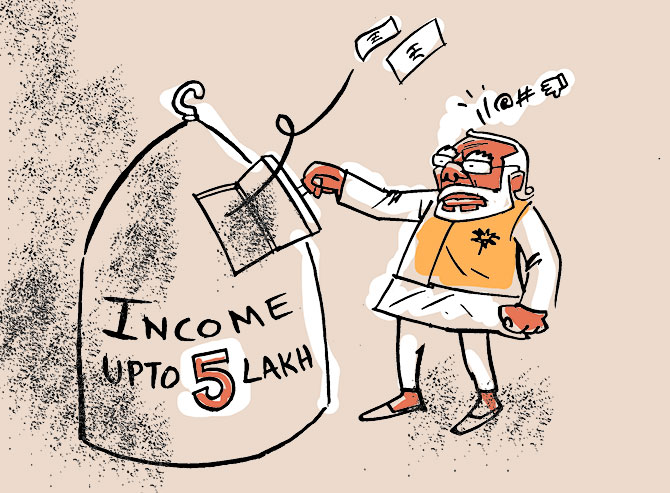

Centre mulls raising tax-free slab to Rs 5 lakh

Policymakers are examining the possibility of increasing the tax-free slab to Rs 5 lakh in the two-year-old alternative personal income tax regime to make it attractive, a government official said.

At present, taxpayers don’t pay income tax if their taxable income is Rs 2.5 lakh and below.

Increasing the threshold will reduce the tax outgo for assessees, thereby leaving more money with them to invest, the official said.

Currently, very few taxpayers have opted for the alternative tax regime. For many, the tax outgo in the older personal income-tax regime is lower if they make use of deductions such as under Section 80C and Section 80D.

In the alternative tax structure many deductions have gone. Up to Rs 5 lakh a year is tax-free.

Taxpayers get rebate for the tax that accrues in the Rs 2.5-5 lakh slab.

“Those earning up to Rs 5 lakh shall not pay any tax either in the old regime or in the new regime,” Finance Minister Nirmala Sitharaman said in 2020.

Sources said the issue had been taken up in the ongoing Budget exercise and the departments concerned had been asked to suggest ways to improve the new regime.

“The Budget exercise on taxes will start next week and we shall look into the possibility of such tweaking in the new regime,” the official said.

“However, any such proposal will depend on the overall revenue impact and whether we have the room to do that,” he added.

He said some initial estimate of the revenue impact had been done on hiking the tax slab under the new regime and that could be taken up further by the Budget makers.

He added there could be a discussion on whether both the old and new regimes of personal income tax needed to be tweaked.

The alternative personal income tax slabs with lower rates were introduced as an option in the Union Budget 2020-21.

However, estimates showed 10-12 per cent of the taxpayers had opted for it due to a high tax outgo compared with the old regime.

There has been a buzz around reforms in direct taxes, including restructuring capital gains tax.

With respect to capital gains, the official indicated it would be a separate exercise and might be done outside the Budget because it requires extensive deliberations with stakeholders.

Tax experts say if the tax outgo in the new and old regimes is similar, most may opt for the new one because it will reduce the compliance burden.

“Filing returns will be easier. Salaried people won’t have to go through the paperwork with employers and preserve documentary proofs in case there’s any scrutiny in future,” said a tax expert.

Naveen Wadhwa, deputy general manager, Taxmann, said: “This new regime has benefited non-residents more because they do not claim significant deductions and exemptions.

“A salaried person is not at an advantage if he opts for the new regime because no deduction is allowed for items like house rent allowance, leave travel allowance, standard deduction, Section 80C and Section 80D.”

Comparing the two regimes, Wadhwa said if a salaried person opted only for Section 80C deduction then the new regime was attractive if the taxable income was above Rs 8.5 lakh.

But if the person opts for Section 80C and 80D, then the tax outgo is lower in the new regime for those who have a taxable income of Rs 15 lakh of more.

However, if someone also claims home loan interest deduction, the old regime is more attractive even for those with a much higher taxable income.

For all the latest business News Click Here