Index of industrial production growth at eight-month high but worries still linger – Times of India

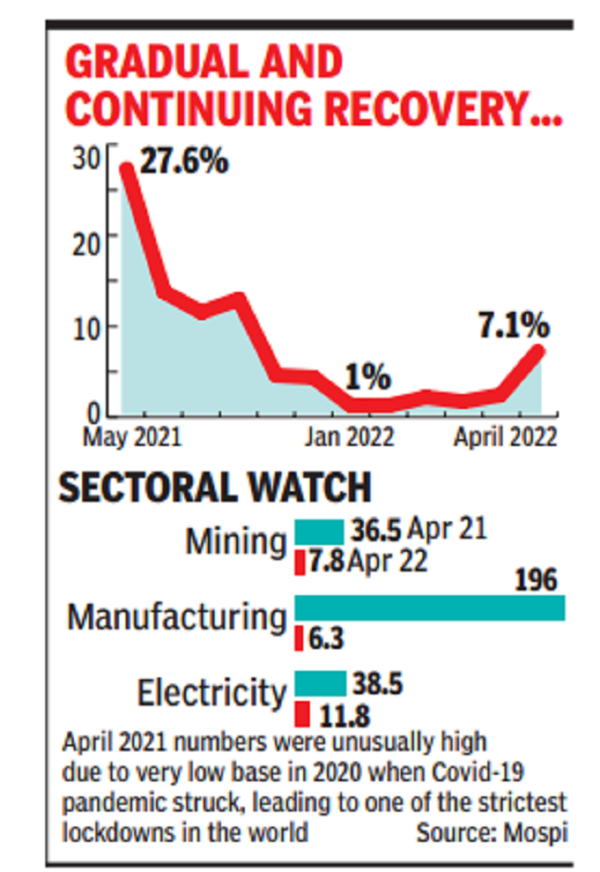

Data released by the National Statistical Office (NSO) on Friday showed the index of industrial production (IIP) rose an annual 7.1% in April, compared with an upwardly revised 2.2% in March. The sector had grown by 133.5% in April 2021 on the back of a very low base of 2020 when the Covid-19 induced lockdown had smothered economic activity and growth.

Several indicators had pointed to the recovery gathering momentum, including PMI manufacturing surveys and GST receipts. The impact of the war in Ukraine and the breakdown in supply chains have triggered stubborn price pressures which will have an impact on growth and the manufacturing sector going forward. But economists were surprised by the resilience of the sector although they pointed to the weak spots that still need to be watched in the manufacturing sector.

The manufacturing sector rose an annual 6.3% in April, higher than the 1.4% in March and the electricity sector rose 11.8% compared to a 6.1% growth in the previous month.

“When compared with the pre-Covid level of April 2019, the IIP was 6.8% higher in April 2022, with a double-digit growth in intermediate, infrastructure and primary goods, amidst a flattish performance of consumer non-durables, and an unpalatable contraction in capital goods and consumer durables,” said Aditi Nayar, chief economist at ratings agency ICRA.

She said consumption remains tentative on the whole, with underlying unevenness. Led by pent-up demand, the agency expects services to outperform the demand for goods in the near term, with the latter further constrained by elevated prices.

Nayar said the weak showing of capital goods output relative to the pre-Covid level confirms the view that the uptick in capacity utilisation in the fourth quarter of FY2022 will not trigger a rapid private sector capacity expansion in light of the uncertainties generated by geo-political developments.

The Reserve Bank of India has retained its GDP growth forecast of 7.2% for 2022-23 but raised its inflation projection to 6.7% from the earlier 5.7% citing the geopolitical situation. The central bank has raised rates by 90 basis points so far and there are expectations of more rate hikes to tame inflation, which has been running above the RBI’s upper tolerance band. The rate hikes will hurt overall expansion as the focus shifts to rein in price pressures.

“The IIP growth number buttresses the confidence given by the PMIs and GST collections during this challenging period. We need to see if this momentum can be sustained going forward as it would be a prerequisite for growth in GDP to be sustained at over 7% this year. Sustenance will be the mantra because Q4 also saw corporates finish the year on a good note. Demand from consumers and investment by corporates will hold the clues in the coming months,” said Madan Sabnavis, chief economist at Bank of Baroda.

For all the latest business News Click Here