Asian markets follow Wall St down as rate hike fears persist – Times of India

HONG KONG: Asian markets tracked another loss in New York on Friday as interest rate hike fears course through trading floors after last week’s blockbuster jobs report.

While data in recent months has shown inflation is coming down, the employment figures showed the economy remained robust, leading several top Federal Reserve officials to warn much more work was needed to get prices under control.

Having spent January optimistic that the days of central bank tightening would soon come to an end, traders have been brought back down to earth this month as they contemplate borrowing costs going higher and staying there longer than expected.

Richmond Fed president Thomas Barkin added his voice to his colleagues this week in warning that the bank had to “stay the course” in lifting rates if it wanted to bring inflation down to its two percent target.

However, with borrowing costs going higher still — and some warning it could go to a two-decade-high six percent — fears are growing that the world’s top economy will tip into recession.

“Inflation most likely won’t get conquered if the economy doesn’t break,” said OANDA’s Edward Moya.

“Disinflation trends remain in place but it will be hard for them to continue with a strong labour market and as the economy keeps on growing. We’ve seen commodities and goods price declines, but core services remain tricky.”

He added that the Fed would continue hiking until personal consumption expenditure — the bank’s preferred inflation gauge — was trending sharply lower. “And that might not happen until the summer,” he said.

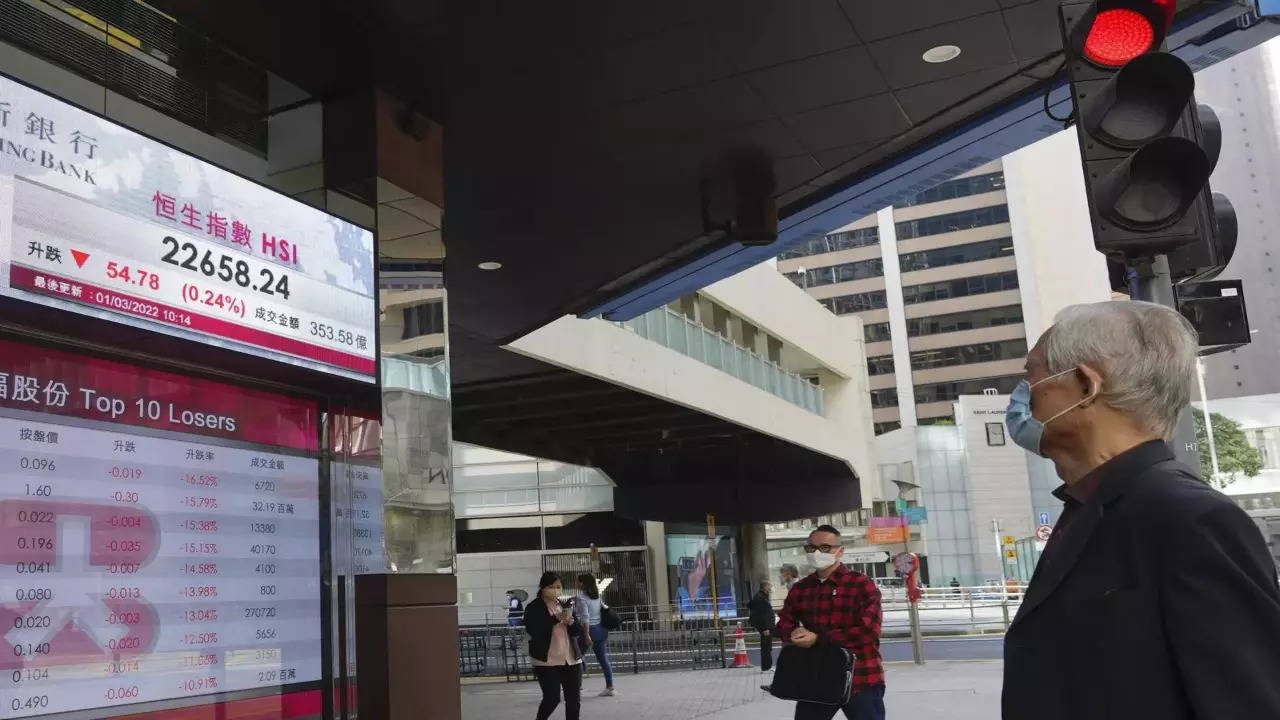

After Wall Street’s retreat, most of Asia was in the red.

Hong Kong, Shanghai, Sydney, Seoul, Singapore, Taipei and Jakarta sank, though a weaker yen helped Tokyo post morning gains.

Analysts said next week’s consumer price index release will be a key data point, which could play a big role in the Fed’s plans for future rate hikes.

“Whether or not the Fed has tightened financial conditions sufficiently to bring inflation down to target over time is going to be the most significant debate in the market agenda through the first half of the year,” said SPI Asset Management’s Stephen Innes.

He added that “the fear is now that we could still be talking rate hikes in the third quarter”.

While data in recent months has shown inflation is coming down, the employment figures showed the economy remained robust, leading several top Federal Reserve officials to warn much more work was needed to get prices under control.

Having spent January optimistic that the days of central bank tightening would soon come to an end, traders have been brought back down to earth this month as they contemplate borrowing costs going higher and staying there longer than expected.

Richmond Fed president Thomas Barkin added his voice to his colleagues this week in warning that the bank had to “stay the course” in lifting rates if it wanted to bring inflation down to its two percent target.

However, with borrowing costs going higher still — and some warning it could go to a two-decade-high six percent — fears are growing that the world’s top economy will tip into recession.

“Inflation most likely won’t get conquered if the economy doesn’t break,” said OANDA’s Edward Moya.

“Disinflation trends remain in place but it will be hard for them to continue with a strong labour market and as the economy keeps on growing. We’ve seen commodities and goods price declines, but core services remain tricky.”

He added that the Fed would continue hiking until personal consumption expenditure — the bank’s preferred inflation gauge — was trending sharply lower. “And that might not happen until the summer,” he said.

After Wall Street’s retreat, most of Asia was in the red.

Hong Kong, Shanghai, Sydney, Seoul, Singapore, Taipei and Jakarta sank, though a weaker yen helped Tokyo post morning gains.

Analysts said next week’s consumer price index release will be a key data point, which could play a big role in the Fed’s plans for future rate hikes.

“Whether or not the Fed has tightened financial conditions sufficiently to bring inflation down to target over time is going to be the most significant debate in the market agenda through the first half of the year,” said SPI Asset Management’s Stephen Innes.

He added that “the fear is now that we could still be talking rate hikes in the third quarter”.

For all the latest business News Click Here

Denial of responsibility! TechAI is an automatic aggregator around the global media. All the content are available free on Internet. We have just arranged it in one platform for educational purpose only. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials on our website, please contact us by email – [email protected]. The content will be deleted within 24 hours.