Pausing Interest Rate Hike Not In My Hands, Depends On Several Factors: RBI Guv Shaktikanta Das

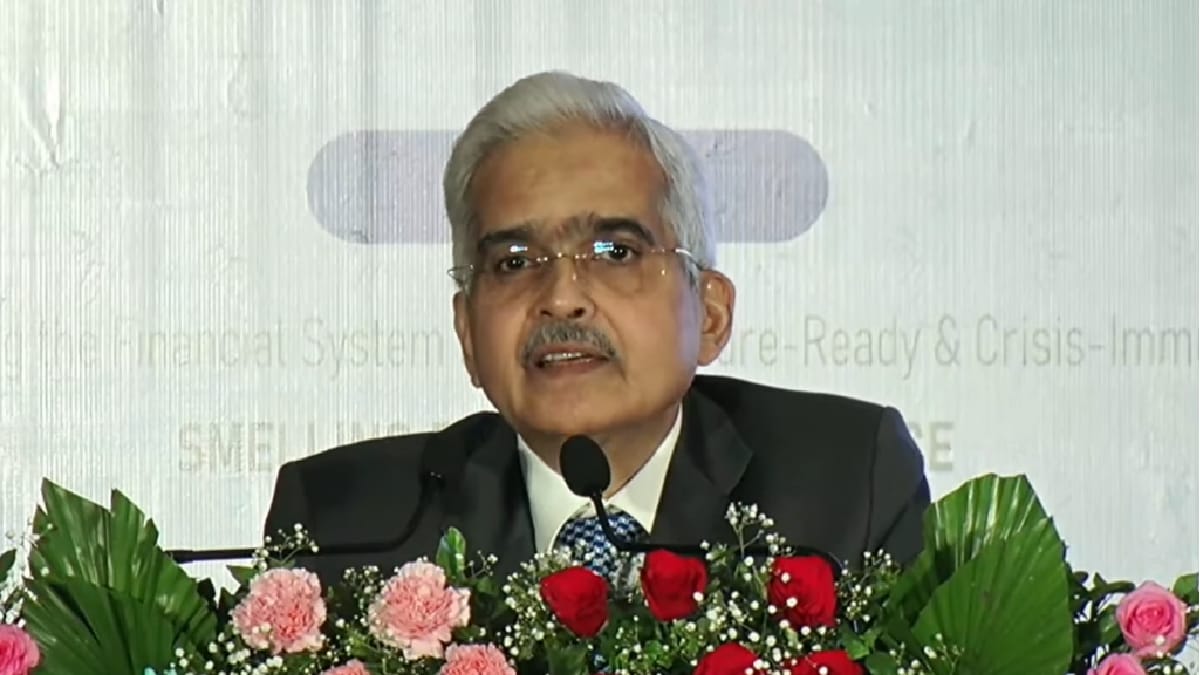

RBI Governor Shaktikanta Das (File photo)

“RBI will remain proactive and prudent, and will do its best to support the economy to maintain financial stability of India,” the Governor said.

Reserve Bank Governor Shaktikanta Das on Wednesday said the decision to tweak policy rates was not in his hand as he himself is driven by the situation on the ground. In April, the Reserve Bank in a surprise move hit the pause button and decided to keep the key benchmark policy rate at 6.5 per cent.

Prior to it, the Reserve Bank of India (RBI) was on a rate hiking spree, raising the repo rate by 250 basis points since May 2022.

Also Read: India’s GDP Growth Could Be Above 7% in FY23, Says RBI Governor Shaktikanta Das

Speaking at an event organised by the industry chamber CII, Das said there is a suggestion that RBI will take a pause in the coming monetary policy meetings.

“It’s not in my hands. It all depends on the situation on the ground. I am driven by what’s happening on the ground. What is the outlook on ground? What are the trends? How is the inflation buildup or the inflation softening? So, it’s all there.

“So, it’s not a decision which is entirely in my hands, because I am driven by what’s happening at the ground level. So, to that extent, you know, I think I will leave it at that,” the Governor said.

The Governor further said retail inflation has moderated, but there is no room for complacency.

According to him, the next inflation print is expected to be lower than 4.7 per cent. The inflation based on the consumer price index was 4.7 in April.

Das also assured the gathering that the Indian banking system remains stable and resilient with strong capital, liquidity position and improving asset quality.

“RBI will remain proactive and prudent, and will do its best to support the economy to maintain financial stability of India,” the Governor said.

He also informed the gathering that the RBI is fine-tuning the Central Bank Digital Currency (CBDC) architecture based on the experience so far.

(This story has not been edited by News18 staff and is published from a syndicated news agency feed – PTI)

For all the latest business News Click Here