Snags hit ecommerce orders on ONDC; IT firms hire more women in FY23

Also in this letter:

■ India key market for Meta: Sandhya Devanathan

■ LTIMindtree’s real estate consolidation plan

■ A blessing in disguise for India’s smartphone users

ONDC logs slow ecommerce uptake, snags may hit expansion

Hi, this is Pranav Mukul in New Delhi. Today, my colleague Digbijay and I have an update on e-commerce orders on ONDC.

Driving the news: The last few days saw a significant social media buzz around the network — mostly capturing the price wars triggered by the platform for food deliveries. We wrote an explainer on how ONDC is trying to make its mark in the segment dominated by Zomato and Swiggy.

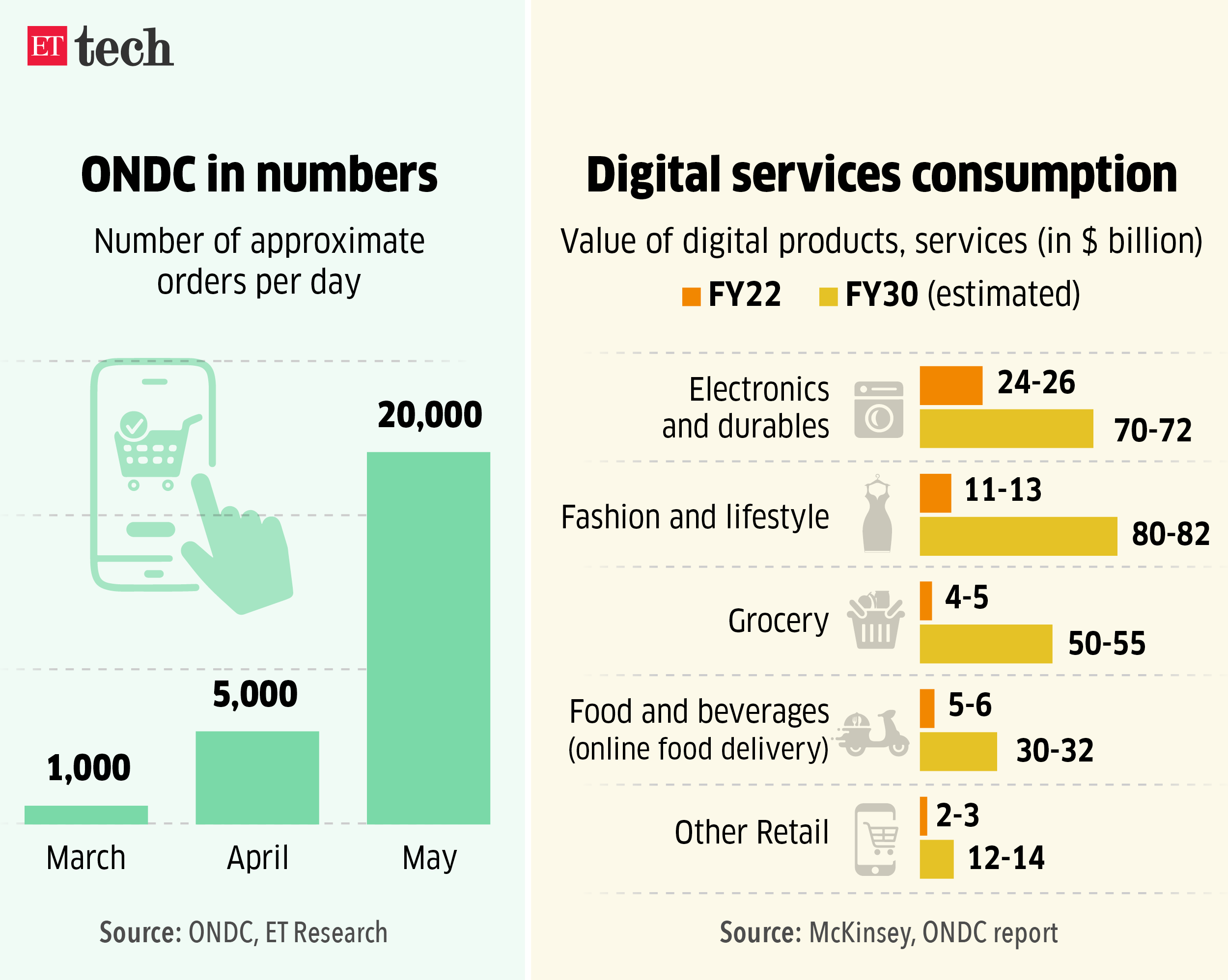

What’s happening? Today, we report that despite witnessing a steady rise in food and grocery orders, ONDC is yet to rack up much traction for ecommerce deliveries in categories such as fashion, electronics and other consumer goods. Going ahead, riding on the attention garnered by food and grocery, the network will likely onboard large players in other categories as well. However, experts indicate that it may not be smooth sailing.

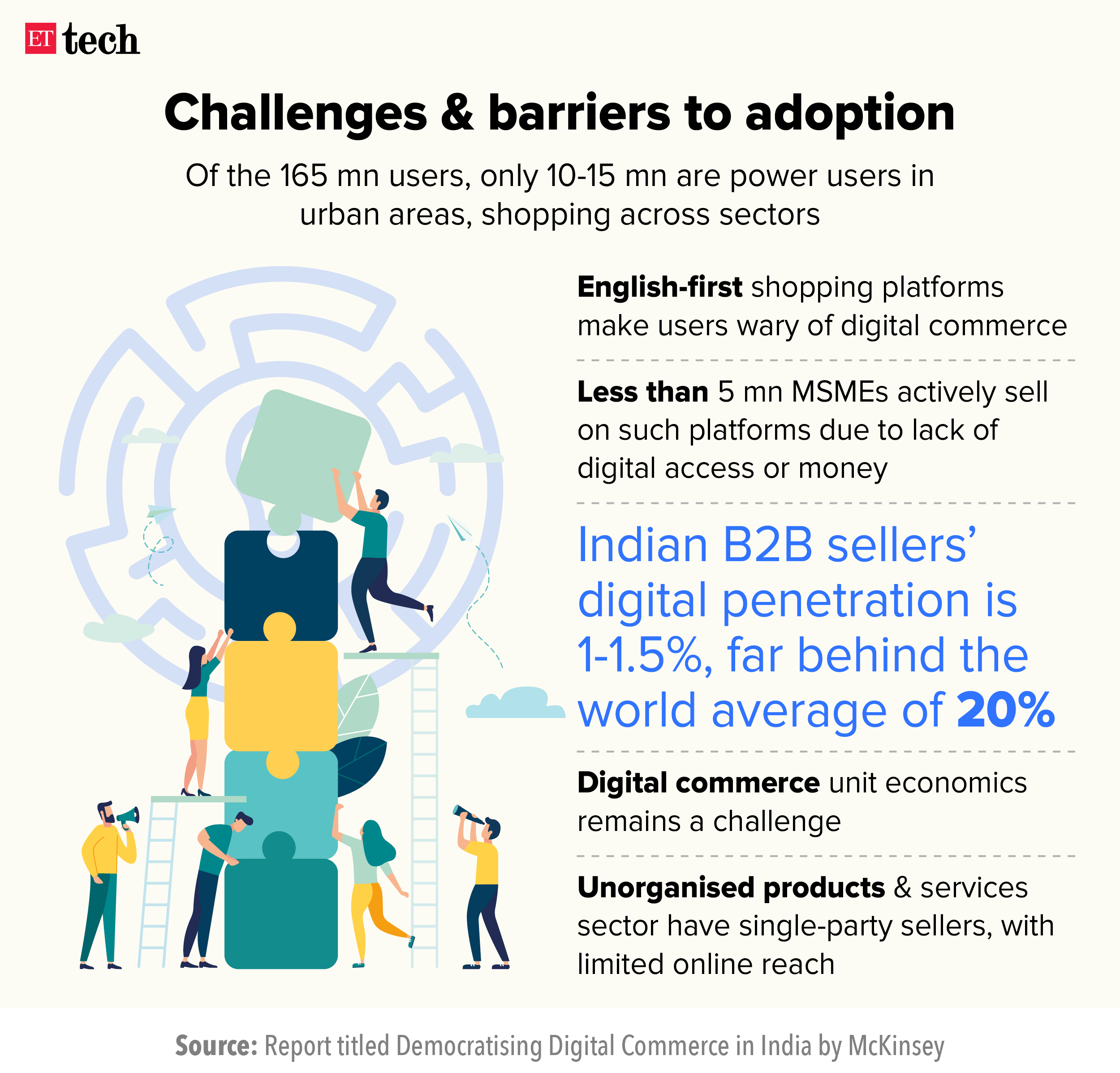

By the numbers: While ONDC, as a network, has scaled to about 20,000 daily orders from around 1,000 in March, 97-98% of the orders have been for hyperlocal deliveries of food and grocery. According to sources, only about 500 orders per day are being placed in ecommerce categories.

Bottlenecks: Industry watchers and ONDC participants suggest that while food and grocery deliveries are the low-hanging fruit considering the hyperlocal and high-frequency nature of the categories, verticals such as fashion and electronics would entail solving for elements such as warehousing and logistics.

Next steps: ONDC chief executive Thampy Koshy told ETtech that it was still early for the network and it has added more categories and merchants only in the last few weeks. He added that new domains have been enabled which will pick up in the coming weeks.

Hiring of women outpaces headcount growth at IT firms

At least one among every three employees at India’s top five tech companies was a woman as of FY23 end, despite layoffs and a general slowdown in tech hiring.

Driving the news: Companies such as TCS, Infosys, Wipro, HCLTech, and LTIMindtree are recruiting women in large numbers, thereby improving their gender scorecards. The number of female employees increased by 6.5% at these IT companies in FY23, outpacing the growth in their total headcount, 5.9%, according to a survey by ET and staffing firm Xpheno.

Expert take: “It is remarkable that the top five Indian IT service bellwethers alone employ more than half a million woman professionals. Even more significant is the 44% growth registered by this cohort’s women workforce since the pandemic,” Xpheno cofounder Kamal Karanth told ET.

India a key market for Meta, bullish on its prospects: VP Sandhya Devanathan

Despite a tough macroeconomic environment and softening advertising spending dragged by inflationary pressures, India continues to be a key market for Meta, its India head Sandhya Devanathan told ET in an exclusive interview.

Green shoots encouraging: “While it is not entirely smooth sailing, we are encouraged by the green shoots we are witnessing this year, compared to challenges we faced last year. The recent 6% GDP growth rate is a positive development, placing India ahead of many other countries. In addition, India is now the ninth-largest advertising market in the world, which further adds to our optimism,” she said.

Also read | Meta begins latest round of layoffs; tech teams affected

Catch up quick: Devanathan took charge of the India operations in January following the exit of Ajit Mohan, who joined Snap as the president of Asia Pacific, at a time when media players, both digital and traditional, have recorded a softening of the advertising markets.

On layoffs: “The company is becoming more tech-focused, agile and wants to quicken decision-making. This process is being run at a global level. I don’t have more to share at this point on the issue,” Devanathan said about the impact of layoffs on Meta’s India staff.

Read the full story here

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

Real estate rationalisation to drive up to 200 bps margin growth: LTIMindtree MD

LTIMindtree, the country’s fifth-largest IT firm by market capitalisation, is working on a real-estate consolidation plan that will drive up to 200 bps margin growth over four-five years, its managing director Debashis Chatterjee told ET.

Tell me more: While the leadership of the Mumbai-based technology services and consulting firm works on real estate consolidation to reduce overlaps and duplication, it is also exploring ways to expand its delivery centre footprint.

Chatterjee said though the merger synergies have kicked in, the real estate alignment is in process and will be realised over the long term. The firm’s chief operating officer Nachiket Deshpande said the company has up to seven real estate projects planned for India to be launched over the next two quarters, in addition to global facilities to be added to the footprint.

Q4 numbers: In the fourth quarter of FY23, LTIMindtree’s net profit grew by 0.5% year-on-year, missing analysts’ estimates mainly due to higher employee costs and other expenses.

Tweet of the day

In a price war between chip majors, Indian smartphone users are the real winners

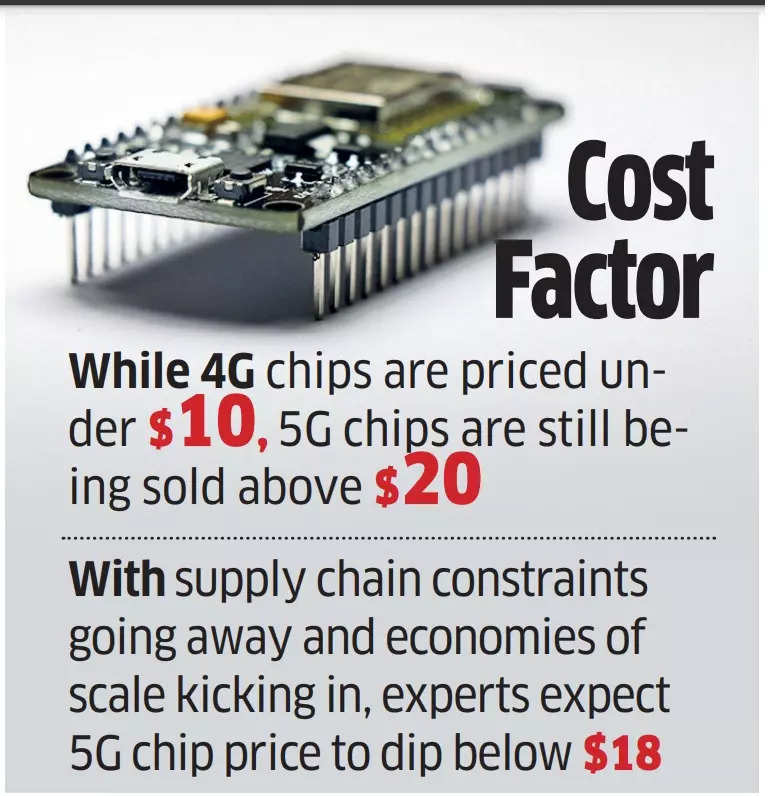

Experts predict that India’s mass-market smartphone buyers may benefit from a potential price war between two major chipset companies, Taiwan’s MediaTek and the US’s Qualcomm, amidst a slowdown in demand. They expect the prices of 5G devices to drop below Rs 10,000 by the second half of 2023.

Battle for market share: With supply chain constraints easing up, chipset players will have more leeway to bring down the price and gain back more market share, according to Sravan Kundojjala, an independent semiconductor analyst. MediaTek had a nearly 45% market share in India in the January-March quarter, he said, compared with Qualcomm’s around 25%.

Products affected: Both companies have said that there would be competition in the market with prices going lower as supply chain constraints ease, however, they differ on which products will see the change in prices.

During a recent earnings call, MediaTek’s chief executive Rick Tsai acknowledged intense price competition but stated that it was primarily limited to certain entry-level smartphone products.

Other Top Stories By Our Reporters

Explained | ONDC vs Zomato-Swiggy: The government-backed Open Network for Digital Commerce (ONDC) platform has taken social media by storm over the last week, with users heaping praise on the platform for better pricing of products in comparison to food delivery majors Zomato and Swiggy.

India sees sharp increase in cyberattacks in Q1 2023: India has seen a sharp increase in the number of cyberattacks in the first three months of 2023, as per the State of Application Security Report’ by Indusface.

Stride Ventures announces close of new fund: Stride Ventures on Tuesday announced the first close of its third fund at $100 million.

Global Picks We Are Reading

■ How a bored NYU graduate captured the absurdity of Chinese diaspora life (Rest of World)

■ ChatGPT Fever Has Investors Pouring Billions Into AI Startups, No Business Plan Required (WSJ)

■ The Team of Sleuths Quietly Hunting Cyberattack-for-Hire Services (Wired)

For all the latest Technology News Click Here