Direct tax kitty swells 12.7% on robust advance mop-up – Times of India

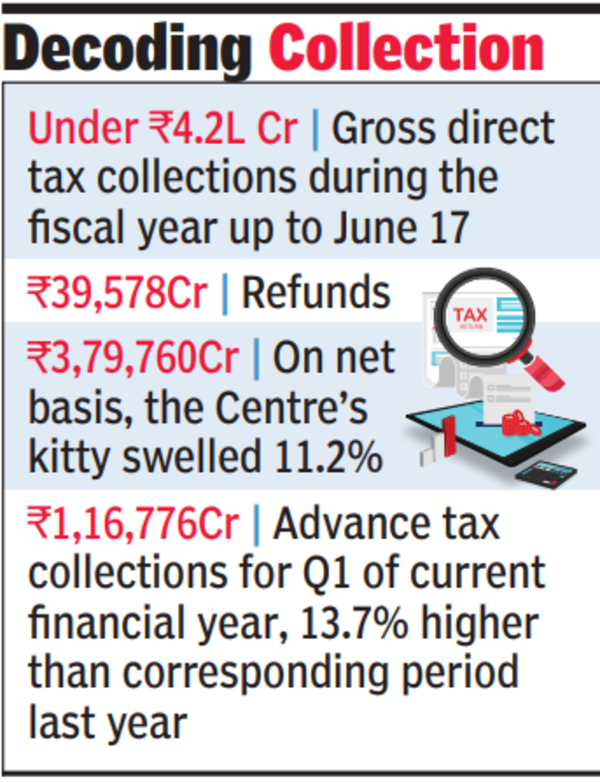

Latest data released by the Central Board of Direct Taxes (CBDT) pegged advance tax collections for the first quarter of the current financial year at Rs 1,16,776 crore — which is 13. 7% higher than the corresponding period last year.

Advance tax collections are to be paid by companies and individuals with annual income of over Rs 10,000 from sources other than salary, with the amount to be paid during the four quarters. The first instalment was due on June 15.

Advance tax is often seen as a barometer of corporate performance. Up to June 16, 2022, advance tax collections had increased by 33%, according to data released by CBDT at that time. The economy is projected to grow at a slightly slower pace duringthe current financial year and is expected to see an expansion of around 6. 5%, against 7. 2% last year. Chief economic adviser V Anantha Nageswaran, however, projected a 7% increase.

The tax collection growth rate, so far in the financial year, is faster than the full year target of 10. 5%.

The tax department said that it has so far issued refunds of Rs 39,578 crore, a jump of over 30% compared to Rs 30,414 crore during the corresponding period last year. As a result, on a net basis (after factoring in refunds), the Centre’s kitty swelled 11. 2% to Rs 3,79,760 crore. This included a mop-up of almost Rs 1. 6 lakh crore from corporation tax, whose share in the total was pegged at 41. 3%.

function loadGtagEvents(isGoogleCampaignActive) { if (!isGoogleCampaignActive) { return; } var id = document.getElementById('toi-plus-google-campaign'); if (id) { return; } (function(f, b, e, v, n, t, s) { t = b.createElement(e); t.async = !0; t.defer = !0; t.src = v; t.id = 'toi-plus-google-campaign'; s = b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t, s); })(f, b, e, 'https://www.googletagmanager.com/gtag/js?id=AW-877820074', n, t, s); };

window.TimesApps = window.TimesApps || {}; var TimesApps = window.TimesApps; TimesApps.toiPlusEvents = function(config) { var isConfigAvailable = "toiplus_site_settings" in f && "isFBCampaignActive" in f.toiplus_site_settings && "isGoogleCampaignActive" in f.toiplus_site_settings; var isPrimeUser = window.isPrime; if (isConfigAvailable && !isPrimeUser) { loadGtagEvents(f.toiplus_site_settings.isGoogleCampaignActive); loadFBEvents(f.toiplus_site_settings.isFBCampaignActive); } else { var JarvisUrl="https://jarvis.indiatimes.com/v1/feeds/toi_plus/site_settings/643526e21443833f0c454615?db_env=published"; window.getFromClient(JarvisUrl, function(config){ if (config) { loadGtagEvents(config?.isGoogleCampaignActive); loadFBEvents(config?.isFBCampaignActive); } }) } }; })( window, document, 'script', );

For all the latest business News Click Here