Executive behind Facebook-backed Novi crypto wallet to leave company

Facebook and its partners plan to launch Diem, a new global cryptocurrency.

Getty Images

David Marcus, one of the executives behind Facebook’s push into cryptocurrencies, said Tuesday he will leave the social network’s parent company by the end of the year to pursue entrepreneurial projects.

Marcus, who joined Facebook from PayPal, has run Novi, the company’s financial technology business, since May 2018. He was responsible for stewarding the launch of Libra, an as-yet-unlaunched cryptocurrency that was rebranded Diem after the project faced headwinds.

“While there’s still so much to do right on the heels of launching Novi — and I remain as passionate as ever about the need for change in our payments and financial systems — my entrepreneurial DNA has been nudging me for too many mornings in a row to continue ignoring it,” Marcus said in a series of tweets.

Marcus’ departure from Facebook, which recently rebranded as Meta, comes as the company’s cryptocurrency ambitions struggle to take hold. In October, the company launched the Novi cryptocurrency wallet without the Diem stablecoin that it initially spearheaded. The debut of the wallet, which lets users send and receive the Pax dollar run by blockchain company Paxos, was limited to Guatemala and parts of the US.

Formerly known as Libra, Diem hasn’t gotten much love since the Facebook-backed Diem Association publicly launched in mid-2019. Partners have bolted from the project, details have shifted and legislators have criticized the plans. The Novi launch prompted a backlash, with a group of five Democratic senators urging CEO Mark Zuckerberg to stop the Diem project.

The group, which included Brian Schatz of Hawaii and Elizabeth Warren of Massachusetts, called on Zuckerberg to “immediately discontinue your Novi pilot.” It also sought a commitment that Diem wouldn’t come to market.

Nonetheless, Facebook has indicated it will press on with the project, whose ambitions have been curtailed over time. Here’s what you need to know.

Why does Facebook want a cryptocurrency?

This isn’t actually Facebook’s cryptocurrency. It’s a project of the Diem Association, which Facebook originally co-founded as the Libra Association. The association will serve as a monetary authority for the cryptocurrency. It says its purpose is to “empower billions of people,” citing 1.7 billion adults without bank accounts who could use the currency.

But Facebook has its own interest in digital cash that predates Diem. The social network ran a virtual currency, called Credits, for about four years as a way to make payments on games played within Facebook. Mark Zuckerberg, Facebook’s CEO, has said that sending money online should be as simple as sending photos. Diem is designed to make it easier and cheaper for people to transfer money online, which might also attract new users to the social network. But Zuckerberg acknowledged that having people use cryptocurrency would likely benefit Facebook by making advertising on the social network more desirable and, therefore, more expensive.

Facebook may also have other plans for the cryptocurrency. The Novi subsidiary runs a wallet for holding and using the digital currency and says its mission is “helping people around the world access affordable financial services.” Analysts at RBC Capital Markets have said those services will likely include games and commerce.

Will Facebook have direct control over Diem?

No. Facebook is one of the members of the Diem Association, the nonprofit that will serve as a de facto monetary authority for the currency. (Facebook’s membership is through Novi.) The association hopes to grow to 100 members, most of which will pony up $10 million to get the project going. Each member has the same vote in the association, so Facebook won’t technically have any more say over the association’s decisions than any other member.

That said, Facebook has played an outsized role in the initial phases of the project. After the network is launched, Facebook says, the social network’s role and responsibilities will be the same as those of any other founding member.

Why have association members dropped out?

Some of the bigger founding members appear to have gotten cold feet. Seven of the original 28 founding members — that’s a quarter of them — dropped out before the association’s inaugural meeting in Geneva. Those exiting included PayPal, eBay, Stripe and financial services giants Visa and Mastercard. The departures are big losses because those members brought expertise in payments and transfers technology. The other dropouts are Mercado Pago, the online payments platform of Argentina’s Mercado Libre marketplace, and Booking Holdings, an online travel company that runs sites including Priceline, Kayak and OpenTable.

The association currently has 26 members.

How is Diem different from other cryptocurrencies?

Let’s start by addressing how it’s similar to other cryptocurrencies, such as bitcoin and ether. Like them, Diem will exist entirely in digital form. You won’t be able to get a physical note or coin. And like other cryptocurrencies, Diem transactions will be recorded on a software ledger, known as blockchain, that confirms each transfer. The Diem blockchain will be managed by the founding members in the early stages but is supposed to evolve into a fully open system in the future.

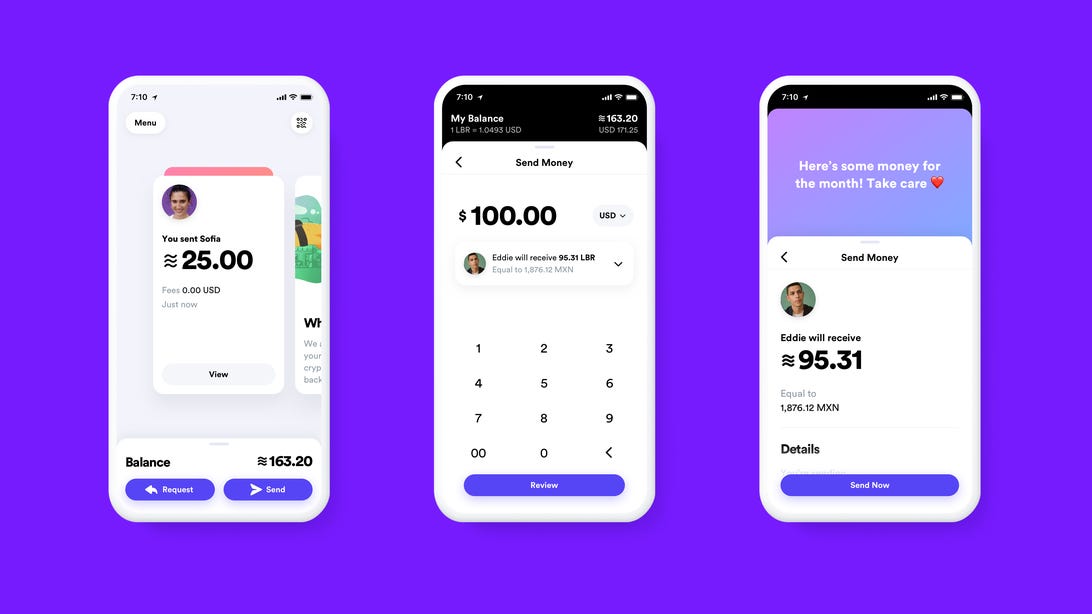

Here’s what a wallet could look like on a phone.

Diem will be pegged to the US dollar, a format widely known as a stablecoin. That contrasts with bitcoin, ether and some other cryptocurrencies that aren’t backed by anything and swing wildly in response to speculation.

Initially, the plan was to use a basket of assets to anchor the cryptocurrency’s value. The association didn’t say what those assets would be but indicated they would be denominated in major global currencies, like the dollar and the euro, which don’t fluctuate intensely day to day. The association would buy more of the underlying assets to create, or “mint,” new Diem when people want more of the cryptocurrency. When people cash out, the association will sell those assets and “burn” Diem.

Backing a currency with an asset isn’t anything new. In fact, it used to be common. The US dollar was backed by gold until 1971. The value of the Hong Kong dollar is pegged to the US dollar and managed by a currency board, which can issue new notes only if it has enough in reserves.

How do cryptocurrencies compare to the dollar?

The US dollar is tried and true and pretty much accepted anywhere in the world. Some countries like the dollar so much that they use it instead of their own money. And dollars earn interest, though at current rates that won’t add up to very much.

Of course, the dollar has weaknesses. Using dollars, particularly across borders, can be expensive because banks take a cut to convert them into local currencies. If you’re using dollars on a prepaid card, the credit card company is probably charging the merchant a portion of your purchase. And if the US government prints too many dollars, inflation could follow.

Despite the hype, cryptocurrencies aren’t widely used yet. Try buying a cup of coffee with ether. (Yes, it’s possible but not widespread.) The value of cryptocurrencies is volatile, often rising or falling more than 5% a day, making it difficult to get a sense of the long-term worth of the asset.

Cryptocurrencies can make it easy to send money directly to someone. Bitcoin transactions aren’t actually untraceable, though they can be very difficult to trace. Similarly, bitcoin use isn’t absolutely anonymous. It’s pseudonymous, meaning that your bitcoin address is recorded even though your identity isn’t.

Some cryptocurrencies, notably bitcoin, have a cap on the number of coins that can be minted, meaning that owners of existing coins don’t have to worry about the arbitrary creation of new ones, although that could create other issues in the future.

Is this just a ploy so Facebook can get my financial data and send more targeted ads?

We hear you. Facebook doesn’t have a great reputation for privacy protection.

The social network says don’t worry — not that you expected it to say anything else. When the plans were first unveiled, Facebook took pains to point out its wallet was housed in a subsidiary of the social network. The arrangement was designed to allow the wallet company to be regulated by authorities and prevent money laundering and other financial crimes. The company also said it would keep financial data separate from Facebook’s social data.

For all the latest world News Click Here