Credit-based fintech startup KreditBee raises $80 million in funding from existing investors

A new investor, Japan-based Mitsubishi UFJ Financial Group (MUFG) Bank, also participated in the round.

MUFG Bank’s other investments in Indian fintech firms include financial infrastructure provider M2P Fintech and contactless ordering and payments startup DotPe.

ET had reported on September 2, citing sources, that Boston-based

Advent is in talks to lead a $100-million (nearly 800 crore) round at KreditBee, which may value it around $600 million.

The company is expected to close the fundraise at $125-$150 million and it is expected to wrap up the round in the next three weeks, people aware of the discussions told ET.

The round comes at a time when digital lending startups have come under intense scrutiny from the Reserve Bank of India (RBI), which has introduced a new set of rules to regulate online credit.

Discover the stories of your interest

The rules have put pressure on new-age lending businesses to actively focus on their non-bank units and capitalise them to meet the central bank’s preference for regulated entities.

KreditBee is expected to use the fresh capital to diversify its product portfolio into small and medium enterprise (SME) lending as well as to provide motor and vehicle loans. It is expected to enter SME lending space in the next six months.

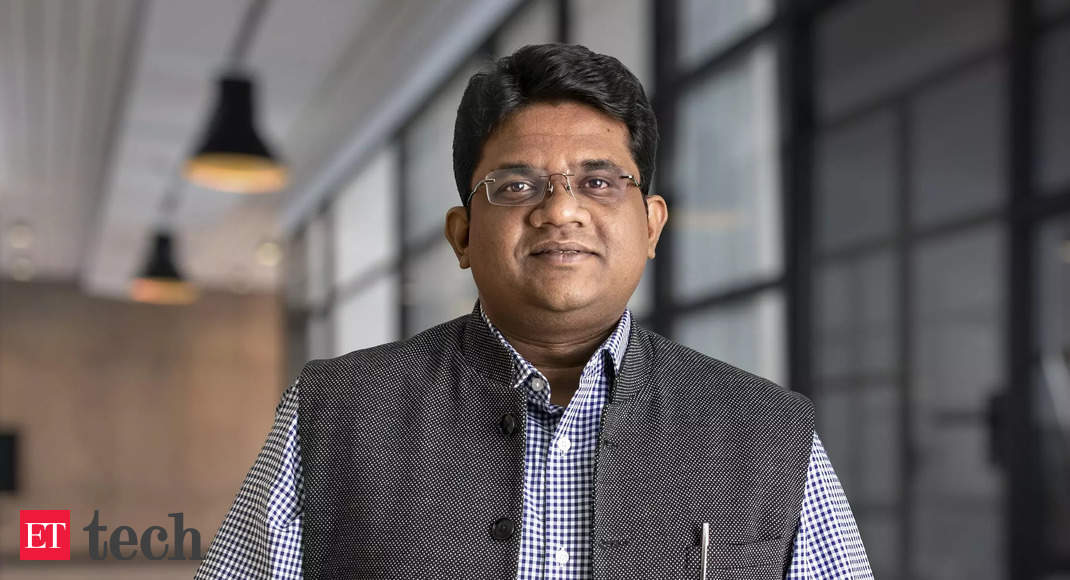

“The fresh raise is for expansion as well as to maintain our equity and debt leverage. As a regulated entity, we need equity to maintain healthy debt. Secondly, we are planning to venture into SME lending and vehicle financing, and may look at an acquihire or acquisitions,” Madhusudan E, cofounder and chief executive of KreditBee, told ET.

Currently, KreditBee has a monthly loan disbursement of a little over Rs 1,000 crore, Madhusudan added. It is looking to cross the $1 billion mark in assets under management (AUM) next year, which will include a small mix of SME loans.

KreditBee has 3.5 million active users at present, the cofounder added.

“How one underwrites a retail customer is very different from how one underwrites SME and vehicle loans. So, we will look to acquihire or acquire, as the market gets colder,” Madhusudan said.

Founded in 2018, KreditBee is an instant lending platform that provides personal loans of up to Rs 4 lakh to self-employed and salaried individuals. It also provides loans for online purchases.

In August,

Fibe (previously EarlySalary), which disburses instant loans to customers, had raised $110 million (about Rs 878.8 crore) in a round co-led by TPG’s Rise Fund and Norwest Venture Partners at a valuation of $300 million.

For all the latest Technology News Click Here