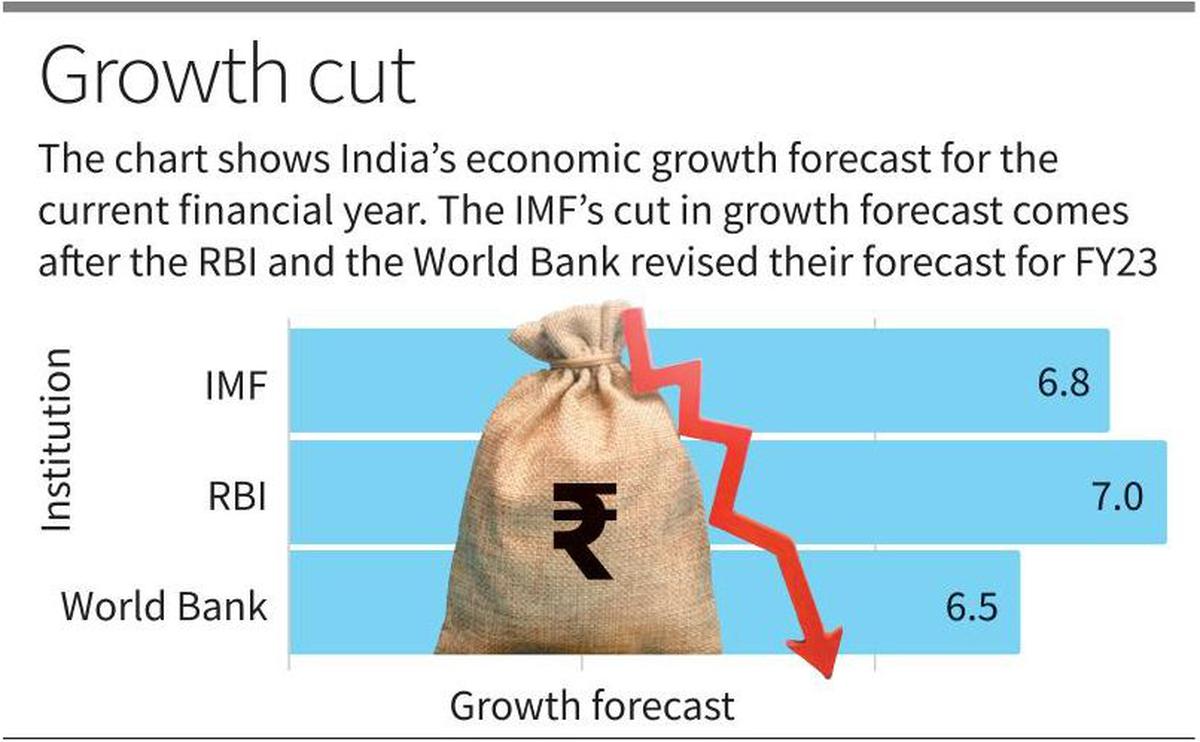

IMF cuts India’s FY 2022-23 growth forecast to 6.8%

The Fund cites Ukraine war, record-high inflation and effects of pandemic as key reasons; it expects inflation in the country to return to the tolerance band in the fiscal year 2023-24

The Fund cites Ukraine war, record-high inflation and effects of pandemic as key reasons; it expects inflation in the country to return to the tolerance band in the fiscal year 2023-24

The world, including India, will experience an overall slowdown in the next year owing to the impact of the Russia-Ukraine war, tightening monetary conditions globally, the highest inflation in decades, and lingering effects of the pandemic, according to the International Monetary Fund (IMF).

India is projected to grow at 6.8% in the current fiscal year, following 8.7% growth in the fiscal year that ended March 31 as per figures released in the IMF’s October 2022 World Economic Outlook: Countering the Cost-of-Living Crisis at the start of the World Bank IMF Annual Meetings here in Washington DC.

The growth rate for this year for India has been revised downward by 0.6 percentage points relative to the IMF’s June 2022 forecast following a weaker output in the second quarter, and subdued external demand, the IMF said. The forecast for the next fiscal year remains unaltered at 6.1%.

India doing ‘fairly well’, inflation above target

“India has been doing fairly well in 2022 and is expected to continue growing fairly robustly in 2023,” the IMF’s chief economist, Pierre-Olivier Gourinchas said at a press briefing in Washington on Tuesday morning.

Inflation in India was above the RBI’s target, Mr. Gourinchas said, adding that the fiscal and monetary policy should be on “probably be on the tightening side”. The IMF has projected 6.9% consumer price inflation this year and 5.1% next year.

The IMF expects inflation in India to return to the inflation tolerance band… in the fiscal year 2023-24, “and additional monetary tightening is going to ensure that that happens”, IMF economist Daniel Leigh said at the briefing.

For the world as a whole, growth will slow down from 6.0% in 2021 to 3.2% in 2022 and 2.7% in 2023. This is reflective of a U.S. GDP contraction in the first half of 2022, a Euro Area contraction in the second half, extended COVID-19 outbreaks in China and associated lockdown and a property sector crisis.

The U.S. is expected to grow at 1.6% this year followed by a slowing down to 1.0% growth next year. The Euro Area at 3.1% this year and 0.5% next, while China is forecast to grow at 4.4% next year, followed by a projected 3.2 % this year.

“The three largest economies, the United States, China, and the euro area will continue to stall,” Mr. Gourinchas said in a statement released before the briefing. “Overall, this year’s shocks will re-open economic wounds that were only partially healed post-pandemic. In short, the worst is yet to come and, for many people, 2023 will feel like a recession.”

There remain high downside risks to the forecasts, as per the IMF. Monetary policy that seeks to restore price stability is the starting point to mitigating these risks, the report said.

Mr. Gourinchas cautioned against fiscal policy working at cross purposes with the monetary authorities’ actions to curb inflation. Fiscal policy can assist economies to adapt to a volatile environment by investing in human capital, supply chain diversification, digitization, green energy, he said.

“The energy crisis, especially in Europe, is not a transitory shock. The geopolitical realignment of energy supplies in the wake of the war is broad and permanent,” Mr. Gourinchas said, adding that countries should target fiscal support towards the vulnerable via temporary transfers rather than focus on price controls, untargeted subsidies and export bans.

“Too many” low income countries at risk of debt distress

Emphasising that a large number of low-income countries, “too many”, are in or near debt distress, the chief economist urged orderly debt restructuring via the Group of Twenty (G20)’s Common Framework. The issue of debt sustainability had been raised by External Affairs Minister S. Jaishankar on his recent visit to the U.S. and listed as an area of potential focus for India’s forthcoming G20 presidency by World Bank President David Malpass last week.

For all the latest business News Click Here