Nykaa is top of the pops; founder among 20 richest Indians

Credit: Giphy

Also in this letter:

■ PharmEasy’s parent firm files draft IPO papers

■ Paytm’s IPO fully subscribed on last day

■ Zomato to announce investments in Curefit, others

Nykaa’s m-cap crosses Rs 1 lakh crore on listing day

Shares of FSN E-commerce Ventures, the parent company of Nykaa, made a blockbuster debut on Dalal Street earlier today. The company’s shares were listed at Rs 2,001 each on the BSE, a hefty premium of 77.87% over its issue price of Rs 1,125. On the NSE, the shares were listed at Rs 2,018 each, a premium of 79.38%.

By 3.10 pm, FSN’s share price had risen to Rs 2,206, giving it a market cap of about Rs 1.03 lakh crore and making its founder Falguni Nayar one of the 20 richest people in India (more on this below). The share price remained more or less flat for the rest of the day, hitting a high of Rs 2,248 before closing at Rs 2,208 on the NSE.

It was coming: We reported yesterday that the listing, which was supposed to take place on Thursday, had been brought forward by a day. On Tuesday, the counter was commanding a strong premium of Rs 800 a share in the grey market, a sign of the blockbuster listing to come.

Nykaa’s IPO was open for subscription from October 28 to November 1. The company raised Rs 5,352 crore from its primary share sale. The issue was subscribed 82 times, with the company receiving more than 216.59 crore bids for 2.64 crore shares, according to data from the NSE.

About Nykaa: Nykaa, founded by former investment banker Falguni Nayar, operates in the beauty and personal care segment both online and offline.

It is one of India’s few profitable startups, having made a profit of Rs 61.95 crore in FY21 after a loss of Rs 16.34 crore in FY20. It reported revenue of Rs 2,440.89 crore in FY21, 38.1% up from the previous year.

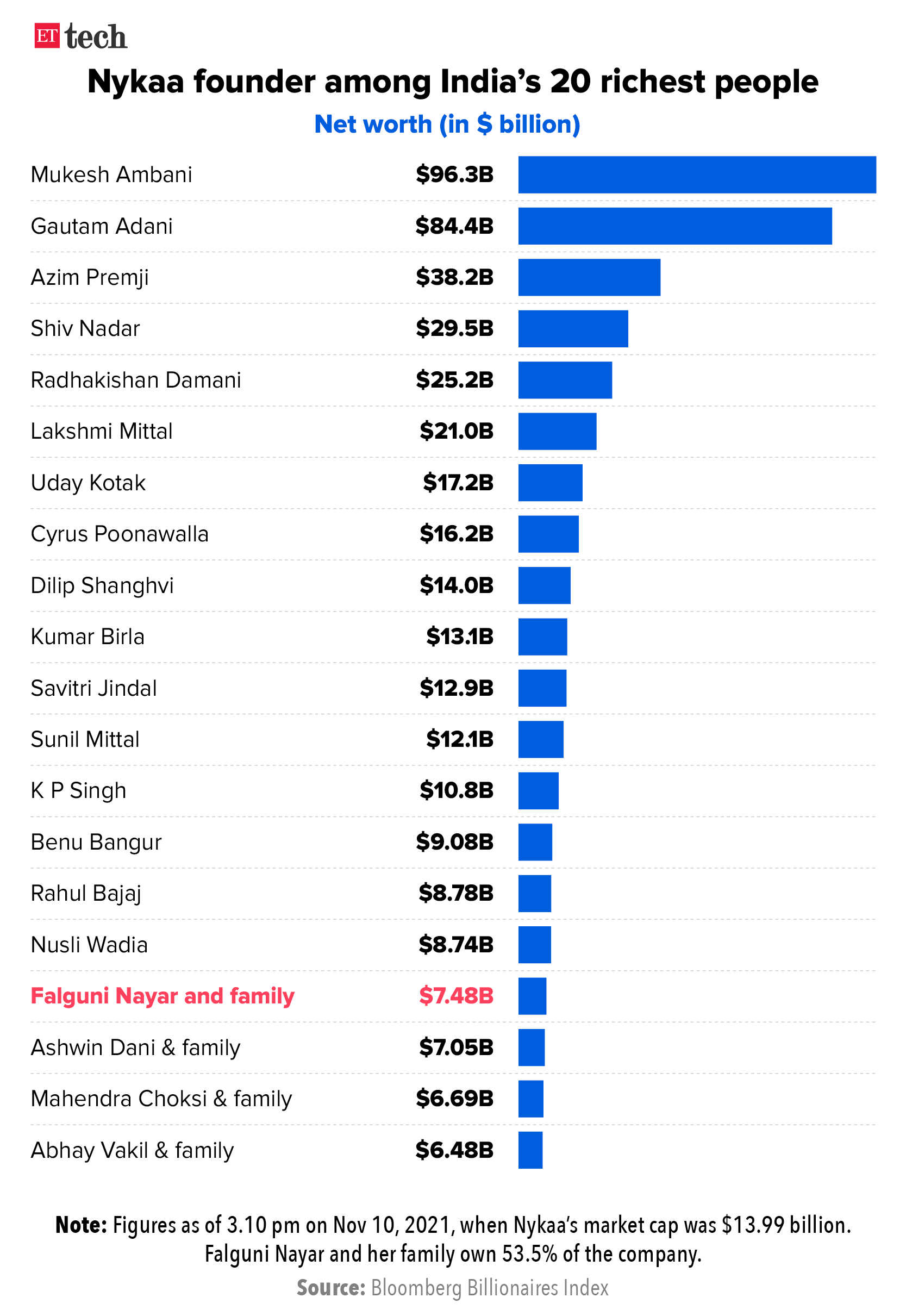

Nykaa founder Falguni Nayar jumps to #17 on India’s rich list

Falguni Nayar, founder of Nykaa

Falguni Nayar, the former investment banker who founded Nykaa in April 2012 at the age of 50, became one of India’s 20 richest people on Wednesday after FSN E-commerce Ventures, Nykaa’s parent firm, made a blockbuster debut on the stock exchanges.

Fortune: Nayar, only the second Indian self-made woman billionaire after Biocon founder Kiran Mazumdar-Shaw, was worth around Rs 5.56 lakh crore ($7.48 billion) as of 3.10 pm on Wednesday, when FSN’s stock was at Rs 2,206 a share. She owns 53.5% of the company through two promoter trusts and seven other promoter entities.

This made her the 17th richest person in India, ahead of Ashwin Dani, non-executive chairman of Asian Paints Ltd ($7.05 billion) and behind Wadia Group chairman Nusli Wadia ($8.4 billion), according to the Bloomberg Billionaires Index.

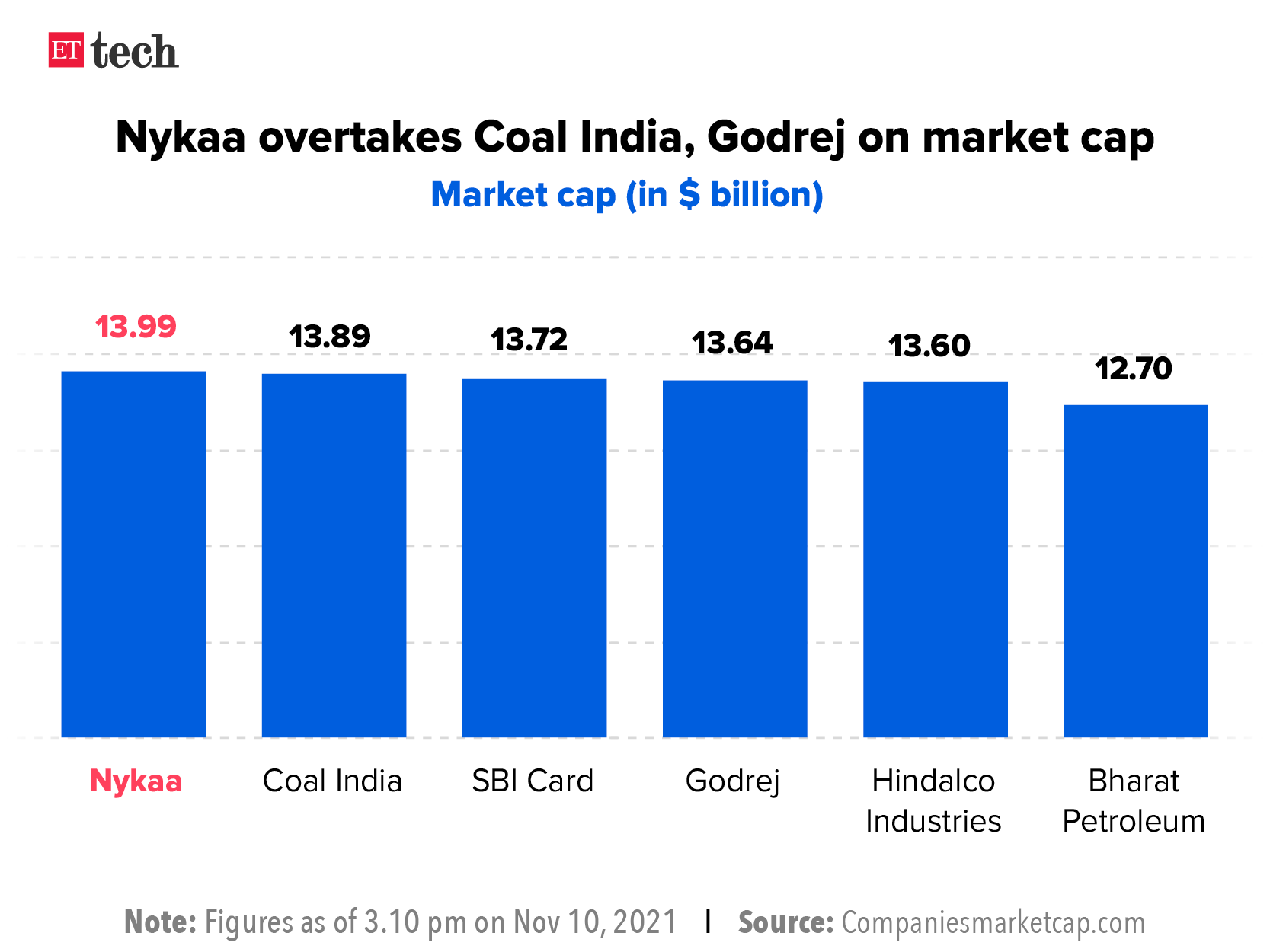

Nykaa in heady company: Nykaa, meanwhile, had a market cap of about 1.03 lakh crore ($13.99 billion) on Wednesday afternoon, making it the 51st largest company in India, data from Companymarketcap.com showed.

This put the online cosmetics retailer ahead of heavyweights such as Coal India ($13.89 billion), Godrej ($13.64 billion), Hindalco Industries ($13.60 billion) and Bharat Petroleum ($12.70 billion). Zomato, the first Indian startup to go public, four places higher at 47, with a market cap of $14.58 billion.

Others who made huge gains from Nykaa’s listing included Bollywood celebrities Katrina Kaif and Alia Bhatt, who own 0.02% and 0.05% of Nykaa, respectively. At a market cap of Rs 1.03 lakh crore, Kaif’s stake is worth Rs 20.6 crore while Bhatt’s is worth Rs 51.6 crore.

Who is Falguni Nayar? Born and raised in a Gujarati family, Nayar’s father ran a small bearings company, assisted by her mother. The household chatter revolved around investments, the stock market and trade. “Plus, I’m Gujarati,” she said in a 2017 interview. Entrepreneurship, it seems, was in her blood.

Also Read: Who is Falguni Nayar, India’s richest self-made woman?

After graduating from IIM, Ahmedabad, Nayar spent the bulk of her career at Kotak Mahindra Capital Co. When she left in 2012, she was the managing director and head of its institutional equities business.

In its early days, Nykaa was funded entirely by her and her husband Sanjay Nayar, chief executive of private equity major KKR & Co. in India. The focus was on building an inventory-led business, she said in a 2017 interview to The Economic Times.

The company became a unicorn in March 2020, after just five rounds of funding — of which only three involved institutional investors.

Tweet of the day

PharmEasy parent files draft papers for Rs 6,250-crore IPO

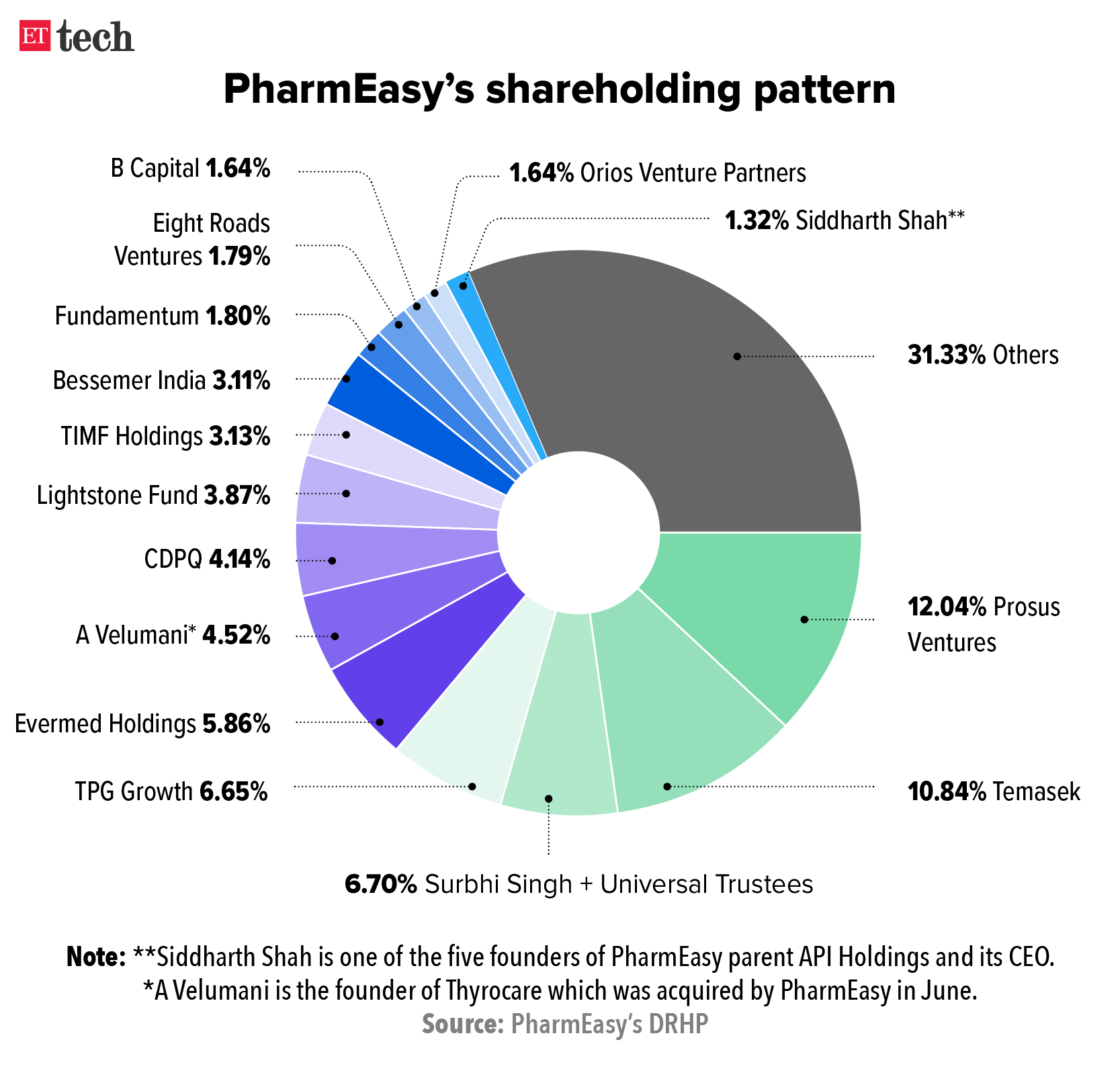

API Holdings, the parent company of India’s largest e-pharmacy platform PharmEasy, has filed a draft red herring prospectus (DRHP) with markets regulator Sebi for a Rs 6,250 crore initial public offering (IPO).

The company may also consider a further issue of equity shares via a private placement of up to Rs 1,250 crore, it said in its DRHP.

If the pre-IPO placement is undertaken, the issue size will be reduced by the amount raised from it, and the minimum issue size will constitute at least 10% of the post-issue paid-up equity share capital of the company.

Proceeds of the issue: The company plans to use funds it raises to prepay or repay all or a portion of its outstanding borrowings to the tune of Rs 1,929 crore. It plans to use Rs 1,259 crore for funding organic growth initiatives and another Rs 1,500 crore on inorganic growth opportunities through acquisitions and other strategic initiatives.

Quote: “We intend to continue to invest in three core areas for the growth of our business, which include a) marketing and promotional activities to increase awareness about our offerings and brands, b) supply chain infrastructure and fulfilment, and c) technology capabilities and infrastructure,” the company said.

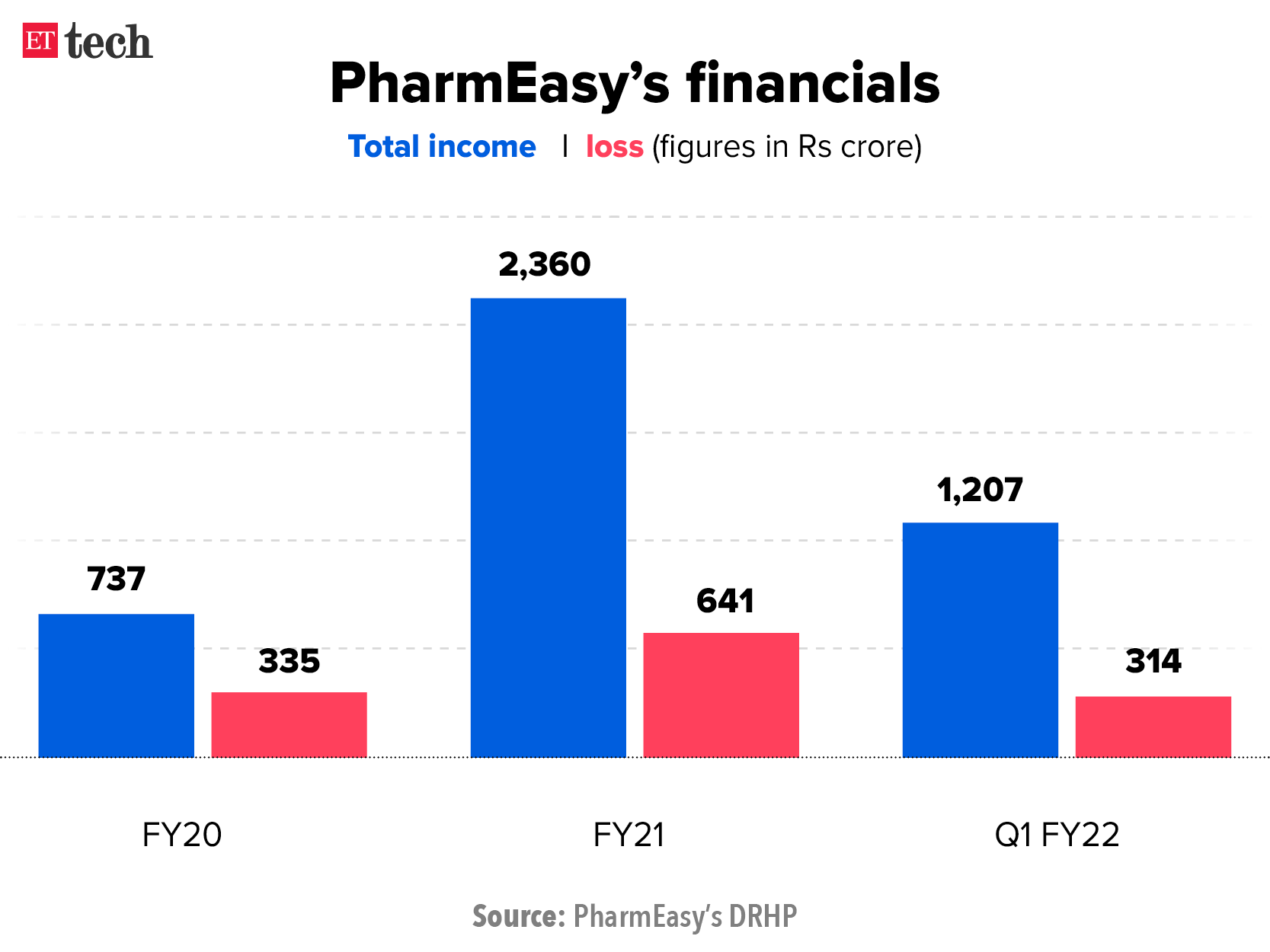

Financials: Pharmeasy posted a loss of Rs 645 crore on total income of Rs 2,360 crore for the year ended March 31, 2021.

Its pro forma gross merchandise value (GMV) stood at Rs 787 crore in FY21 and declined to Rs 303 crore in Q1 FY22.

Year of the tech IPO: With this, PharmEasy will join a slew of startups that have launched IPOs this year, including Zomato, Paytm, Nykaa and Policybazaar.

Paytm’s Rs 18,300-crore IPO fully subscribed on last day

Paytm’s IPO, worth Rs 18,300 crore, was fully subscribed on the third day of bidding today.

Subscription numbers: Paytm’s IPO has been subscribed 1.89 times, with the tranche for qualified institutional buyers (QIBs) subscribed 2.79 times.

The portion set aside for retail investors was subscribed 1.66 times, while the portion reserved for non-institutional investors was subscribed 0.24 times.

The issue, the largest in India’s history, struggled to generate the sort of buzz that Zomato and Nykaa managed.

Paytm’s Rs 18,300 crore IPO comprised a fresh issue of Rs 8,300 crore and an offer for sale (OFS) by existing shareholders worth Rs 10,000 crore.

The company said it plans to use the money it raises to grow and strengthen its ecosystem. It will spend Rs 4,300 crore on acquiring and retaining more customers and merchants, and giving them greater access to technology and financial services. It also plans to use Rs 2,000 crore for new business initiatives, acquisitions and strategic partnerships, and for other general corporate purposes.

Zomato expected to announce investments in Curefit, Magicpin, Shiprocket

Zomato CEO Deepinder Goyal

Food delivery platform Zomato will likely announce a slew of investments in internet startups after releasing its earnings report today.

The company is expected to announce investments in business discovery and rewards platform Magicpin, fitness startup Curefit, and logistics aggregator Shiprocket, according to people aware of the development. Zomato cofounder and CEO Deepinder Goyal was appointed as an independent director on Magicpin’s board in July.

Divestment plan: The company will also likely announce its divestment from Fitso, a sports discovery platform, in which it invested earlier this year.

In an interview with ET in October, Goyal said that the company was looking to invest in businesses that could add more than $10 billion to its market capitalisation.

- “We are investing in some really good founders and companies — all in synergistic or adjacent areas to our business. We hope that over time, some of these companies and founders will choose to merge with Zomato to continue on their growth path. We are not asking any of these founders or companies for future M&A rights. We want chemistry to do the work here,” Goyal said in the interview.

The team: The investments are being led by Zomato’s corporate development team, which reports to chief financial officer Akshant Goyal. The four-member team is headed by Kunal Swarup, who was previously at Kotak Investment Banking.

The startup had previously invested in online grocery delivery startup Grofers for about a 10% stake.

Food remains a core focus: The series of new investments come on the back of the food delivery and discovery platform undergoing changes including a cleaning-up exercise this year as part of which it shuttered its international operations in the US, the UK, Ireland and Singapore.

Earlier this year the company seemed to be focused on building its fitness and health verticals through Fitso and nutraceutical business. Now, it is likely going to divest from Fitso after shutting the nutrition business in September.

- “The growth of the food delivery business was such that in the bigger picture, these businesses had ceased to add much to the overall business. We don’t want to build businesses which can add just $1 billion to shareholder value anymore. We need to be prudent with our team’s time and the money in our bank,” Goyal said in an earlier interview, when asked about the different businesses the company had shut down over the year.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here