‘Foreign-return’ startups on the rise; India’s monthly mobile exports hit record $1B

Credit: Tenor

Also in this letter:

■ India’s monthly mobile phone exports hit record $1 billion in Sept

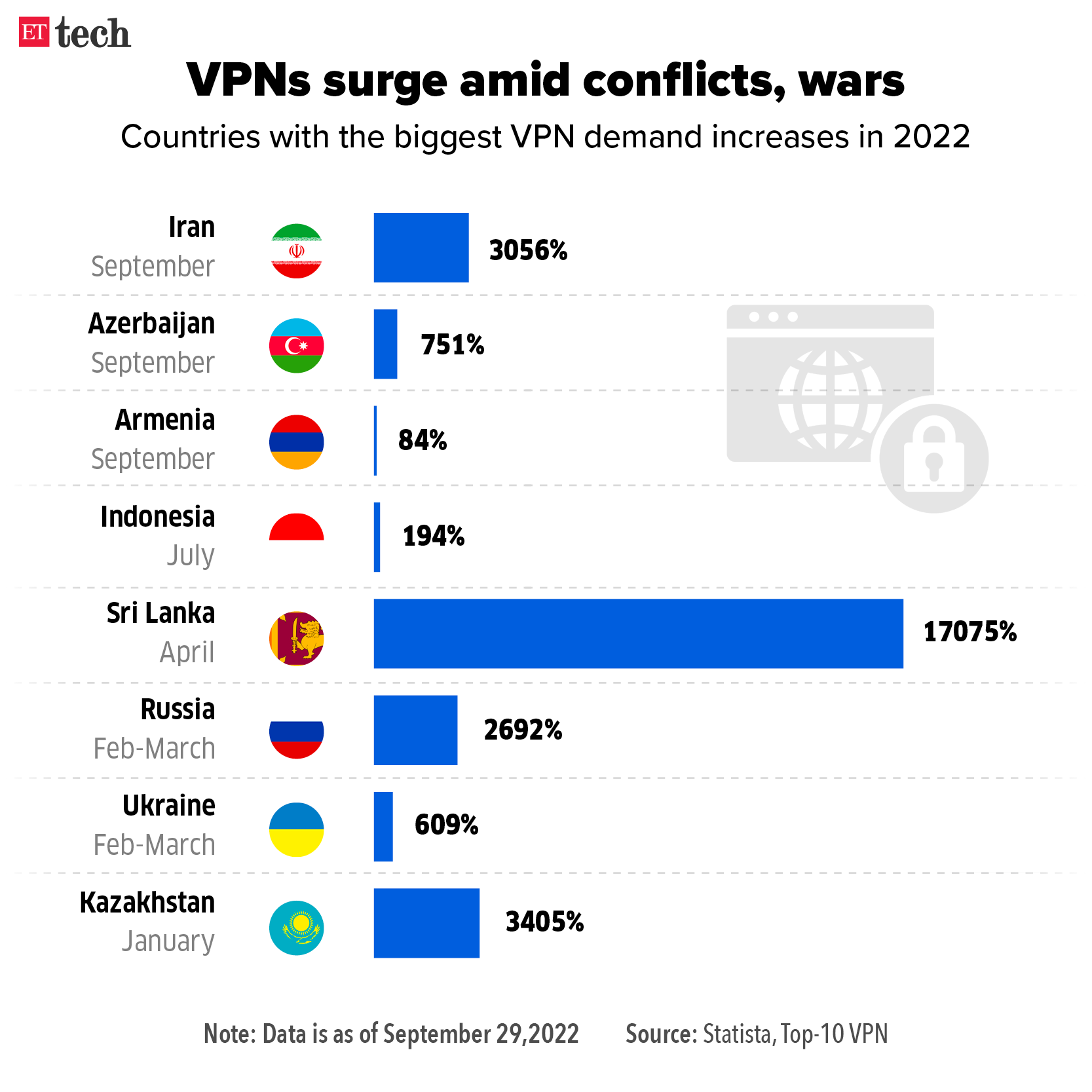

■ Infographic Insight: VPN demand spikes amid war, conflicts

■ Infosys becomes India’s fourth-largest firm by market cap after Q2 show

Startups explore ‘reverse flipping’ to bring ownership back to India

Indian startups that had set up overseas holding companies or were considering merging with blank-cheque companies to explore foreign listings are reversing their strategies and considering local public offers.

Flip it and reverse it: Market participants say some of these companies are now exploring the so-called ‘reverse flipping’ to bring their ownership back to India and list locally, like tech unicorns Zomato, Paytm, and Nykaa did last year.

Why? The over 20% correction in the tech-heavy Nasdaq and the rapid loss of interest in special purpose acquisition vehicles (SPACs) this year have dimmed the allure of a foreign listing.

The recent relaxations in the round-tripping rules by the Reserve Bank of India (RBI) and the government’s policy support for startups are also encouraging the shift.

Case in point: On October 3, Walmart-owned PhonePe said it had reversed its overseas structure and was also eyeing an India listing. Market participants say at least three more big startups are currently looking at bringing ownership back to India.

How it works: A company with a foreign holding structure cannot list in India, and Indian companies are prohibited from directly listing overseas. To get around this, Indian companies eyeing foreign listings would create a holding company overseas that would own the Indian business. This holding company would then list on Nasdaq or be acquired by a SPAC.

This process is referred to as ‘flipping’ since the corporate structure of the company changes from domestic to foreign. ‘Reverse flipping’ is simply the process of rolling back foreign ownership.

India’s monthly mobile phone exports hit record $1 billion in Sept

Monthly mobile phone exports from India touched $1 billion (over ₹8,200 crore) for the first time ever in September.

What’s driving the growth? They were boosted by the government’s production-linked incentive (PLI) scheme, which has pushed global players such as Apple and Samsung to increase local production for both the domestic and overseas markets.

Industry executives say export growth has been primarily driven by Apple contract manufacturers Foxconn, Wistron and Pegatron, along with Samsung – leading global participants in the ₹40,995-crore PLI scheme announced in April 2020.

Also Read |Apple may move a quarter of iPhone production to India by 2025: JP Morgan

By the numbers: According to data available exclusively with ET, mobile phone exports for April-September more than doubled to $4.2 billion, from $1.7 billion in the corresponding period of 2021.

Previously, the highest monthly export of cell phones was in December 2021, when devices worth $770 million were shipped. Exports hovered around $700 million each month during June-August this year.

The estimated value of mobile phone exports in September 2022 showed a growth of more than 200% over September 2021, the data showed.

The global majors account for roughly 75-80% of smartphone exports from India.

Ambitious target: The PLI scheme for smartphones launched in 2020 was aimed at weaning away manufacturers from dominant geographies such as China and Vietnam.

Backed by the scheme, India is trying to catch up with the two countries, which still lead the world in mobile phone exports. India aims to export mobile phones worth $60 billion by 2025-26.

Also Read | Apple’s iPhone 14 India manufacturing shows maturity of India production capabilities: Moody’s

Infographic Insight

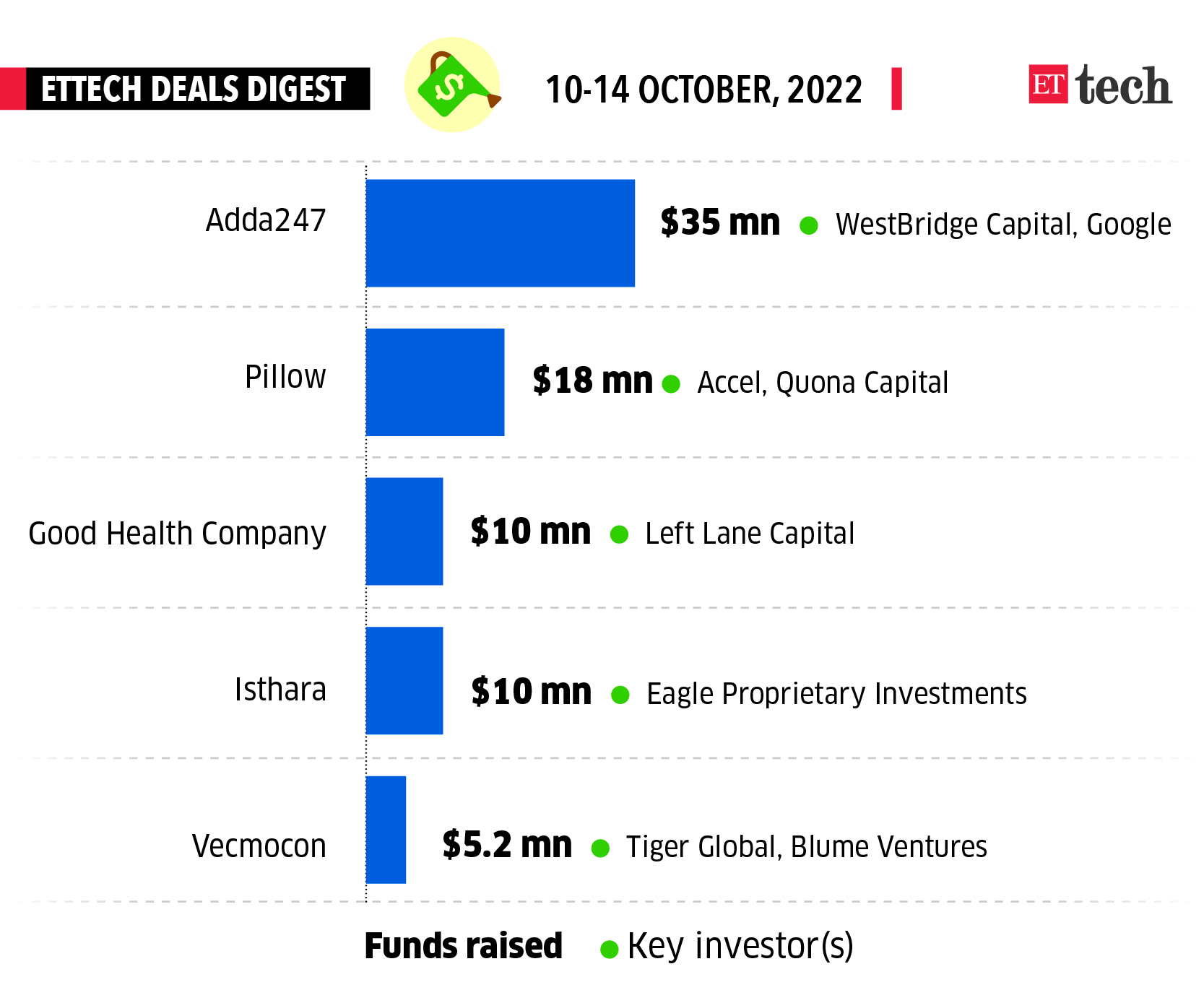

ETtech Deals Digest

Funding for Indian startups barely picked up pace this week as cautious investors remained wary of placing large, risky bets. In the current macroeconomic climate, big-ticket deals will remain absent or rare for some time to come.

Several reports and studies this week revealed that funding for Indian startups is at multi-year lows. According to a report by CB Insights, VC funding in India hit a 21-month low in the July-September quarter with 387 deals bringing a paltry $2.8 billion, compared with $9.8 billion raised in 525 deals in the same period last year.

This week, edtech startup Adda 247 and cryptocurrency platform Pillow led the funding charts, raising $35 million and $18 million, respectively.

Here is a list of all the startups that raised funds this week

Infosys becomes India’s fourth-largest firm by market cap after Q2 show

Infosys’s resilient performance in Q2 breathed new life into its long-suffering stock, which rallied nearly 5% on Friday, making the IT bellwether India’s fourth-largest company by market capitalisation.

Jargon buster: Market capitalisation, or market cap, is the total value of a publicly traded company’s outstanding common shares owned by stockholders. It is equal to the market price per common share multiplied by the number of common shares outstanding. (Common shares are simply those that give holders the power to elect the board of directors and vote on corporate policies.)

By the numbers: With a market cap of Rs 6.25 lakh crore, the IT major has once again taken the No. 4 spot after Reliance Industries, Tata Consultancy Services and HDFC Bank, overtaking FMCG giant Hindustan Unilever Ltd on the list of largest listed companies in India.

Results-driven: After Infosys reported a 23.4% year-on-year (YoY) jump in consolidated revenue for the September quarter to Rs 36,538 crore, global brokerage CLSA increased its target price on the stock to Rs 1,800 a share, signalling an upside potential of over 28% from day’s high of Rs 1,490.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Gaurab Dasgupta in New Delhi. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here