‘Millionaire tax’ plans are on the ballot in California and Massachusetts. Here’s what that means for taxpayers

How states plan to spend ‘millionaire tax’ revenue

While the proposed taxes sound similar, there are differences in how each state plans to use the revenue.

In Massachusetts, assuming voters pass the measure, the tax is expected to generate about $1.3 billion of revenue in 2023, according to a Tufts University analysis. The state aims to use the revenue to fund public education, roads, bridges and public transportation.

California’s tax is projected to bring in $3.5 billion to $5 billion annually should it pass, and the state plans to use the revenue to pay for zero-emissions vehicle programs and wildfire response and prevention.

Whether voters support higher income taxes or not, revenue plans often affect the results on Election Day, experts say.

“We’ve seen voters reject income tax increases on high earners, even when it applies to relatively few people,” said Jared Walczak, vice president of state projects at the Tax Foundation. “And we’ve seen them embrace income tax changes that would affect many.”

We’ve seen voters reject income tax increases on high earners, even when it applies to relatively few people.

Jared Walczak

Vice president of state projects at the Tax Foundation

Overall, there’s one clear trend with state tax ballots: Voters care about the plans for the money, he said.

With funds earmarked for zero-emissions vehicle subsidies, Proposition 30 is opposed by Gov. Gavin Newsom, who believes the measure will negatively impact the state’s economy without a benefit that “broadly accrues to Californians,” Walczak said.

There’s been a push for progressive taxes in Massachusetts

Another factor that may affect voters is the current income tax structure in each state, experts say.

“Massachusetts has been talking about creating a progressive tax rate for a long time,” said Richard Auxier, senior policy associate at the Urban-Brookings Tax Policy Center, noting the current flat income tax is 5% regardless of income.

“Part of this is they want that ability to shift some of the overall state’s tax burden up the ladder,” he said.

By contrast, California has a graduated state income tax system, with a top rate of 13.3% for individuals making over $1 million per year.

“California already has very high top marginal [tax] rates,” Walczak said. “Even if voters are broadly in favor of progressive taxes and support higher rates on high earners, they may feel that it goes far enough.”

Walczak said he does not believe the proposed millionaire taxes are part of a broader trend at the state level. Since 2021, some 21 states have slashed individual income taxes, and only one state, New York, and the District of Columbia have raised levies.

“You can’t read much into what voters want based merely on ballot access,” he added.

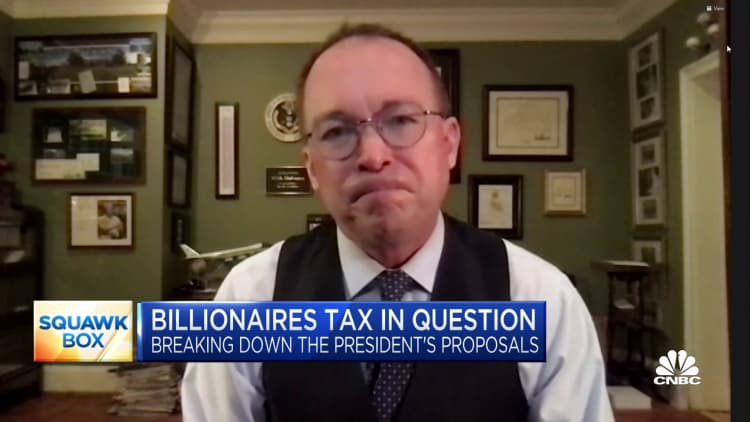

Federal plans for higher taxes on the wealthiest Americans have faltered

Despite the growing interest in taxing the ultrawealthy, federal proposals have failed to gain traction.

After releasing dueling wealth tax proposals during the 2020 presidential primaries, Sens. Elizabeth Warren, D-Mass., and Bernie Sanders, I-Vt., along with other Democrats, in March 2021 floated the Ultra-Millionaire Tax Act, a 2% annual tax on wealth over $50 million and 3% on wealth over $1 billion.

And Senate Finance Committee Chairman Ron Wyden, D-Ore., in October 2021 proposed a plan for a tax affecting Americans with more than $1 billion of wealth or an adjusted gross income exceeding $100 million for three consecutive years.

In March, President Joe Biden unveiled a wealth tax proposal as part of his 2023 budget, calling for a 20% levy on households worth more than $100 million.

While many Americans approve of higher taxes on the ultrawealthy, these plans have failed to gain broad support.

For all the latest business News Click Here