Building entry barriers in fintech; and other top tech & startup stories this week

The free run that Indian fintech founders had is a thing of the past. Not only has the regulator stepped in to check the speed of innovation, but banks are also looking to work only with regulated fintechs.

“It is better to work with regulated players. It will be slower, but at least there will not be any sudden shocks,” a senior banker at a private sector lender told me recently.

By shocks, he meant things like digital lending guidelines, which disrupted fintech lenders, or rules around the flow of credit through prepaid channels, which disrupted business for Slice and Uni.

Excited at the prospect of quick customer acquisition and snazzy digital properties, there was a time when banks partnered with as many fintechs as possible. But now they are turning cautious.

“We need to focus on building our own stack and I think we are all entering the zone where we need to work with a select few fintechs across sectors we want to (target),” said another banker. Areas like credit cards and quick personal loans through consumer applications are good opportunities.

“But we need to take a hard look at opportunities around neo banking, account opening etc,” he added.

Shared responsibilities

The first era of fintech was all about competing with banks. It played out in a profound way in the wallet space, where banks were competing with wallets for retail payments. But with UPI, it became more collaborative. The same was the case with the RBI’s co-lending guidelines — it became more about working with large lending partners rather than disrupting lending. But now fintechs are getting edged out.

“The new features on UPI are getting launched with banks first. That way, they can be tested in a regulated environment and eventually be opened for fintechs,” said one of the bankers quoted above.

In the lending space also, it is the larger lenders that have a distinct advantage over fintechs. And for those fintechs that do not have an NBFC licence, the game is restricted to just being a sourcing agent, which means limited revenue-generation abilities.

Cases like ZestMoney are making banks even more cautious. If the lending and loan management stack is not able to detect ballooning bad assets, then what is the technology that fintechs are bringing, they ask.

Entry barriers

So, to ensure stability, banks are pushing their large fintech partners to secure an operational licence.

And that is exactly what is happening. In the credit space, Cred, BharatPe and Jupiter are all NBFCs now. In the payment space, players are under payment aggregator regulations.

This will bring more stability to the sector, but what this also creates is entry barriers for future innovators. Any disruptor will have to consider a hundred things before they can start working in the fintech space.

For instance, there were experiments being carried out on student credit, prepaid cards for the entire family, sound-based payments, and innovative models in B2B credit. With so many early-stage founders finding it difficult to scale up in this protective environment, will entrepreneurs get inspired to start up? And even if they do, if banks do not support them, how can they experiment with their products?

“There will be sandbox initiatives at the regulator’s end and at the banks’ end, which should keep encouraging innovations, but in the long run, the sector will stabilise,” said one of the bankers quoted earlier.

Just as chaos gives rise to ideas, stability makes things boring. Will India’s enterprising (read jugaadu) founders still manage to push the envelope or will they get preoccupied with audits, filings and compliance? We will keep tabs on that.

Now moving on to other top stories this week.

ETtech Exclusives

Sales grow quickest via quick commerce for packaged goods: Senior executives at multiple consumer goods companies including Britannia and Nestle have said that sales through Swiggy’s Instamart, Zomato’s Blinkit, Zepto, and BigBasket’s BBnow are growing faster than traditional ecommerce platforms.

But will quick commerce catch up with the likes of Flipkart and Amazon? Perhaps not. Because now is a time when new users are hard to come by for quick commerce companies as they struggle to expand beyond the top cities.

Paytm opposes IAMAI’s submission to panel on digital competition law: A critic of Big Tech companies like Google, Paytm has formally opposed the Internet and Mobile Association of India’s final submissions to the Committee on Digital Competition Law (CDCL), multiple sources told ET.

ET had reported on May 13 that IAMAI had submitted its views to the CDCL opposing the prescription of ex-ante regulations for digital companies, saying that ex-ante measures “may limit growth not only of the market in question but the digital economy altogether”.

AWS CEO on $12.7 billion India investment, ChatGPT challenge, and how cloud tech will enable $5 trillion economy goal: India is an “incredibly energised, high growth market,” according to Adam Selipsky, the newly appointed chief executive officer of Amazon Web Services (AWS), the $80 billion cloud computing arm of online retail giant Amazon. In the coming decade, the Seattle-based company will invest about $12.7 billion to expand its business in India, he told ET while pointing to the country’s “tremendous” economic development in the previous ten years.

Earnings Report

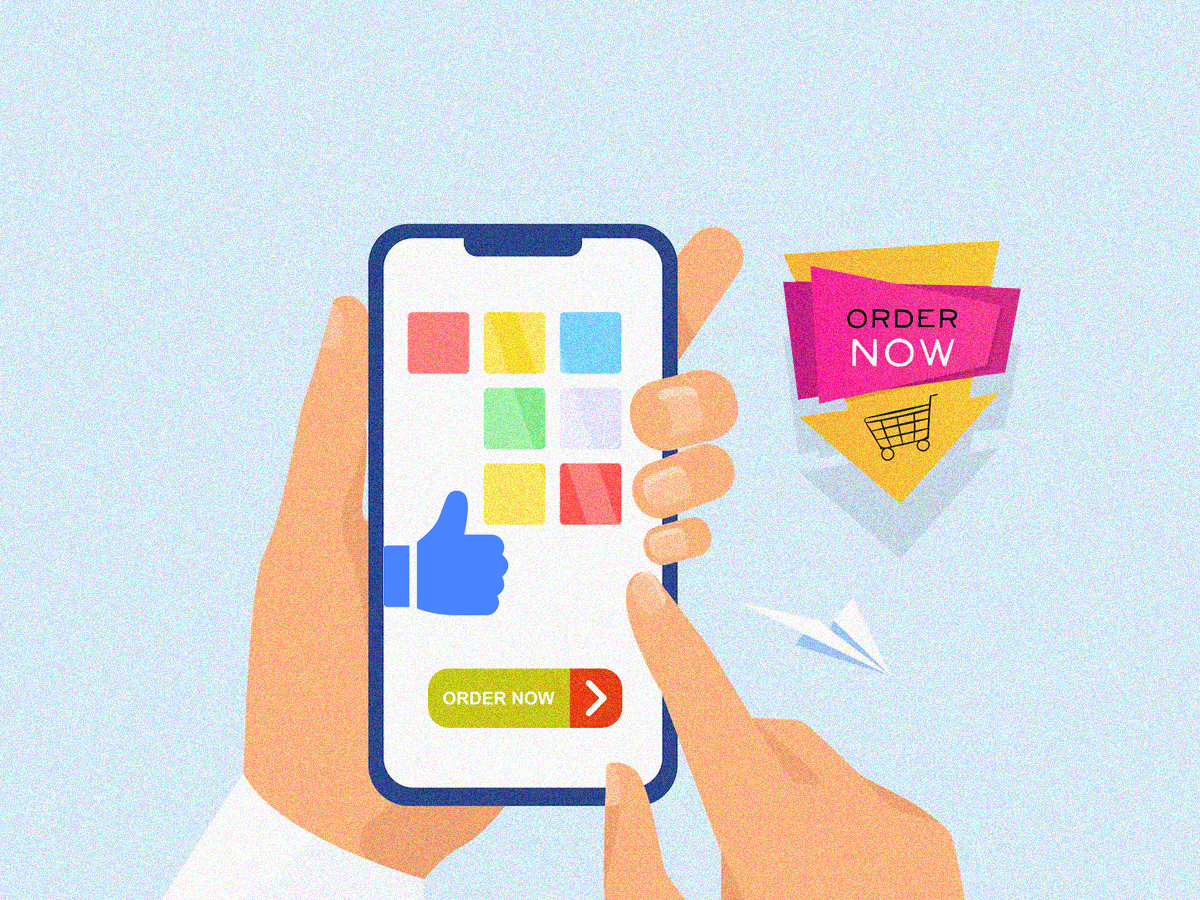

■ Zomato Q4 Results: Consolidated loss narrows to Rs 188 crore, revenue surges 70% YoY: Gurgaon-based food and grocery delivery platform Zomato said its fourth-quarter net loss narrowed to Rs 187.6 crore from Rs 359.7 crore a year ago. Revenue from operations jumped 70% to Rs 2,056 crore.

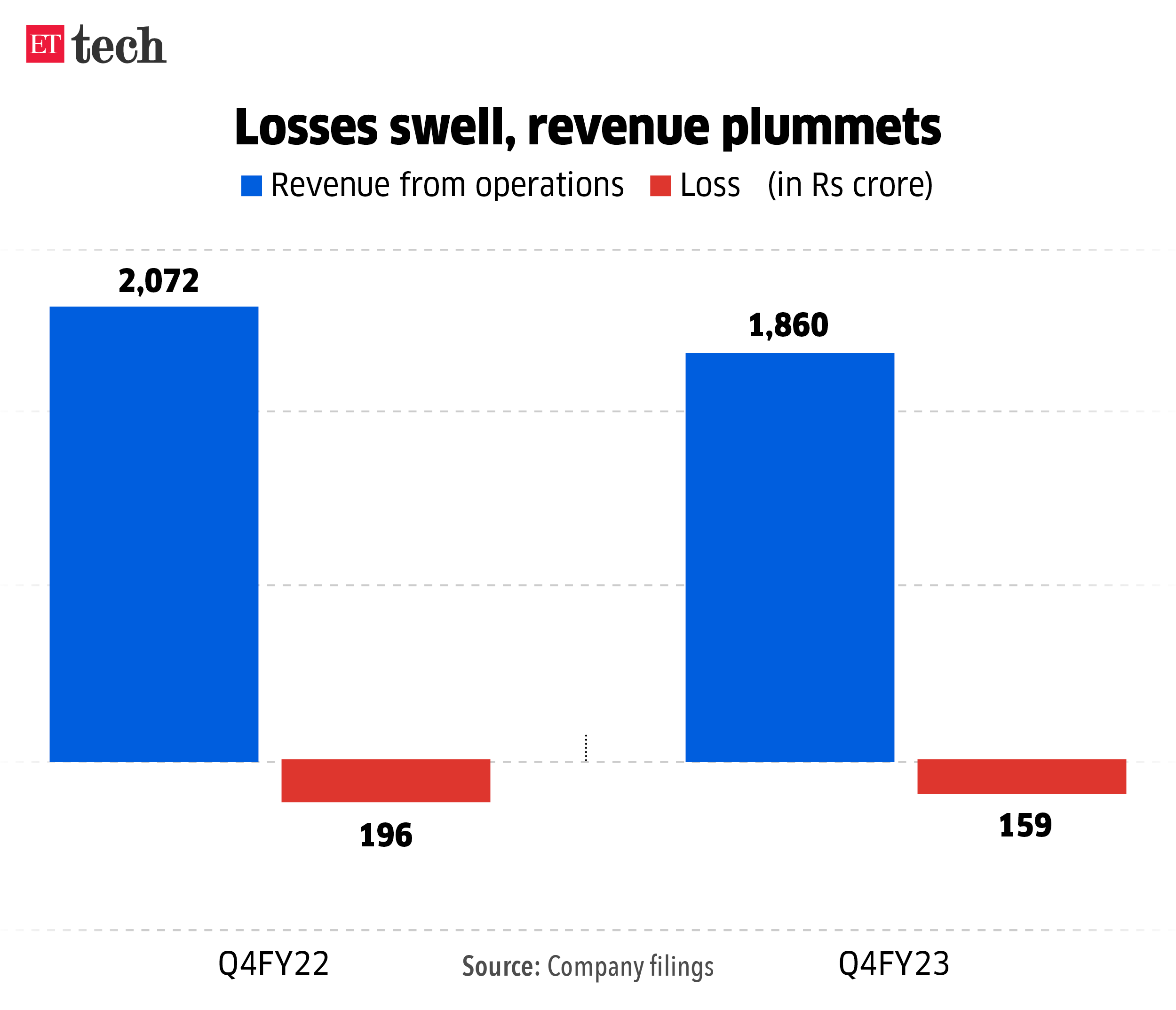

■ Delhivery Q4 Results: Loss widens to Rs 159 crore; revenue falls 10%: Ecommerce-focussed logistics company Delhivery said March-quarter revenue fell 10% to Rs 1,859 crore from the year earlier and its net loss widened to Rs 158 crore from Rs 119 crore. Expenses fell 6% to Rs 2,107 crore from Rs 2,254 crore, it said in an exchange filing.

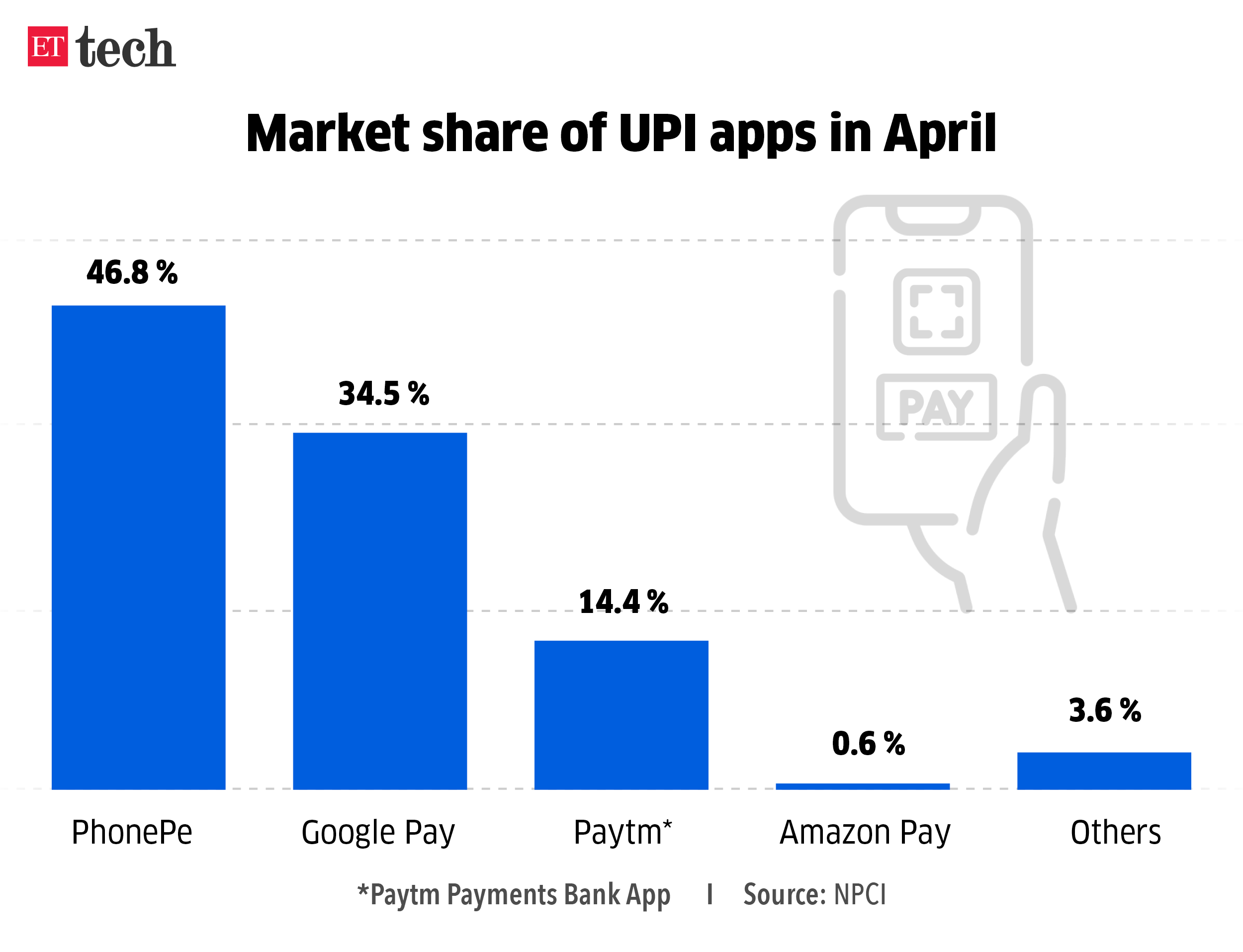

■ Flipkart posts double-digit growth in sales, PhonePe crosses $1 trillion in transactions processed: Ecommerce major Flipkart has posted doubledigit growth in sales and has improved its contribution profit in the January to March quarter, Walmart’s top leaders said during the earnings call of the company on Thursday.

ETtech Deep Dives

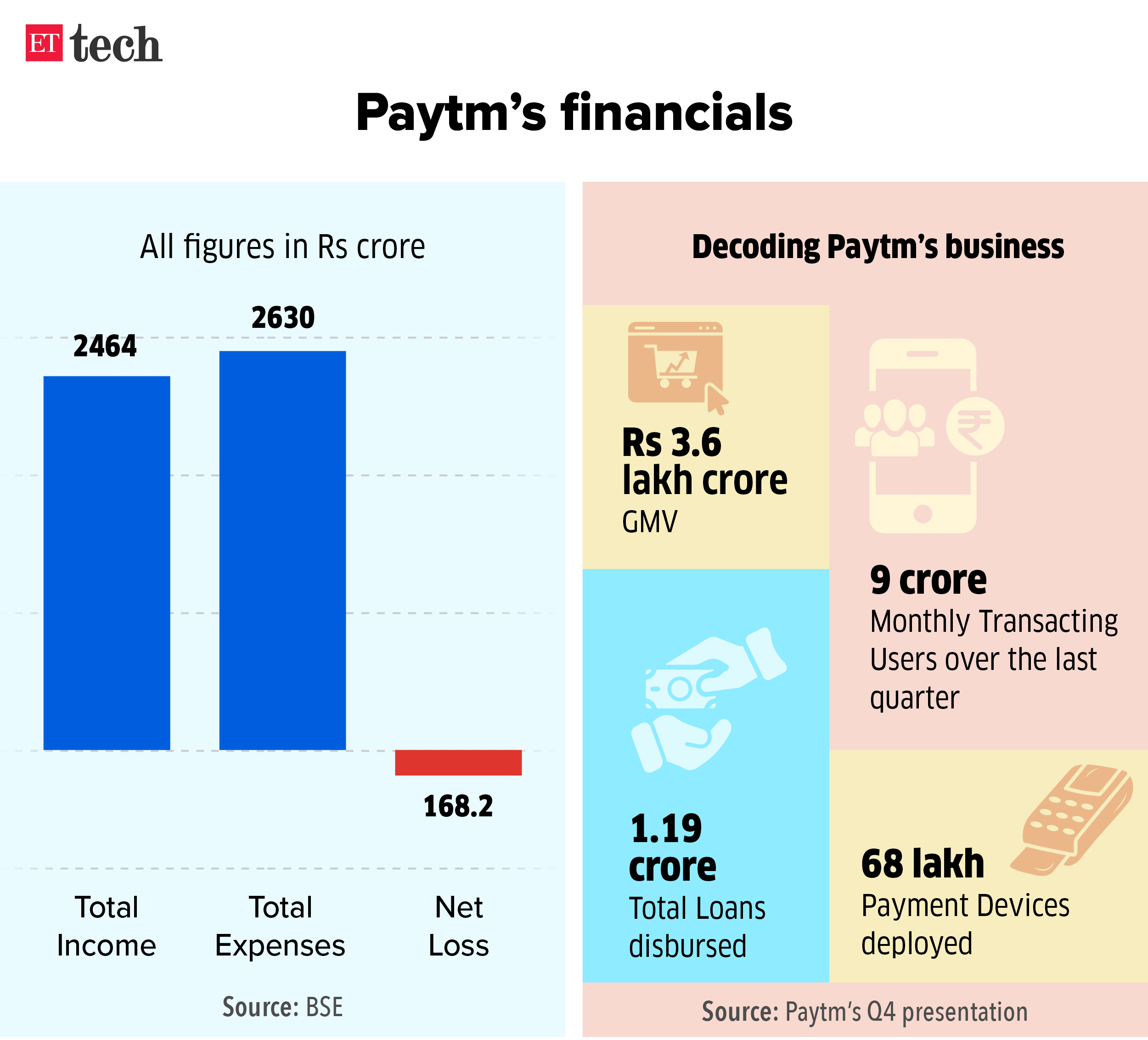

■ Decoding Paytm’s aggressive lending and collections playbook: The company has managed to grow its disbursals 250% to Rs 12,554 crore in March 2023 from Rs 3,553 crore in March 2022.

■ Inside the changing VC deal terms as easy startup funding era ends: While discussing deal terms, a marquee venture capitalist proposed a 2x liquidation preference in case of a liquidity event at a health-tech startup, meaning the investor gets twice the amount of capital they contributed to the company. The founder walked from the deal. Liquidation preference determines who gets paid first and how much they get paid when a company must be liquidated.

Fintech Corner

■ ZestMoney founders leaving troubled fintech firm post PhonePe deal collapse: Capping months of twists and turns at the troubled fintech startup ZestMoney, its founders Lizzie Chapman, Priya Sharma and Ashish Anantharaman, are leaving the company after its potential acquisition by PhonePe fell through in March.

■ Lending taps starting to dry up for crisis-hit ZestMoney: The sudden exit of ZestMoney founders after its planned acquisition by PhonePe failed has compounded the challenges for the fintech startup with its already clogged lending taps likely to dry up.

■ RBI planning strict rules for firms offering payments via PoS machines: The Reserve Bank of India is set to implement strict capitalisation norms and mandatory Know Your Consumer (KYC) requirements for digital payment companies offering merchant payments through point-of-sale terminals

■ Payments council pings FM Nirmala Sitharaman to bring back RuPay MDR: The Payments Council of India (PCI), an industry body representing payment fintechs in the country, has written to the finance minister on restoration of merchant discount rate (MDR) for RuPay debit cards, as payment aggregator fintechs continue to lose on revenue lines for processing payments through the card infrastructure.

■ Zomato starts own UPI offering, Flipkart to follow suit: Online food and grocery delivery platform Zomato has gone live as a third-party payments application provider for the Unified Payments Interface (UPI) for some of its users.

Tech Policy

■ MeitY likely to lead proposed body to fact-check government news: The Centre is likely to opt for a fact-checking team led by the Ministry of Electronics and Information Technology (MeitY) to verify any information pertaining to the government that is published on social media and internet intermediaries.

■ Vedanta-Foxconn chip factory set to get green light: The government is set to approve the chip-making plan of the Vedanta-Foxconn joint venture under the $10-billion Indian Semiconductor Mission (ISM), senior government officials told ET. This will pave the way for the Centre’s bid to establish India as a global hub for semiconductors.

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

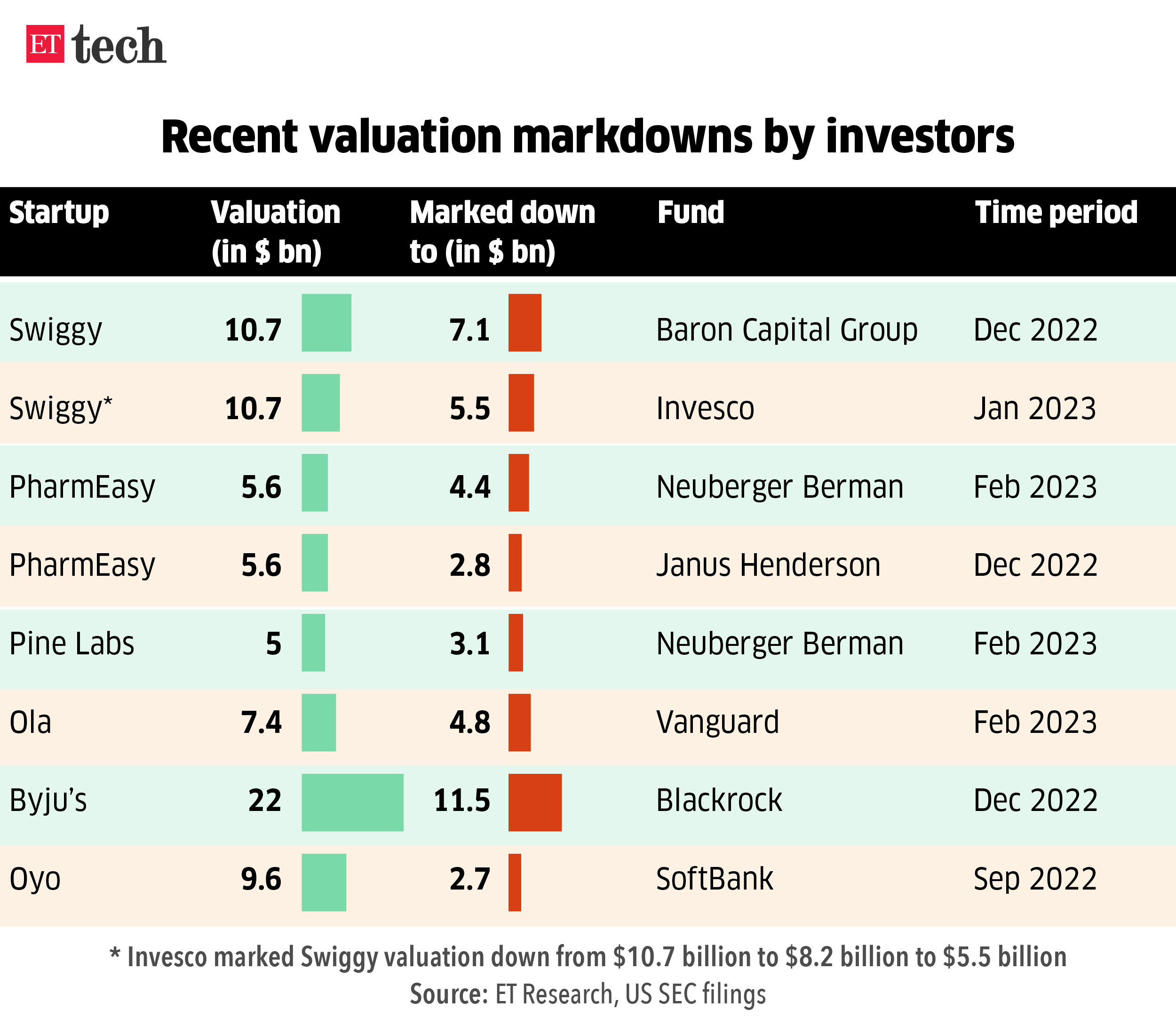

Markdowns Continue

■ US investor Janus Henderson cut PharmEasy valuation by half to $2.8 billion: Mumbai-based online pharmacy PharmEasy’s parent company API Holdings has seen yet another valuation markdown – this time by funds managed by global asset management company Janus Henderson, regulatory filings with the US Securities and Exchange Commission (SEC) showed.

■ US investor Baron Capital marks down Swiggy’s valuation by 34% to $7.1 billion in latest filing: A fund managed by US-based asset management firm Baron Capital Group has marked down its valuation of food and grocery delivery platform Swiggy by 34% to $7.1 billion as of December 2022, regulatory filings with the US Securities and Exchange Commission (SEC) show.

Tweet of the day

ETtech Deals Digest

■ Puma India head Abhishek Ganguly’s new startup raises $52 million funding: Abhishek Ganguly, outgoing India and Southeast Asia managing director of Puma, has raised Rs 430 crore, or around $52 million, for his new venture Agilitas Sports in its first round of funding.

■ Nodwin Gaming raises $28 million in funding from Nazara, Sony, Krafton: Nodwin Gaming, a subsidiary of Nazara Technologies, has signed agreements to raise $28 million (about Rs 232 crore) from Nazara, South Korean digital games developer Krafton, Japanese conglomerate Sony Group, Hyderabad-based gaming solutions provider InnoPark India, and digital entertainment and tech company JetSynthesys.

■ Data analytics company Course5 Intelligence raises $28 million: Data analytics and artificial intelligence (AI) solutions company Course5 Intelligence has raised $28 million from 360 ONE Asset Management, its chief executive officer, Ashwin Mittal, told ET on Wednesday.

■ ETtech Deals Digest: Indian startups raised $617 million this week: Startups garnered around $617 million in funding from 26 rounds this week. The figure was a significant improvement over the previous week, according to data provided by market intelligence firm Tracxn.

For all the latest Technology News Click Here