FPI flows this year ride the coat-tails of ETFs, block deals

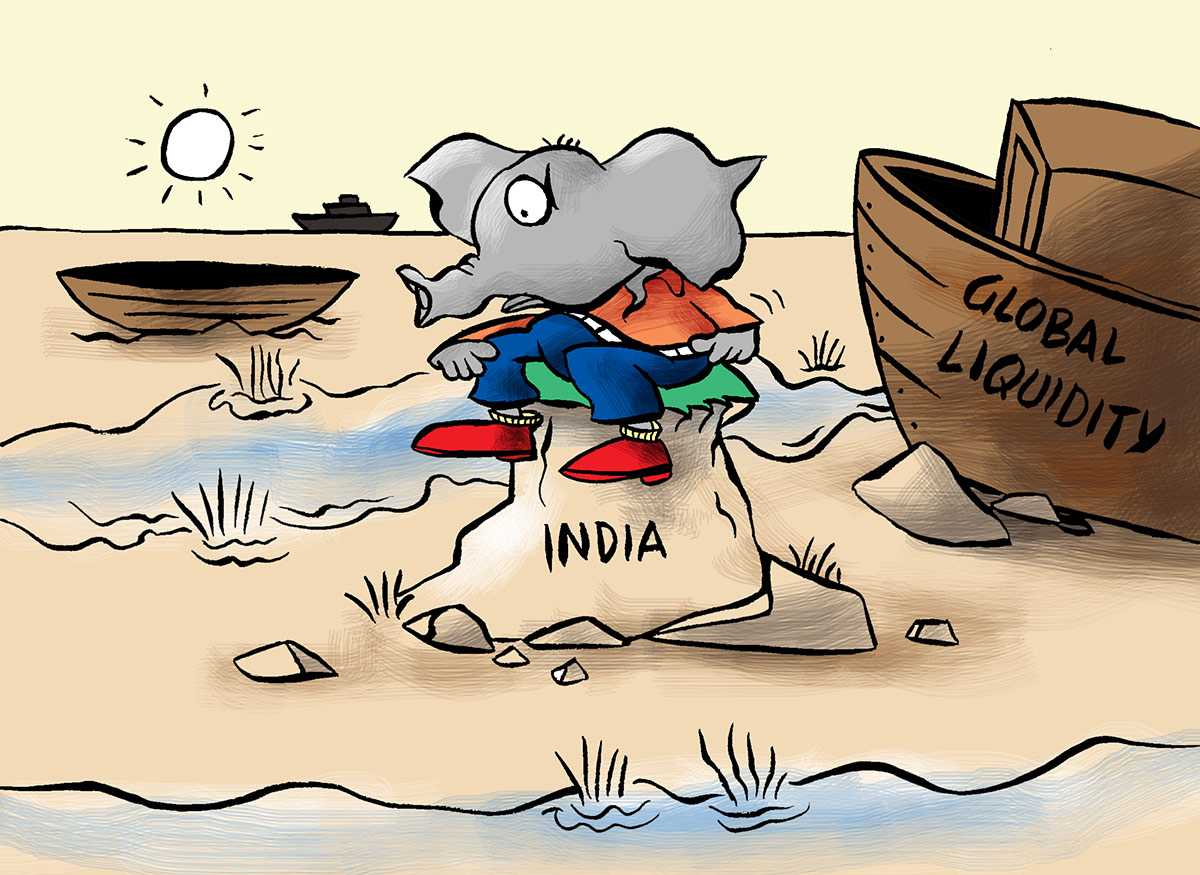

After pulling out $17 billion in calendar year 2022, foreign portfolio investors (FPIs) have pumped $7.3 billion back into equity markets so far this year.

The turnaround in foreign flows has helped domestic markets exceed the all-time highs chalked up in December 2022 and bounced back more than 10 per cent from this year’s lows.

However, a big nugget of FPI inflows seen this year could be off the back of two factors: exchange-traded funds (ETFs) and block deals.

Flows coming through the ETF route essentially mean investors are not looking to buy individual stocks but are backing an index, which could be based on benchmarks such as the National Stock Exchange Nifty50 or the Morgan Stanley Capital International Emerging Markets Index.

“Our analysis of FPI equity flows shows that the bulk of inflows into India in 2023 could be ETFs.

“Net ETF inflows stood at $3.3 billion during the first four months of 2023 versus cumulative net FPI inflows of nearly $7 billion so far this year.

“We assume the trend of passive flows would have continued in May and June,” reads a note by Kotak Institutional Equities (KIE).

Not just FPIs, KIE also believes that a huge section of the domestic mutual fund (MF) inflows are “passive by nature”.

“FPI inflows into India in recent months may simply be driven by the top-down excitement of foreign households around India and the expectation of certain returns, which may or may not materialise in the future.

“Similarly, large systematic investment plan inflows into MFs may reflect expectations of certain returns of domestic households related to returns from other asset classes and/or historical returns from equities,” states a note by KIE.

The report cautions against the rich valuations in sectors such as consumption and investment, making the risk/reward ratio less favourable.

The benchmark Nifty50 trades at over 20x its estimated earnings for 2023–24.

Meanwhile, experts point out that over half of the $6 billion inflows since May and June could be a consequence of large share sales in listed companies.

In May and June, the domestic markets saw block deals totalling over $5 billion.

Analysts say these share sales are, in a way, positive as they help soak up excess liquidity. Otherwise, some portion of it may have gone into stocks through the direct route, drumming up valuation fanfare.

For all the latest business News Click Here