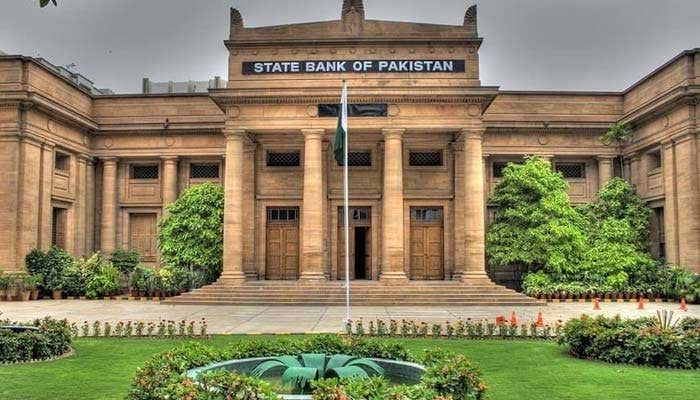

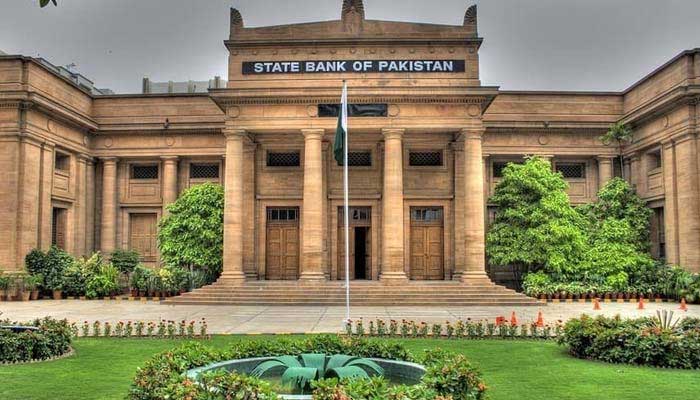

Interest rate hike likely in SBP’s off-cycle review today

The State Bank of Pakistan’s (SBP) Monetary Policy Committee (MPC) is likely to jack up the interest rates in an off-cycle review meeting today (Thursday).

The MPC meeting had been originally scheduled for March 16, but the SBP “preponed” it in another attempt to accelerate efforts to secure the long-awaited tranche from the International Monetary Fund (IMF).

The SBP’s chief spokesperson Abid Qamar had earlier said that after the last month’s meeting, no MPC meeting could be held to date.

The committee had been formed under the SBP’s Amendment Act, which is empowered to make decisions in the light of macroeconomic fundamentals.

The market expects the SBP to raise benchmark interest rates as the rise in treasury yields in the last auction hinted towards market weighing-in concerns on the economic front with the investors continuing to take note of rising inflation around the world as well as in Pakistan, Arif Habib Limited stated in a commentary released earlier.

Moreover, sources had told Geo News last week that the coalition government had agreed to hike the interest rate from the existing level of 17% to 19% under one of the major conditions put forth by the Fund to revive the loan programme.

However, analysts believed that the SBP needed to bring forward the MPC meeting date as the ministry of finance cannot afford failure in the next T-bill auction.

The Fund and the central bank had held a round of discussions about the possibility of further tightening of monetary policy and building up foreign exchange reserves by the end of June 2023.

The IMF had also asked the SBP for hiking the policy rate by 300 to 400 basis points in order to move towards the interest rate from a negative to a positive trajectory.

The cash-strapped country is undertaking key measures to secure IMF funding, including raising taxes, removing blanket subsidies, and artificial curbs on the exchange rate. While the government expects a deal with IMF soon, media reports say that the lender expects the policy rate to be increased.

Off-cycle rate reviews are not uncommon in Pakistan, though.

For all the latest business News Click Here