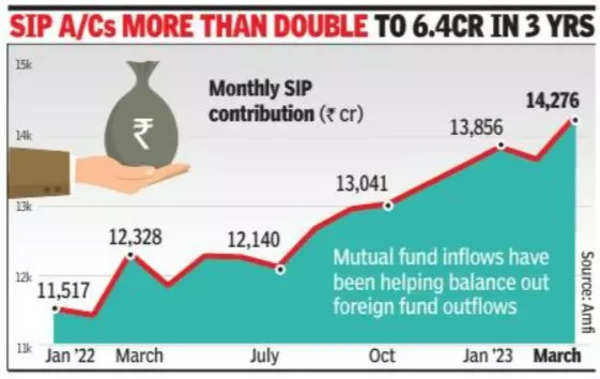

Mutual fund SIP inflows hit Rs14,000 crore 1st time ever in March – Times of India

In March, retail investors put Rs 14,276 crore into mutual fund schemes, compared to the previous peak monthly inflow of Rs 13,856 crore in January, data released by industry body Amfi showed. With nearly 22 lakh new SIPs registeredduring the month, total accounts were at about 6. 4 crore. The number of SIP accounts have more than doubled from 3 crore in March 2020.

According to Amfi chief executive N S Venkatesh, the spike in investors witnessed in the post-pandemic period, despite the volatility due to global geopolitical reasons and inflation, is a cue to resilient investor behaviour. Industry players also said that the fast adoption of digital channels of investments during the pandemic also helped this strong surge in SIP accounts, alarge part of which came from the hinterlands, which were mostly untapped before Covid.

Industry data further showed that despite a volatile market during FY23, equity mutual funds together took in net inflows aggregating over Rs 2 lakh crore. March 2023 also saw over Rs 15,600 crore net inflows into corporate bond schemes, nearly Rs 6,500 crore into banking & PSU schemes, and another Rs 5,661 crore in dynamic bond funds.

Liquid funds saw nearly Rs 57,000-crore net outflow, while the corresponding figure for money market funds was Rs 11,422 crore and for ultra-short duration funds it was Rs 10,281 crore. Most of these redemptions were ahead of the last date for payment of advance tax obligations.

For all the latest business News Click Here