Cognizant Q1 net profit up 3%, to lay off 3,500; Ready to tie up with NPCI: Visa’s Alfred Kelly

This and more in today’s ETtech Top 5.

Also in this letter:

■ Market cap of US tech firms tumbles post IPO

■ EV makers to reimburse cost of charger to customers

■ ETtech Done Deals

Cognizant Q1 bottomline rises 3% YoY; to lay off 3,500 over two years

US-based software exporter Cognizant’s net profit increased 3% in the fourth quarter to $580 million on lower administration costs and a bump in other income.

Revenue down: The company’s revenue declined 0.3% year on year (YoY) to $4.81 billion for the three-month period ended March, beating Street estimates of $4.74 billion. Revenue was down 0.7% while profit rose 11.3% on a sequential basis.

Rejig and layoffs: Cognizant said it is going to terminate around 3,500 employees or 1% of total workforce and also rationalise its office spaces in a bid to cut costs in what is being seen as a challenging time for the IT services sector.

Attrition down: The company’s attrition on a 12-month basis was down to 23% from 30% on year. Total headcount at the end of the first quarter stood at 351,500, a decrease of 3,800 from the previous quarter, but an increase of 11,100 from the same period last year.

‘Accelerating investment in generative AI’: CEO Ravi Kumar said Cognizant was accelerating its investment in generative AI. It is operating pilots that use generative AI to accelerate consulting, design, engineering and operations with the long-term goal of doubling productivity.

Capgemini posts weaker Q1 revenue growth: French IT consulting group Capgemini on Thursday reported weaker revenue growth in the first quarter of 2023 compared with the year-ago period amid a challenging economic environment, with delayed spending by clients across segments.

Alfred Kelly, executive chairman, Visa Inc.

Visa Inc is open to cooperating with the National Payments Corp of India (NPCI) as it looks to expand its footprint locally, executive chairman Alfred Kelly said. Zero merchant charges, while helping enhance digital transactions, are unviable over the long term, he added.

Here are excerpts from Kelly’s freewheeling chat with ET:

NPCI’s entry amid Visa-Mastercard duopoly: India was a fairly nascent market 10 years ago. The biggest catalytic event was demonetisation; it basically woke the population to the fact that there were other ways to pay… The formation of NPCI, RuPay and UPI has helped the advancement of digitisation.

To really see India grow and become a digital commerce powerhouse is going to require multiple players, and that’s fine with me. We expect to continue to invest in this market and see it explode.

India’s progress in digital payments: I think the story that has happened in India is one of the greatest stories of commerce in the world. The best innovation and best creativity comes from being together. I want government officials, regulators and all key stakeholders to come together and deliberate on the best way to collaborate — to take this to a whole new level.

There is tremendous opportunity, but we have to get the right people to sit together to focus on the right issues. The Government of India has been an extremely important catalyst. I don’t think we would be where we are but for the government playing that catalytic role.

Read the full interview here

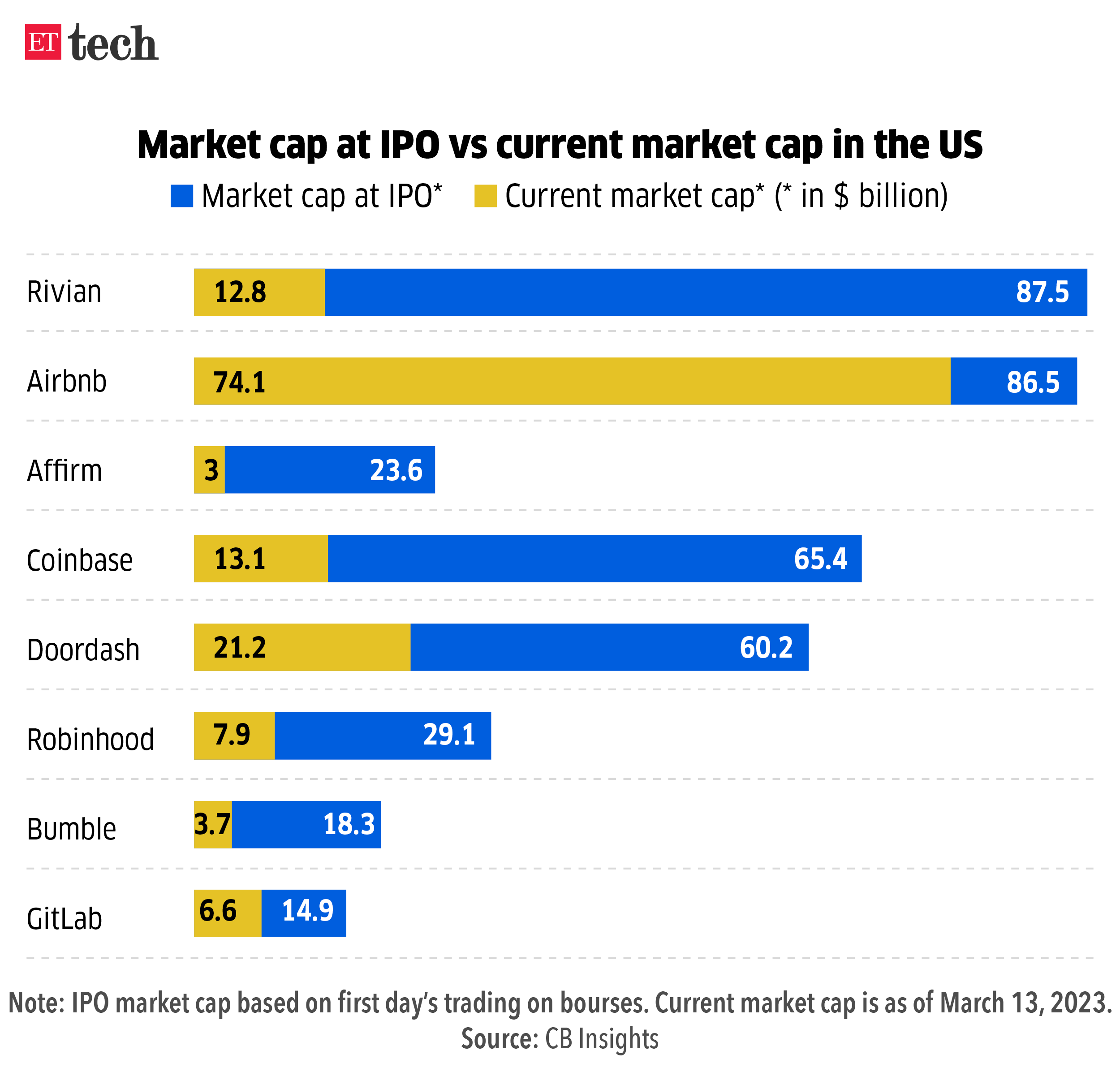

Infographic insight: Market cap of US tech companies tumbles post IPO

The combined market cap of the 50 largest US tech company IPOs since 2020 has dropped 59% since the day listed, per data from CB Insights.

Of the top 20 tech IPOs since 2020, 90% — 18 out of 20 — are trading well below their IPO listing valuation, it said.

Tweet of the day

ETtech Done Deals

EV cab startup BluSmart raises $42 million in funding: Electric vehicle (EV) ride-hailing startup BluSmart has raised about $42 million from BP Ventures and several other existing investors. The latest round includes an equity component of $37 million and venture debt of $5 million.

EduFund raises $3.5 million in funding: EduFund, an India-based edu-fintech company, has raised $3.5 million in a funding round led by global venture capital firm MassMutual Ventures (MMV). The fundraise also saw participation from investors DSP Investment Managers, Anchorage Capital Partners, and Kunal Shah.

Credit card platform Kiwi raises $6 million in funding: Credit card platform Kiwi, founded by Siddharth Mehta, the former chief executive of Freecharge, has raised $6 million in funding from the likes of Nexus Venture Partners, Stellaris Venture Partners, and a host of angel investors.

Ola, Ather, other EV makers to reimburse cost of chargers to customers

Electric vehicle maker Ola Electric has said that it will reimburse the amount it had collected from customers for chargers.

Moral high ground: Ola Electric, however, did not go into allegations of creative accounting and instead asserted that the charger pricing issue was a “narrative” built by vested interest groups. “Setting aside the technicalities and as an example for others to follow, we have decided to reimburse the charger monies to all eligible customers,” the company said in a statement on Thursday morning. That refrain is not new.

In March, facing allegations of poor safety checks over problems in the front fork of its S1 model, Ola Electric said it was the victim of a “concerted campaign”. Many customers had complained on social media about the front fork collapsing.

Ather, others to follow: Ather Electric, TVS, and Hero MotoCorp will also refund buyers the cost of EV chargers that were sold separately.

Catch up quick: The decision comes after these companies came under government scrutiny following complaints that EV makers had mispriced vehicles to claim the FAME-II subsidy.

The FAME policy document specifies that electric two-wheelers that retail above ₹1.50 lakh per unit are ineligible for benefits under the ₹10,000-crore programme.

All companies bill the charger and software separately from the vehicle so as to keep the ex-factory price of the vehicle below Rs 1,50,000, thereby complying with FAME-II norms.

Okinawa to raise $100 million: Electric two-wheeler maker Okinawa Autotech is in advanced talks to raise $100 million (about ₹800 crore) from private equity firms and a deal is likely to be signed shortly, said managing director Jeetender Sharma.

Today’s ETtech Top 5 newsletter was curated by Erick Massey in New Delhi and Megha Mishra in Mumbai. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here