Home Loan to Remain Cheaper: RBI Relaxes Loan-to-Value Rules till March-end Next Year

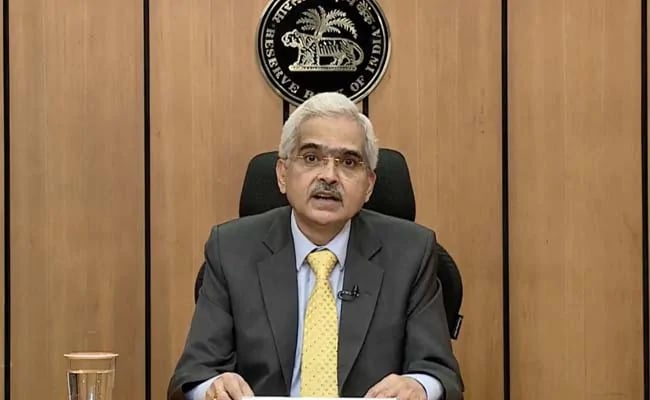

RBI governor Shaktikanta Das will announce the outcome of first MPC of this financial year today

Reserve Bank of India (RBI) on Friday announced that it will rationalise the risk weights and link them to loan-to-value (LTV) ratios for new home loans till March 31, 2023

In a move to make home loans cheaper, the Reserve Bank of India (RBI) on Friday announced that it will rationalise the risk weights and link them to loan-to-value (LTV) ratios for new home loans till March 31, 2023. RBI governor Shaktikanta Das said, “In terms of the extant regulations on capital charge for credit risk of individual housing loans by banks, differential risk weights are applicable based on the size of the loan as well as the loan to value ratio (LTV). Recognising the criticality of real estate sector in the economic recovery, given its role in employment generation and the interlinkages with other industries, it has been decided, as a countercyclical measure, to rationalise the risk weights by linking them only with LTV ratios for all new housing loans sanctioned up to March 31, 2023.”

“From a real estate perspective, the unchanged repo rate will continue to provide elbowroom to homebuyers, since home loan rates are at a record low. The housing sector saw a revival in 2021 and the continued low home loan rates can further propel homebuyers’ sentiments,” said Ramesh Nair, CEO, India and Managing Director, Market Development, Asia, Colliers.

Read all the Latest News , Breaking News and IPL 2022 Live Updates here.

For all the latest business News Click Here