Falguni Nayar on Nykaa’s bumper listing; Zomato’s Q2 results

Also in this letter:

- Zomato announces Q2 results, three more investments

- Parliamentary panel to meet crypto stakeholders

- Panel calls for national non-personal data authority

Falguni Nayar on Nykaa’s blockbuster listing and the next milestone

FSN Ecommerce, which runs the online beauty and fashion marketplace Nykaa, hit the Indian bourses on Wednesday in what was a bumper debut for the company.

Its market capitalisation surged past Rs 1 lakh crore after the company’s stock started trading at premium of more than 80% over its issue price of Rs 1,125.

For Nykaa’s founder & CEO Falguni Nayar, an acclaimed investment banker with Kotak Mahindra Bank who turned entrepreneur nine years ago, the listing propelled her into the club of top billionaires.

In an interview after Nykaa’s blockbuster listing, Nayar spoke about how she built the company differently from other tech startups, about it being promoter-led, what that means for professionals in new-age companies like hers, and her next milestone after the IPO.

Here are some edited excerpts:

Many people said Nykaa’s IPO valuation was way too high. What is your day-one reaction to the listing and the reception it has received?

In the whole journey of the IPO, we met almost 120 top investors across the world. These were all high-quality, long-only investors who asked us very tough questions. Based on that experience and the way we responded, these investors loved our story and the way we had built our business. It was a big endorsement of our strategy. We knew we were building our business in the right manner, and that it would have long-term appeal.

What drove you to tap the public market?

The business and the brand should have a life of their own. We didn’t build the company to sell out so we always worked towards this — that the company, when it is mature enough, should have a life in the stock markets. Even if we were to get a higher valuation in the private markets, we would have always considered a public listing.

Talk a bit about how Nykaa’s promoters (you and your family) hold more than 50% in the company; does that make it harder to bring professionals on board?

Professional talent is very well respected and they have a huge role to play — how much can we as a family do? It’s just great for me that both Anchit and Adwaita (her son and daughter) are excited about the business and have chosen to join me. Family ownership brings long-term orientation to any business, and there is not just ownership but also involvement. Many of our professional team members are equally important, and many of them are very happy being a part of the journey for more than six or seven years.

What is the next milestone for Nykaa?

It’s a multi-year journey and we believe that over the next five years we will continue to grow both our beauty and fashion businesses multi-fold. Similarly, the house of brands will also continue to grow, as we become more like a consumer company which has a number of brands within its fold. We are also setting up our e-B2B (business to business) vertical.

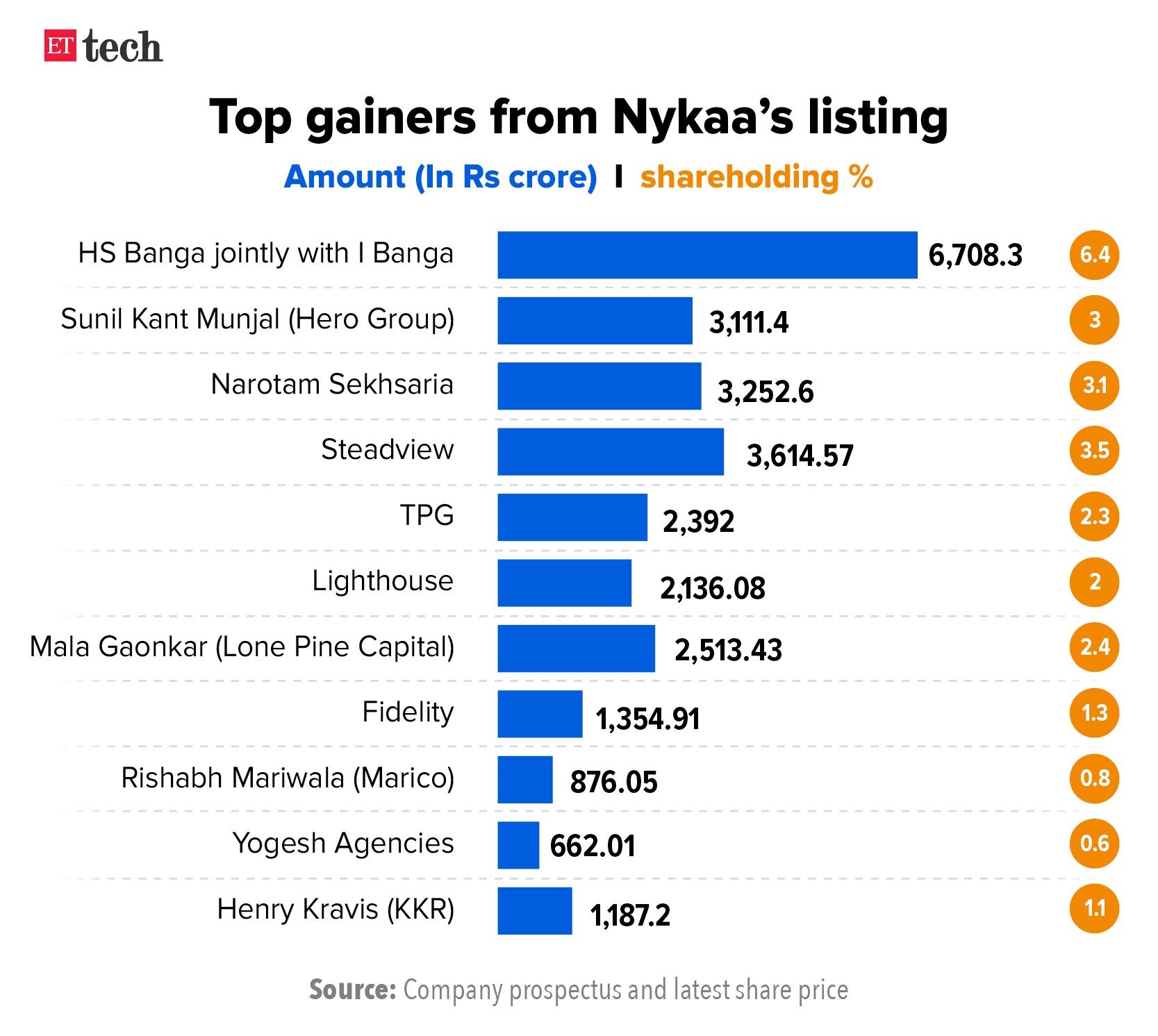

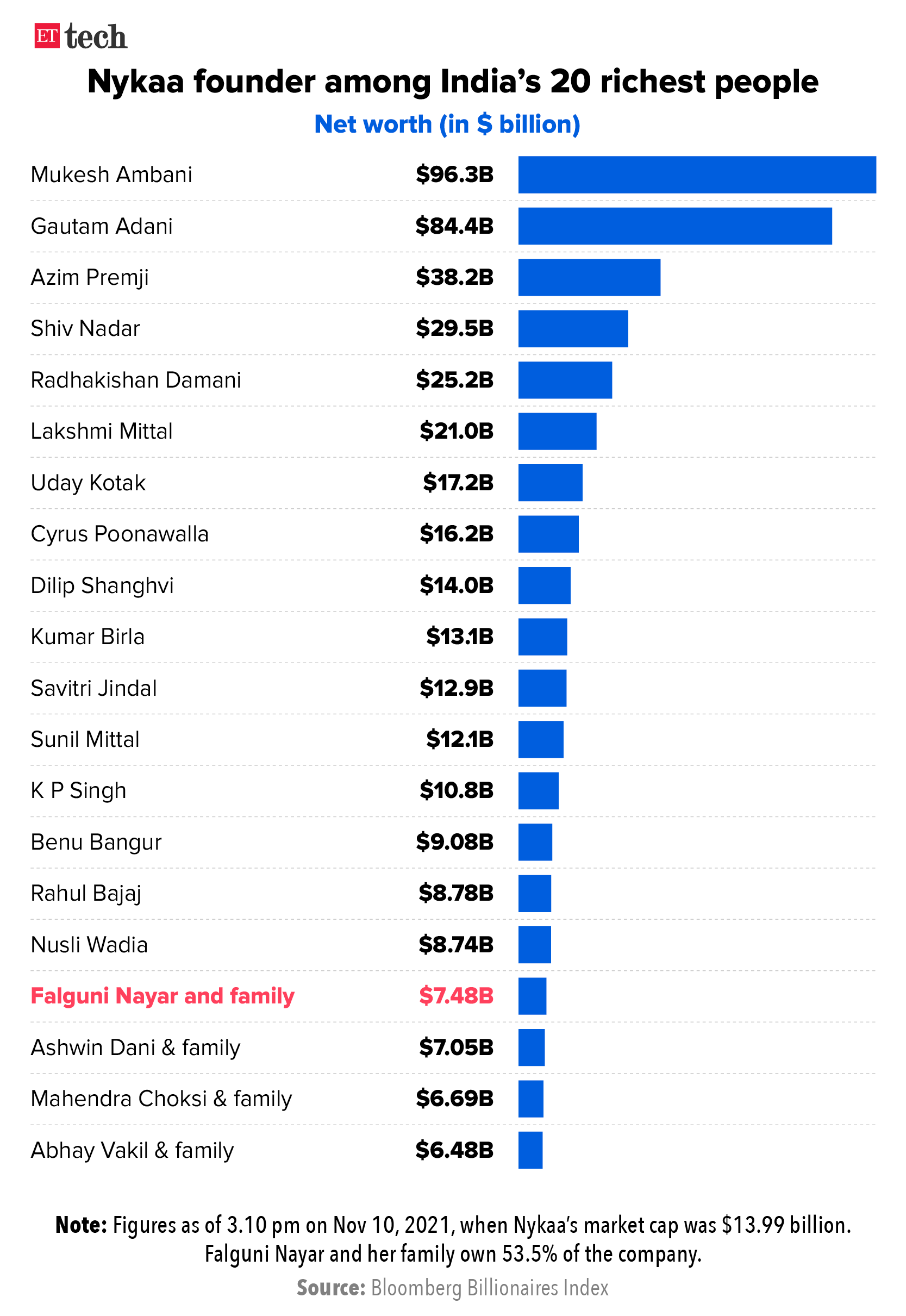

Nayar 17th on India’s rich list: By 3.10 pm on Wednesday, FSN’s share price had risen to Rs 2,206, giving it a market cap of about Rs 1.03 lakh crore ($13.99 billion) and making Nayar the 17 richest person in India with a fortune of around Rs 55,572 crore ($7.48 billion). She is also only the second Indian self-made woman billionaire after Biocon founder Kiran Mazumdar-Shaw. Nayar owns 53.5% of FSN through two promoter trusts and seven other promoter entities.

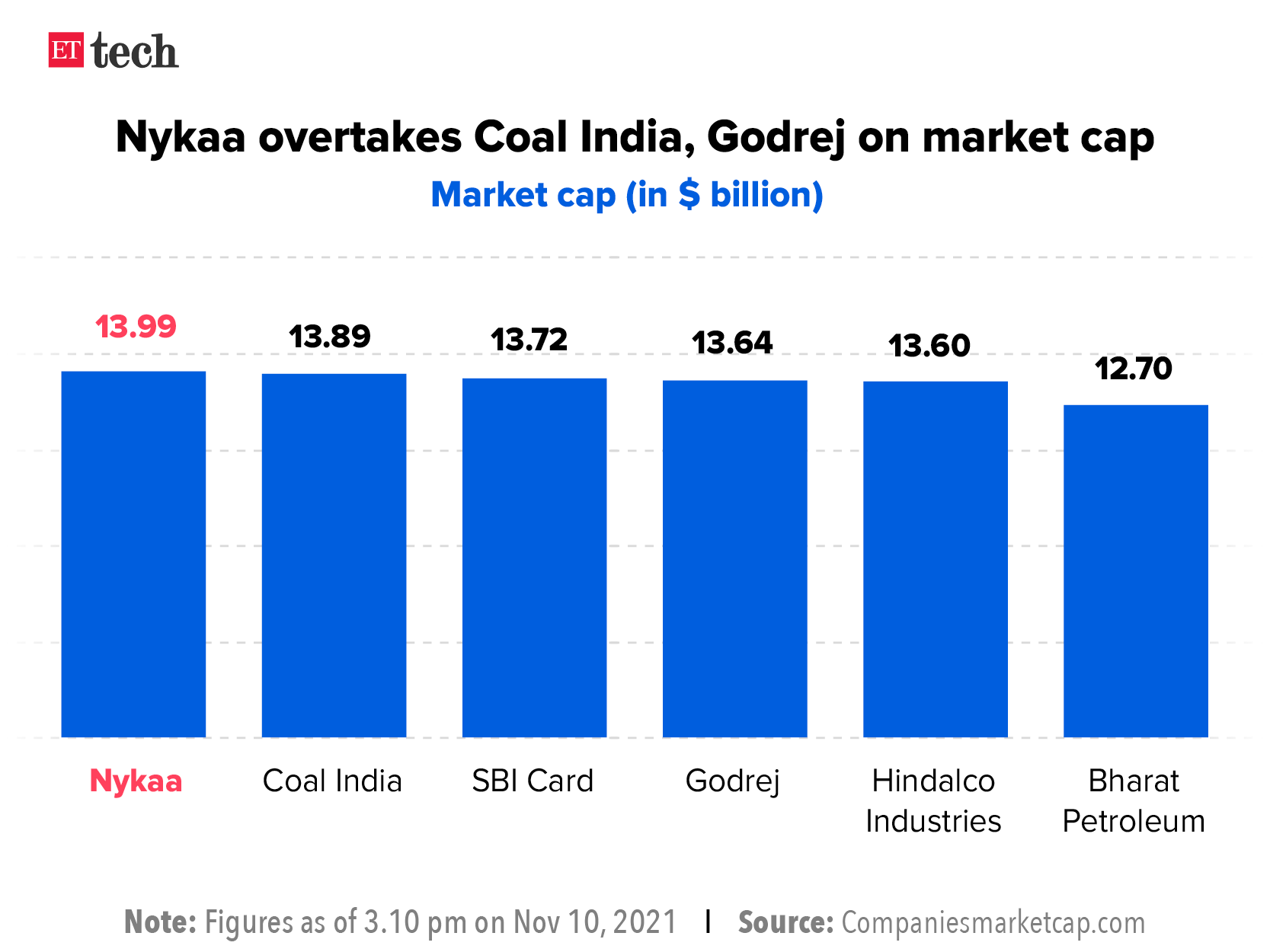

Nykaa in heady company: Nykaa’s $13.99 billion market cap, meanwhile, made it the 51st largest company in India, according to data from Companymarketcap.com. The online cosmetics retailer was ahead of heavyweights such as Coal India ($13.89 billion), Godrej ($13.64 billion), Hindalco Industries ($13.60 billion) and Bharat Petroleum ($12.70 billion). Zomato, the first Indian startup to go public, was four places higher at 47, with a market cap of $14.58 billion.

Others who made huge gains from Nykaa’s listing included Bollywood celebrities Katrina Kaif and Alia Bhatt, who own 0.02% and 0.05% of the company, respectively. At a market cap of Rs 1.03 lakh crore, Kaif’s stake is worth Rs 20.6 crore while Bhatt’s is worth Rs 51.6 crore.

Also Read: Who is Falguni Nayar, India’s richest self-made woman?

Zomato Q2 revenue surges to Rs 1,024 cr; firm invests in Curefit, Magicpin, Shiprocket

Online food delivery firm Zomato said its revenue from operations jumped to Rs 1,024.2 crore in the quarter ended September 30 from Rs 426 crore a year earlier, even as its loss widened to Rs 434.9 crore from Rs 229 crore. The company, which made a stellar debut on the stock exchanges in July, had posted Rs 844.4 crore in revenue from operations in the fiscal first quarter ended June 30.

Why loss is up: The Gurgaon-based Zomato attributed the rise in loss to increased spending on branding and marketing for customer acquisition, higher investments, and higher delivery costs due to unpredictable weather and high fuel prices.

More investments: Zomato also announced plans to deploy $1 billion in startups over the next couple of years. It announced key investments in three companies — logistics aggregator Shiprocket, local shopping and savings platform Magicpin as well as fitness startup Cultfit, earlier known as Curefit.

The company said it has now committed $275 million across four companies in the past six months, including its $100 million investment in online grocery Grofers in August.

- “We plan to deploy another $1 billion over the next 1-2 years, with a large chunk of it likely to go into the quick-commerce space,” the company said.

These investments, the company said, are part of its long-term view, in which it is prioritising in three core areas — divesting businesses that are not going to add exponential value to shareholders, increasing focus on the core food delivery business to build an ecosystem, and investing and partnering with companies to tap into growth opportunities beyond food.

As part of the Curefit investment, Zomato will sell fitness app Fitso to Curefit for $50 million. “This will help us potentially explore cross-selling benefits between Zomato and Curefit, as we see food and health becoming the same side of the coin in the long term,” Zomato added.

Zomato said it is investing $75 million in Shiprocket for an 8% stake as part of a larger $185 million round, and that it also invested $50 million in Magicpin as part of a $60 million funding round, for a 16% stake. Goyal recently joined the board of Magicpin.

Last month, chief executive Deepinder Goyal told us in an interview that Zomato was looking to back businesses that would add more than $10 billion to its market capitalisation. “We are investing in some really good founders and companies — all in synergistic or adjacent areas to our business. We hope that over time, some of these companies and founders will choose to merge with Zomato to continue on their growth path. We are not asking any of these founders or companies for future M&A rights. We want chemistry to do the work here,” Goyal had said.

Tweet of the day

Parliamentary panel to meet crypto stakeholders

The Parliamentary Standing Committee on Finance may hold a closed-door meeting with stakeholders from the cryptocurrency industry on Monday.

What’s happening? The committee, which is led by Lok Sabha member Jayant Sinha, has invited India’s top crypto exchanges, members of the Blockchain and Crypto Assets Council (BACC), and analysts for the discussion. BACC is part of the Internet and Mobile Association of India.

Why it matters: This is the first time the committee has invited stakeholders for “official” discussions, according to people aware of the matter. The industry has been engaged in backchannel conversations with the government over the past year. This is also a significant development because the government was said to be considering an outright ban on cryptocurrencies as recently as early this year.

We reported on November 8 that the government was considering a middle path on cryptocurrencies, as it finalises legislation on the virtual asset.

The bill is expected to be introduced in the upcoming winter session of Parliament.

Panel calls for national non-personal data authority

The Kris Gopalakrishnan-led committee, tasked with defining the regulatory structure for use of non-personal data (NPD) in the country, has recommended the establishment of a national NPD authority in the draft bill and the final report that it has already submitted to the government, sources told us.

This makes India one of the first countries globally to have a draft legislation to regulate NPD.

What’s NPD? Non-personal data is information that is stripped of personally identifiable material.

The government-constituted panel’s draft NPD legislation also lays out conditions under which companies that control large amounts of data will be classified as “data businesses”, and what constitutes “high value data”, the sources said.

The draft report envisages the setting up of several data trusts by the government, which can ask for high-value data sets (these are anonymous and will not identify individuals) from companies such as Google and Amazon, people aware of the recommendations said.

Concerns: Big Tech companies and other large firms have voiced concerns about provisions emanating data sharing with the government and other private businesses. They have argued that such data sharing will violate intellectual property rights. On the other hand, startups and small and medium enterprises have welcomed the proposals and said that being able to request metadata from large companies will benefit them.

Good Glamm in talks to buy stake in St Botanica

Darpan Sanghvi, cofounder and chief executive of Good Glamm Group

Good Glamm Group, which houses direct-to-consumer (D2C) brands in the beauty and personal care segment, is in advanced talks to acquire a stake in skin and personal care brand St Botanica.

A spokesperson confirmed in an email response, “We confirm that the Good Glamm Group is in advanced discussions with St Botanica.”

On Tuesday, the startup raised $150 million from investors led by South Africa’s Prosus Ventures and private equity major Warburg Pincus. The funding round had catapulted the consumer brand firm into an ever-growing tribe of Indian unicorns, which are privately held startups with a valuation of $1 billion or more.

The parent firm of brands like MyGlamm, BabyChakra, PopXo and Scoopwhoop was valued at $1.2 billion post-money, a senior company executive told us. It is the second Indian D2C company to become a unicorn after Licious.

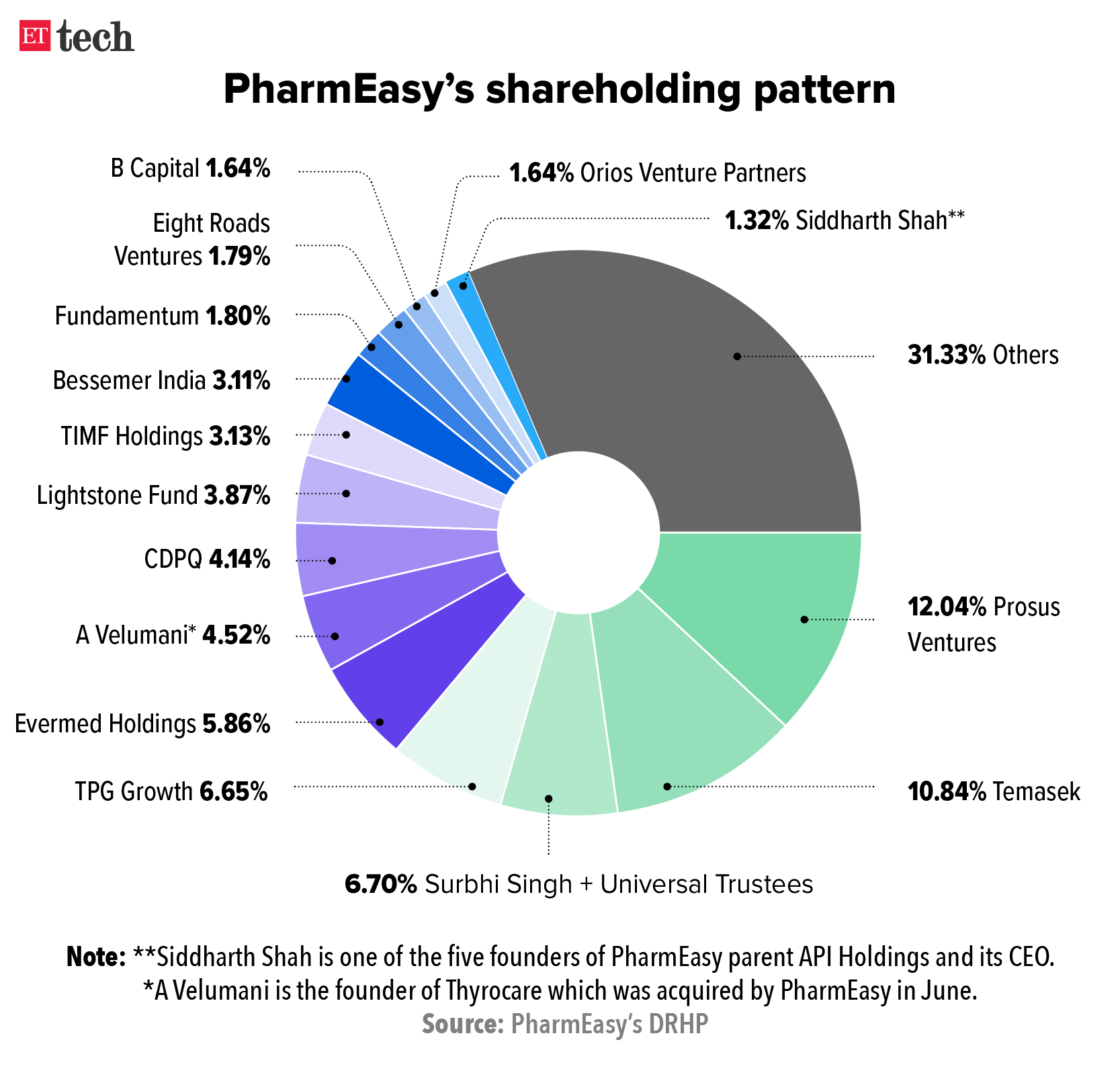

PharmEasy parent files draft papers for Rs 6,250-crore IPO

API Holdings, the parent company of India’s largest e-pharmacy platform PharmEasy, has filed a draft red herring prospectus (DRHP) with markets regulator Sebi for a Rs 6,250 crore initial public offering (IPO).

The company may also consider a further issue of equity shares via a private placement of up to Rs 1,250 crore, it said in its DRHP.

If the pre-IPO placement is undertaken, the issue size will be reduced by the amount raised from it, and the minimum issue size will constitute at least 10% of the post-issue paid-up equity share capital of the company.

Proceeds of the issue: The company plans to use funds it raises to prepay or repay all or a portion of its outstanding borrowings to the tune of Rs 1,929 crore. It plans to use Rs 1,259 crore for funding organic growth initiatives and another Rs 1,500 crore on inorganic growth opportunities through acquisitions and other strategic initiatives.

Quote: “We intend to continue to invest in three core areas for the growth of our business, which include a) marketing and promotional activities to increase awareness about our offerings and brands, b) supply chain infrastructure and fulfilment, and c) technology capabilities and infrastructure,” the company said.

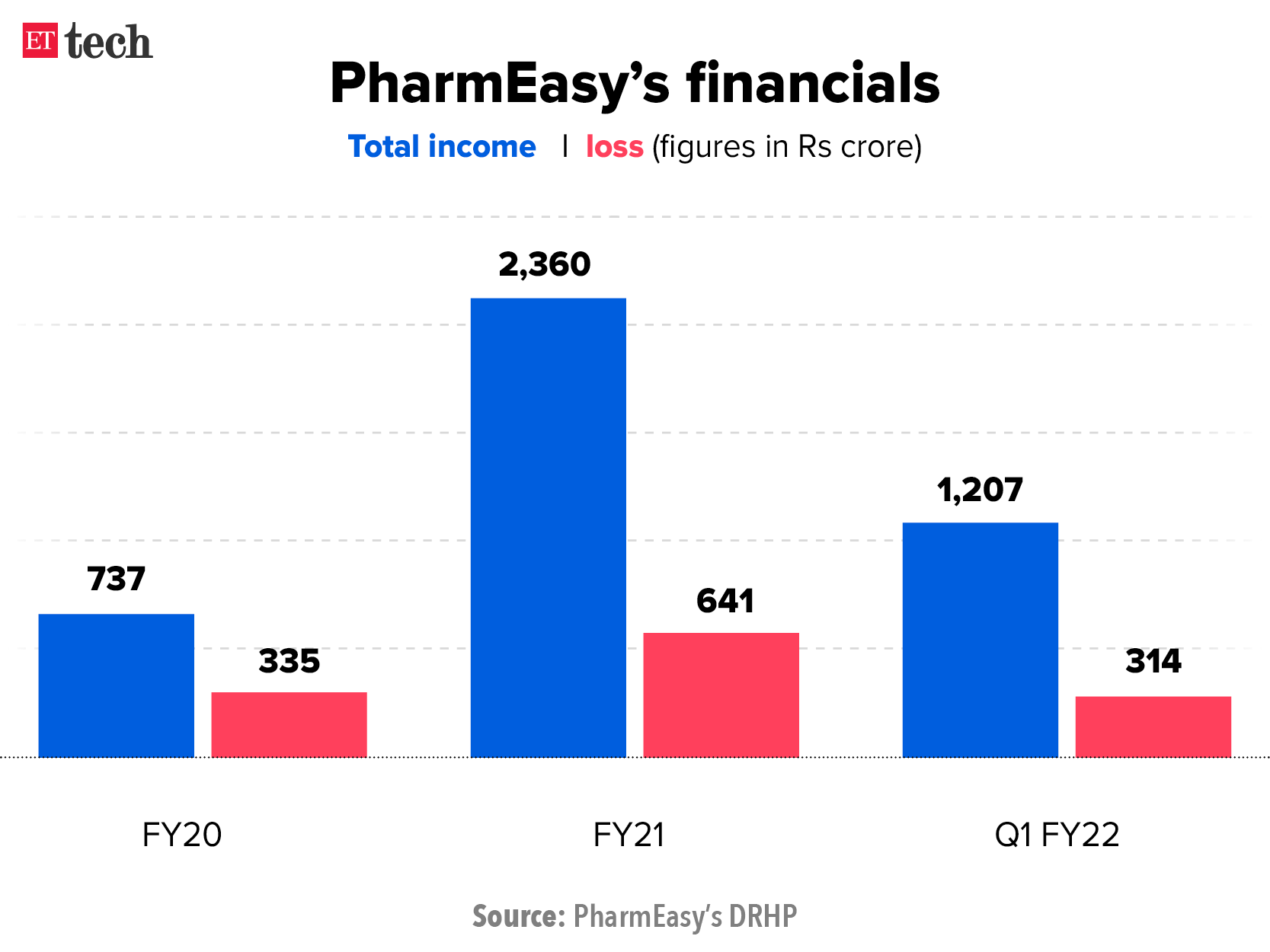

Financials: Pharmeasy posted a loss of Rs 645 crore on total income of Rs 2,360 crore for the year ended March 31, 2021.

Its pro forma gross merchandise value (GMV) stood at Rs 787 crore in FY21 and declined to Rs 303 crore in Q1 FY22.

Year of the tech IPO: With this, PharmEasy will join a slew of startups that have launched IPOs this year, including Zomato, Paytm, Nykaa and Policybazaar.

Other Top Stories By Our Reporters

Paytm IPO sails through on final day: The mega IPO of One97 Communications sailed through on the third and final day of the bidding process on Wednesday helped by a late buying spree from foreign institutional investors. According to the data from NSE, investors bid for 9,14,09,844 equity shares by 5:00 pm of Day 3, against the total issue size of 4,83,89,422 equity shares. This translates into a subscription of 1.89 times.

Governments have the right to lawful interception, says Rajeev Chandrasekhar: Governments do have the right to have lawful interception where national security is at risk and respect our fundamental rights, said Rajeev Chandrasekhar, minister of state for electronics and IT.

Global Picks We Are Reading

- Google loses court challenge against EU antitrust ruling (Reuters)

- China’s internet crackdown pushes Tencent to slowest profit growth in two years (Reuters)

- Amazon-backed EV start-up Rivian set to go public at $106.6 billion implied valuation (CNBC)

For all the latest Technology News Click Here