Sceptics remain unconvinced but M&S sales show encouraging signs of a turnaround

News that Marks & Spencer has reported record Christmas trading will inevitably spark debate over whether the much-loved retailer’s oft-promised turnaround has finally been accomplished.

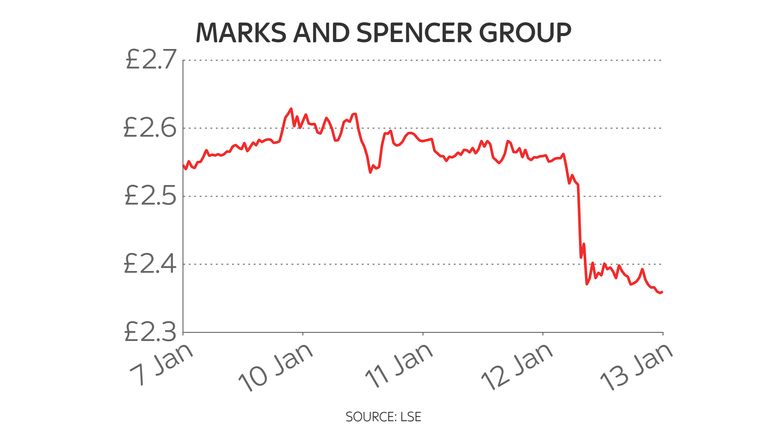

Today’s movement in M&S shares, which at one point fell by 6%, suggest there is still scepticism among some investors.

Yet the numbers themselves are pretty encouraging.

Not so much the 18.5% rise in group sales, to £3.27bn, during the 13 weeks to New Year’s Day.

Many M&S outlets were closed during the same period in 2020 and so it was not too much of a stretch for the business to improve on that performance.

It’s not even, for the same reason, the spectacular-looking 37.7% rise, on the same period last year, in UK clothing and home sales to £1.08bn.

No, the real stand-out number in today’s trading update is the more modest-looking 3.2% rise in UK clothing and home sales on the same period two years ago in the pre-pandemic era.

Most analysts had actually expected a fall.

That provides encouragement that clothing and home, long the problem child for M&S, is enjoying genuine and sustainable growth.

Much of that reflects the hard work put into upgrading M&S’s online operation.

M&S was one of the first UK retailers to actually have a website, launching it as long ago as 1998, but that side of the business was de-emphasised in the early 2000s and it lost ground, in particular, to Next.

The company sought to catch up by investing heavily in a giant distribution centre at Castle Donington in Leicestershire, which opened in 2013, but which was blighted for years by inefficiencies.

Steve Rowe, chief executive since 2016 and Archie Norman, who became chairman the following year, made a priority of fixing Castle Donington.

Evidence of their success – and that of operations chief Katie Bickerstaffe – can be seen in today’s figures.

Clothing and home online sales were up 2.3% on the same period a year ago – an achievement in itself given that stores were closed for much of the same period a year ago, boosting online sales – and an impressive 50.8% on two years ago.

M&S also did several other things to help its online business.

For the first time in its history, it began selling third party fashion labels on its website, including Joules, Hobbs, Seasalt, Sosandar and Phase Eight.

Most successful of all in this respect, arguably, has been Nobody’s Child, the first “guest” brand on the website, which has brought in customers – around one in seven – that had never previously shopped with M&S.

M&S likes the partnership so much that, in November last year, it bought a 25% stake in the environmentally-friendly business.

The second was an initiative launched in November 2020, during the second national lockdown, called MS2.

The aim was to use M&S’s own customer data and information gleaned from its loyalty programme, Sparks, to introduce a more personalised online shopping experience.

The relaunch of Sparks as a digital loyalty programme is credited with having both driven membership of the scheme to more than 13 million – more, for example, than the number of people holding a Boots Advantage card.

Mr Rowe credits the initiative with being a “driving force” behind the growth M&S has enjoyed online.

The third big development also came about during the pandemic.

Lockdown saw M&S begin to fulfil online orders from stock that was held in stores that were closed.

It has used that experience by investing in its systems to enhance its click and collect proposition and seek, where possible, to fulfil more orders that way.

Mr Rowe is aiming to fulfil a fifth of click and collect orders in this way before long which, if M&S succeeds, would pave the way offering same-day collection for customers where possible.

But the improvement in clothing and home is not just down to a better online performance.

Industry surveys suggest M&S has recaptured leadership in credentials such as quality and value for money that, historically, made it such a potent player in clothing and home.

The number of lines was reduced, availability of the most sought-after items was improved and M&S clothes are now regarded as more stylish than they have been in many years thanks, in part, to more energetic use of social media platforms like Instagram.

Sector watchers detect the influence here of Richard Price, managing director of clothing and home, who began his career at Next before joining M&S but who, latterly, had been running Tesco’s fashion business, F&F, before rejoining M&S in July 2020.

As for the food side of the business, long the star performer, it also performed well, with sales up 10% on a year ago and up 12.4% on two years ago.

M&S always sees its share of the food market grow over Christmas, as customers trade up, but Mr Rowe detects signs that customers are using M&S for more of their everyday shopping.

It claims to have been the fastest-growing major store-based food retailer in the period.

Strikingly, not included in the figures were the sales M&S makes from its partnership with Ocado, where M&S products accounted for roughly 30% of items delivered by the business.

There are some who will say we have been here before.

There was much scepticism when, in May 2018, M&S spoke in detail about work it was doing to transform the business and, for the subsequent 18 months, the share price drifted lower.

It culminated in the company’s relegation, for the first time, from the FTSE 100 in late 2019 – something about which Mr Norman was admirably stoical at the time.

Sceptics will also argue that, with a host of well-known fashion retailers – including Monsoon, Debenhams, Arcadia, Quiz, Peacocks and Bonmarche – either changing hands after going into administration or disappearing from the high street altogether during the last two years, M&S has benefited from there being less competition.

And questions remain over whether M&S can convert this markedly improved sales performance into profits.

Today’s share price reaction reflects disappointment that M&S did not raise its profits guidance for the current financial year as dramatically as some investors had hoped and did not do so at all for the next financial year.

Unease also persists about the grim outlook for consumer spending, with inflation – something flagged by Mr Rowe today – and soaring energy bills potentially eating into disposable incomes, not to mention Rishi Sunak’s looming National Insurance increases.

Some, though, see M&S navigating its way through this.

Analyst Clive Black of broker Shore Capital – admittedly the joint house broker to M&S – observed today: “We have seen much worse UK consumer economic metrics than those at present.

“Despite the vested political, economic and cultural interests, the UK standard of living crisis may not be as extreme as many suggest, especially to M&S customers, who we feel will, in the main, still be able to afford their food and gas bills.”

Messrs Norman and Rowe will not be the only retail chiefs hoping that analysis holds true.

For all the latest business News Click Here