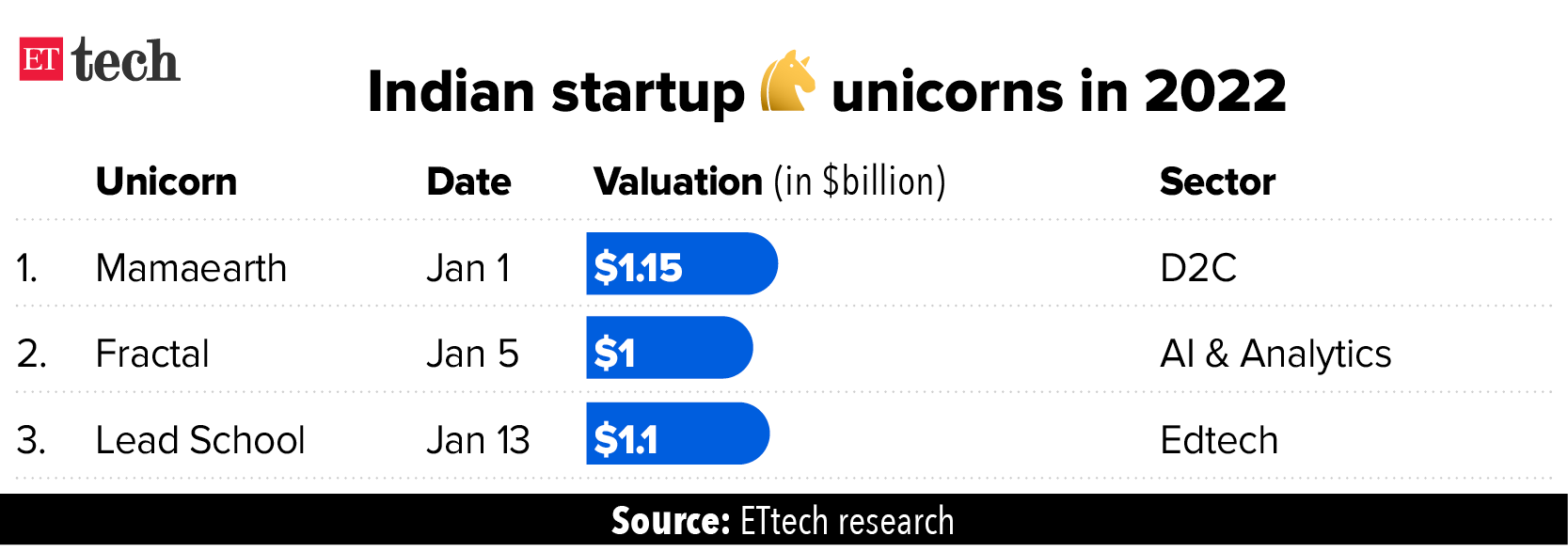

- Lead School turns unicorn after $100 million funding

- Fact checkers suggest four-step fix to YouTube

India’s ‘Big Tech’ firms post strong Q3 numbers amid high attrition

Marking an industry first, India’s three largest IT services firms announced their December quarter results on the same day.

- Infosys outperformed peers TCS and Wipro in terms of sequential growth and said its revenue will grow by 19.5-20% in the fiscal ended March 31, buoyed by sustained expansion in global technology spending amid the ongoing pandemic.

Tata Consultancy Services said its consolidated net profit for the quarter ended December 2021 rose 12.3% to Rs 9,769 crore from Rs 8,701 crore in the corresponding quarter last year. Revenue from operations increased 16.3% year-on-year to Rs 48,885 crore from Rs 42,015 crore in the same quarter a year ago.

Its operating margin stood at 25% for the quarter, down 1.6% year on year. TCS added 10 new $100 million-plus clients during the quarter, taking the total to 58. It also added 21 new $50 million-plus clients, for a total of 118.

Net cash from operations was at Rs 10,853 crore, or 111.1% of net income. It said the company’s IT services attrition rate was at 15.3%, the “lowest” in the industry.

Huge share buyback: Meanwhile, the board of TCS recommended a Rs 18,000-crore share buyback—the fourth and biggest such exercise by India’s largest IT services firm in the past five years. Shares will be priced at Rs 4,500 each in the buyback.

Between Dec 18, 2020, and Jan 1, 2021, TCS had returned Rs 16,000 crore to shareholders in a buyback, in which Tata Sons tendered shares worth around Rs 10,000 crore. As many as 5.33 crore equity shares were bought back at Rs 3,000 each. TCS had undertaken similar buybacks in 2018 and 2017.

Infosys: Infosys meanwhile said its consolidated net profit for the quarter ending December climbed 11.8% to Rs 5,809 crore from Rs 5,197 crore in the corresponding quarter last year.

It said its revenue from operations increased 22.91% year on year to Rs 31,867 crore, from Rs 25,927 crore in the same quarter last year. The company upgraded its revenue guidance from 16.5-17.5% to 19.5-20% for FY22.

The company said its operating margin during the fiscal third quarter was at 23.5%, down 1.9% year-on-year and 0.1% quarter on quarter. Free cash flow stood at $719 million, down 6.9% year on year. Infosys’ digital revenue was 58.5% of total revenue.

Wipro: Wipro said its standalone net profit for the quarter ending December 2021 fell by 8.67% to Rs 2,419.8 crore from Rs 2,649.7 crore in the corresponding quarter last year.

Its revenue from operations increased 21.29% year on year to Rs 15,278 crore from Rs 12,596 crore in the same quarter last year. This was lower than the 30% revenue growth analysts had expected.

On a consolidated basis, revenue stood at Rs 20,313 crore ($2.7 billion), an increase of 3.3% quarter on quarter and 29.6% year on year, the company said. Net consolidated income for the quarter was Rs 2,970 crore ($399.1 million), an increase of 1.3% QoQ.

High attrition: All three firms reported an increase in attrition in the quarter ended December, the highest in the past three years. They also made a net addition of nearly 51,000 people to their combined headcount.

- Infosys saw attrition shoot up to 25.5%, the highest in recent quarters. Wipro reported attrition of 22.7%, while for TCS, attrition was relatively low at 15.3%.

TCS, which hired 43,000 freshers in the first half of FY22, said it hired 34,000 freshers in the quarter—its target for the entire second half of the year—and will likely hire more in the fourth quarter. At the end of December, its headcount was 556,986.

Wipro reported a net addition of 10,306 employees during the quarter, taking its total headcount to 231,671. This is a net increase of 41,363 over a year earlier. Infosys added 15,125 people in the quarter, taking its total strength to 292,067 employees.

Wipro CEO Thierry Delaporte said the company continued to focus on hiring, adding over 34,000 people in the last nine months. “We have added in three quarters what took 11 quarters in the past,” he said. The company is expected to hire a total of 17,000 freshers in FY2022 and is targeting 25,000-30,000 next year.

Also Read: Omicron surge won’t impact IT budgets, Wipro CEO says

Many restaurants down shutters in Delhi, say delivery isn’t enough

A large number of restaurants, pubs and bars located in Delhi’s commercial centres which focus on experiential dining—or depend heavily on alcohol revenues—have downed shutters temporarily, saying the delivery business may not be enough to sustain them amid renewed Covid-19 restrictions.

Who said what: “Deliveries are not sustainable for existing operational costs,” said Priyank Sukhija, CEO of First Fiddle, which runs brands such as Lord of the Drinks, Diablo, and The Flying Saucer. He has shut all his outlets in the national capital except for the Lazeez Affaire restaurant on Malcha Marg. “Even on Malcha Marg, we are hardly getting any business,” he said.

“Most restaurants are looking at shutting down completely and won’t open for deliveries,” said Sukhija who is also the head of the Delhi chapter of National Restaurant Association of India (NRAI).

Atul Bhargava, president of New Delhi Traders Association, expects a majority of restaurants in Connaught Place to shut down. “Connaught Place is a commercial centre. Had it been a residential area, people would have still hoped for takeaways,” he said.

“It is difficult to sustain expenses such as rentals and there are other fixed costs. Last year, a few did open after curbs eased, but some of the costs per day were around Rs 8,000-10,000 while the sales were around Rs 4,000-5,000. It is difficult for people to survive.”

On Zomato, places such as Mr Choy and Public Affair at Khan Market had temporarily suspended delivery services.

Riyaaz Amlani, chief executive of Impresario Entertainment and Hospitality, which runs restaurant brands including Social, Saltwater Café, Slink & Bardot and Smokehouse Deli, said, “We are hoping that the peak (of the third wave of Covid-19) will come quickly and that the government will act based on hospitalisations and actual cases,” Amlani said.

Gaurav Kanwar, founder of Harajuku Tokyo café, said online platforms charge “exorbitant” commissions and just doing deliveries and takeaways can’t be feasible. “We are giving discounts for direct deliveries from us and will try to focus on the cloud kitchen format,” he said.

Tweet of the day

Lead School turns unicorn after $100 million funding

Lead School’s cofounder and CEO Sumeet Mehta.

Edtech startup Lead School has raised $100 million in a funding round led by GSV Ventures and Westbridge Capital at a post-money valuation of $1.1 billion.

- With this, the company has become the third entrant to India’s unicorn club in 2022, after Fractal AI and Mamaearth.

Lead School, which provides tech-enabled solutions for hybrid pedagogy, differentiates itself from other edtech startups by tying up with schools instead of going direct to children.

Quote: “In K-12, everyone has been talking about edtech that is direct to students by circumventing schools. And everyone focuses on test prep and tuitions. Because people have accepted that schools cannot be improved,” said Sumeet Mehta, cofounder at Lead School. “But we thought differently. That’s why we focussed on a school-based edtech (solution).”

At present, Lead School works with 5,000 schools across 500 cities, Mehta said. By the start of FY23, the company aims to reach two million students in the country. It has an annual contract value—garnered from partnering with schools—of $80 million in FY22.

Infographic Insight

ETtech Done Deals

■ Pluang, a Southeast Asia-based investing super app, has raised $55 million in a Series B round led by Accel India. The startup, which has its entire technology team operating out of India’s NCR, will look to add to its headcount here going forward.

■ A clutch of angel investors, including Robinhood’s Aparna Chennapragada, Coinbase’s Sorojit Chatterjee and former Coinbase and Andreessen Horowitz executive Balaji Srinivasan, have invested in Clear in their personal capacity in a follow-on round.

■ Owl Ventures, a global venture capital fund, has raised more than $1 billion across three new funds to double down on education technology—its key focus area.

■ Vellvette Lifestyle, the parent company of Sugar Cosmetics, has picked up 51% stake in natural skin and hair care brand ENN Beauty, a move that will further consolidate the beauty and personal care segment in the country.

■ Curefoods has raised $62 million from Iron Pillar, Chiratae Ventures, Sixteenth Street Capital, Accel Partners and Flipkart cofounder Binny Bansal at a valuation of about $280 million.

■ Refyne, a platform which helps employees draw their salaries on demand, has raised $82 million in new funding led by New York-based investment firm Tiger Global.

■ Foundation PE, an Asia-focused secondary fund, has bought out all investors in Prime Venture Partners’ first fund, extending the fund’s life by four years.

■ Rooter, India’s leading game streaming and e-sports platform, raised $25 million in a Series A funding round to push growth, create a robust content creator ecosystem, and for building a marketplace.

Fact checkers suggest a four-step fix to YouTube’s misinformation problem

More than 80 professional fact-checking organisations from over 40 countries, including India, sent a letter to YouTube CEO Susan Wojcicki on January 12, urging her to take at least four steps to stop the company from being “one of the major conduits of online disinformation and misinformation worldwide”.

- In the letter, fact-checkers listed examples of YouTube videos from different countries that they said caused real harm but nevertheless went “under the radar” of the company’s current policies.

- The fact checkers are of the opinion that the policies put in place by YouTube to combat disinformation are “insufficient” and “not working”. They emphasised in their letter that the situation is even worse in non-English speaking countries and in the global south, where policies are even less exercised.

Quote: “We see that YouTube is one of the major conduits of online disinformation and misinformation worldwide. This is a significant concern among our global fact-checking community,” the fact checkers said in the letter.

The group expects to have a meeting with YouTube’s CEO to discuss the issues.

Paytm founder says global market conditions impacted its IPO

Paytm’s founder and CEO Vijay Shekhar Sharma

Vijay Shekhar Sharma said choppy global markets led to a tepid response to Paytm’s initial public offering and lacklustre listing last year.

- Paytm went public at a time when the market was spooked by various factors, which affected the pricing, Sharma told Sequoia Capital MD Rajan Anandan at IAMAI’s India Digital Summit 2022 in what was one of his first public appearances since Paytm’s disastrous market debut in November.

Still hopeful? “The success of Paytm will depend on what we do with monetisation, led by financial services. Payment is a revenue line item which is growing massively. This quarter we are talking about $100 million revenue from payments which is like a sizable revenue… People underestimate the size of payments revenue,” he said.

He said Paytm ought to be benchmarked against only one company—Bajaj Finance.

“Bajaj Finance has been there for 30-32 years. Paytm processes more loans than Bajaj today, in less than three years… For our credit business, we should be benchmarked against only one guy and that is Bajaj (Finance). We should be looked at for the scale we deliver in terms of total loans, value of loans and quality of loans,” he said.

Slippery slope: On Monday, brokerage firm Macquarie slashed the target price of Paytm’s parent, One97 Communications, from Rs 1,200 to Rs 900. This was 58% lower compared to the issue price of Rs 2,150. Macquarie said Paytm’s payments business accounts for 70% of overall gross revenues and hence any regulations capping charges for digital payments could affect the company.

On Wednesday, the One97 stock ended 3.22% lower at Rs 1,083.40 apiece on the BSE. The company’s market cap now stands at $9.49 billion, a far cry from its private market valuation of $16 billion.

Also Read: Behind Paytm’s dismal IPO and its constant valuation catchup

Other Top Stories By Our Reporters

Whatfix to provide vertical solutions for insurance and banking: The SaaS startup will also focus on acquiring early-stage tech companies, “which are doing good work or have a solid depth in a specific industry”, CEO Khadim Batti said. (read more)

Polygon sees intermittent downtime, users struggle to transfer NFTs: According to a tweet by Polygon, the network was facing difficulties because there was a high level of activity from bots farming on some decentralised finance applications. (read more)

I&B ministry’s Twitter account hacked, restored later: The hacker renamed the account as Elon Musk and posted some tweets. The account was restored and posts made by hackers were deleted. “The account @Mib_india has been restored. This is for the information of all the followers,” the ministry tweeted. (read more)

Global Picks We Are Reading

■ Intel is having a happy new year so far (Bloomberg)

■ Robinhood plans permanent WFH for most employees (Reuters)

■ The best cars of 2022 aren’t the innovative EVs (Axios)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here