RBI maintains repo rate at 4% for ninth time in a row

Mumbai: The Reserve Bank of India’s monetary policy committee kept its key lending rate steady at record lows on Wednesday, with investors awaiting its outlook on inflation and what steps it will take to withdraw surplus cash from the banking system.

The committee held the lending rate, or the repo rate, at 4%. The central bank is keeping its benchmark lending rate unchanged 9th time in a row. The reverse repo rate, or the key borrowing rate, was also maintained at 3.35%.

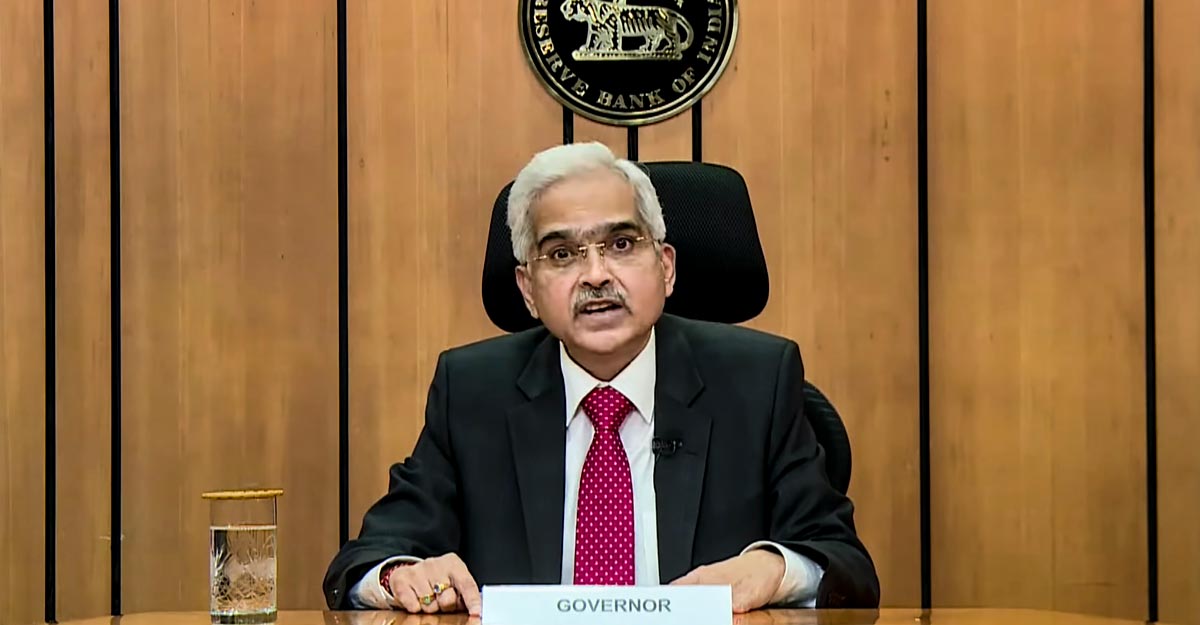

RBI to continue with accommodative stance to revive and sustain growth on durable basis, RBI Governor Shaktikanta Das said.

All 50 economists polled by Reuters had expected no change in the repo rate and they did not expect a change before the second half of 2022.

A quarter of 41 respondents surveyed on the reverse repo rate had predicted an increase.

Economists had priced in a small increase in the reverse repo rate – the rate at which the central bank borrows short-term funds from banks – as the RBI tries to normalise the gap between lending and borrowing rates to pre-COVID levels.

The central bank has slashed the repo rate by a total of 115 basis points (bps) since March 2020 to soften the blow from the coronavirus pandemic and tough containment measures. This follows 135 bps worth of rate cuts since the beginning of 2019.

For all the latest business News Click Here