‘Risky’ for government to intervene as mortgage costs surge, ex-Bank of England deputy warns

It would be “risky” for the government to protect mortgage holders against rising interest rates, according to a former Bank of England deputy governor.

Speaking to Sophy Ridge on Sky News, Sir Charlie Bean said trying to help those paying off home loans could force the bank to raise the base rate even further.

His warning follows a report from the Resolution Foundation think tank that says average annual mortgage repayments are set to rise by £2,900 for those renewing next year.

Total annual mortgage repayments could rise by £15.8bn by 2026, the report added.

Politics live: Cabinet minister reacts to ‘indefensible’ lockdown party video

Sir Charlie said: “There’s not a lot [government] can do to influence the overall macro environment in a favourable way.

“There may be things it wants to do to alleviate pain on particular parts of the population, poor households or whatever.

“There obviously have been some calls for protecting those with mortgages.

“I think that’s risky territory to get into because of course, if you do that and reduce the pressures on those with mortgages, that reduces the extent to which the economy slows and just means the bank has to raise interest rates even more.”

An extended period of inflation led the Bank of England to raise interest rates, pushing up the cost of borrowing.

These increases are now expected to continue until the middle of next year, with the base rate forecast to peak at nearly 6%.

Read more:

Explained: What is causing the mortgage crunch

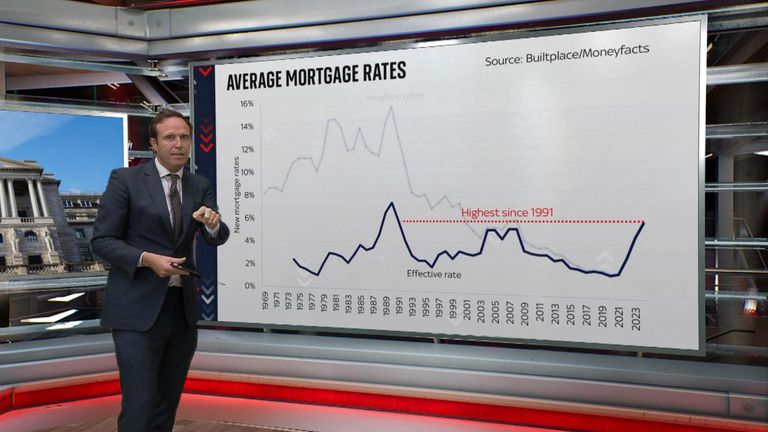

Ed Conway: Mortgage payers face largest home loan squeeze since early 90s

Sunak insists he won’t pass the buck if he misses key inflation pledge

With an election expected in 2024, interest rates continuing to rise ahead of the vote would cause headaches for Rishi Sunak and campaigners for the Conservative Party.

The uncertainty has led to TSB pulling all its 10-year fixed-rate deals from the market – and Santander withdrew its offers for new borrowers this week.

Michael Gove, the housing secretary, was asked by Sophy Ridge whether he was “frightened” by the situation.

He said he was “concerned of course”, saying the government’s target of getting inflation down would allow the bank to reduce interest rates.

The cabinet minister revealed he does not have a mortgage, but acknowledged the situation is “very difficult for hundreds of thousands of people”.

He added: “As a minister who is responsible for housing, I do take a close interest in what’s happening in the mortgage market.

“It only reinforces the importance of doing everything else that we can to support homeowners and indeed, specifically, to help those in the rental sector as well who have faced the prospect of increasing rents and that’s why we are bringing forward legislation, the Private Rented Sector Reform Bill, in order to help them.”

The bill is aimed at removing no-fault evictions and holding landlords to higher standards, while also allowing homeowners to have an easier time recovering properties from disruptive tenants.

Criticisms have been made of the Bank of England for not raising interest rates fast enough, allowing inflation to rise.

Sir Charlie admitted that his old employer was “a little behind the curve” in its actions – but added most of the inflationary pressure was coming from external factors like “the war in Ukraine, rising gas prices, global food prices, also supply chain pressures as economies reopened after the pandemic”.

For all the latest business News Click Here