Apple India stores post record sales; PharmEasy breaches loan covenant; and Amazon’s ten-year India ride

Also in the letter

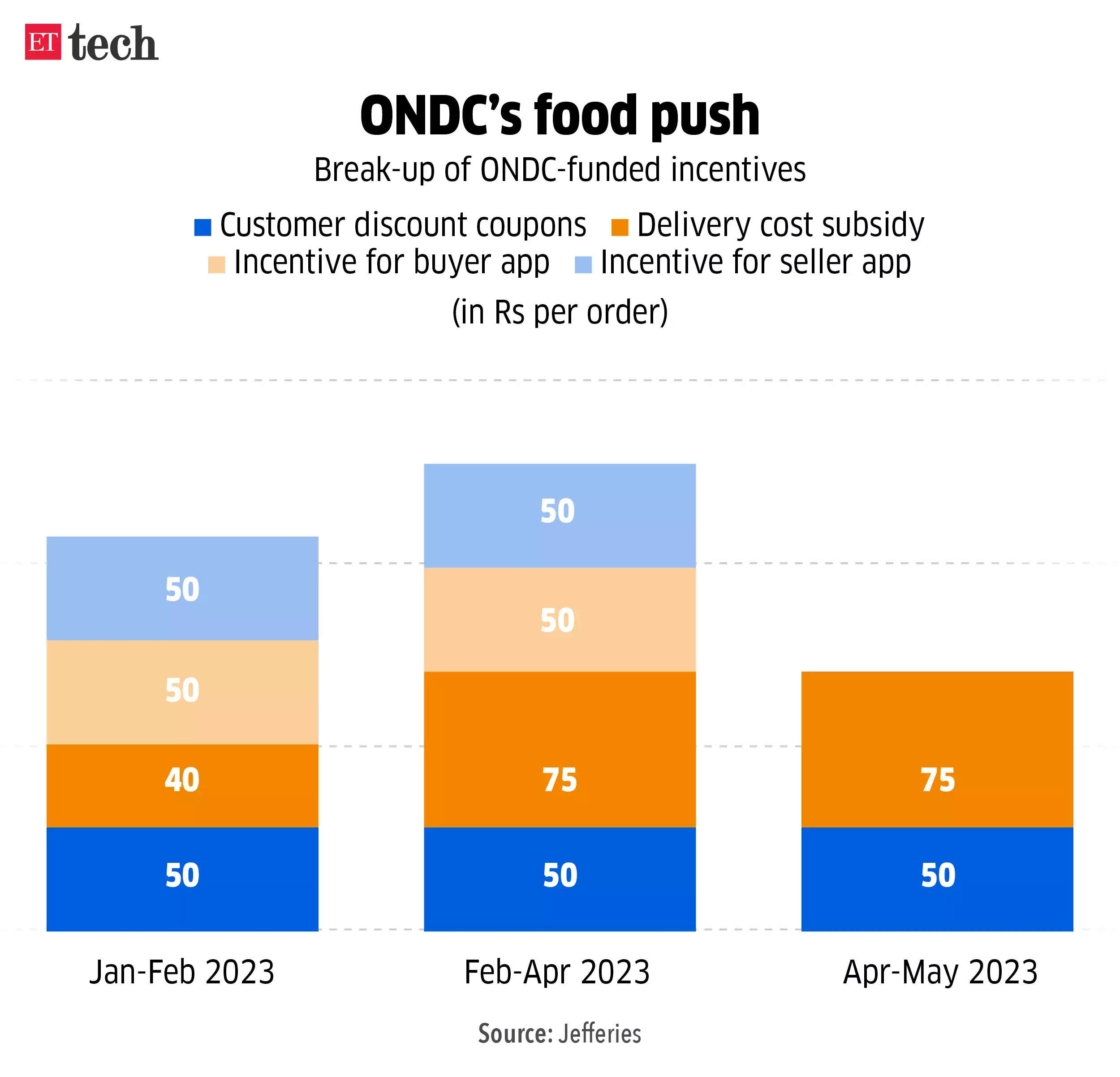

■ ONDC revises incentives

■ ETtech Deals Digest

■ Govt reopens applications for semiconductor scheme

Apple’s India stores bear fruits, post record sales across Mumbai, Delhi

A month after opening its first two retail stores in Mumbai and New Delhi, Apple has won a new laurel – operating India’s largest electronic retail stores by sales.

Driving the news: The iPhone maker’s first two company-owned stores in India have grossed monthly sales of over Rs 22-25 crore each, across Mumbai and New Delhi. This is twice as much of what could be the highest revenue of an electronics store in the country during the non-festive period, two industry executives told ET.

Festive season type sale: Apple BKC had a first-day billing of over Rs 10 crore, which is Rs 2-3 crore more than what some of the largest electronic stores in the country post in a month. In fact, even on a Diwali day, such large stores may have billings of Rs 3-5 crore at best. Apple Saket is over 10,000 square feet, less than half the 22,000 square feet of Apple BKC, but revenues are almost similar.

What’s behind the sales? “The average selling price (ASP) of Apple products is much higher, which leads to higher revenue, and footfalls are still high with both the stores remaining crowded on any given day. The sales have far exceeded Apple’s own internal estimates,” one of the executives said.

Tell me more: As per market research firm IDC India, iPhone’s average selling price (ASP) in India for calendar year 2022 was $935 ($990 at offline channels and $890 via ecommerce). With the two Apple stores, the overall ASP will likely cross $950 and it will be $1,000-plus for offline sales, without 18% GST.

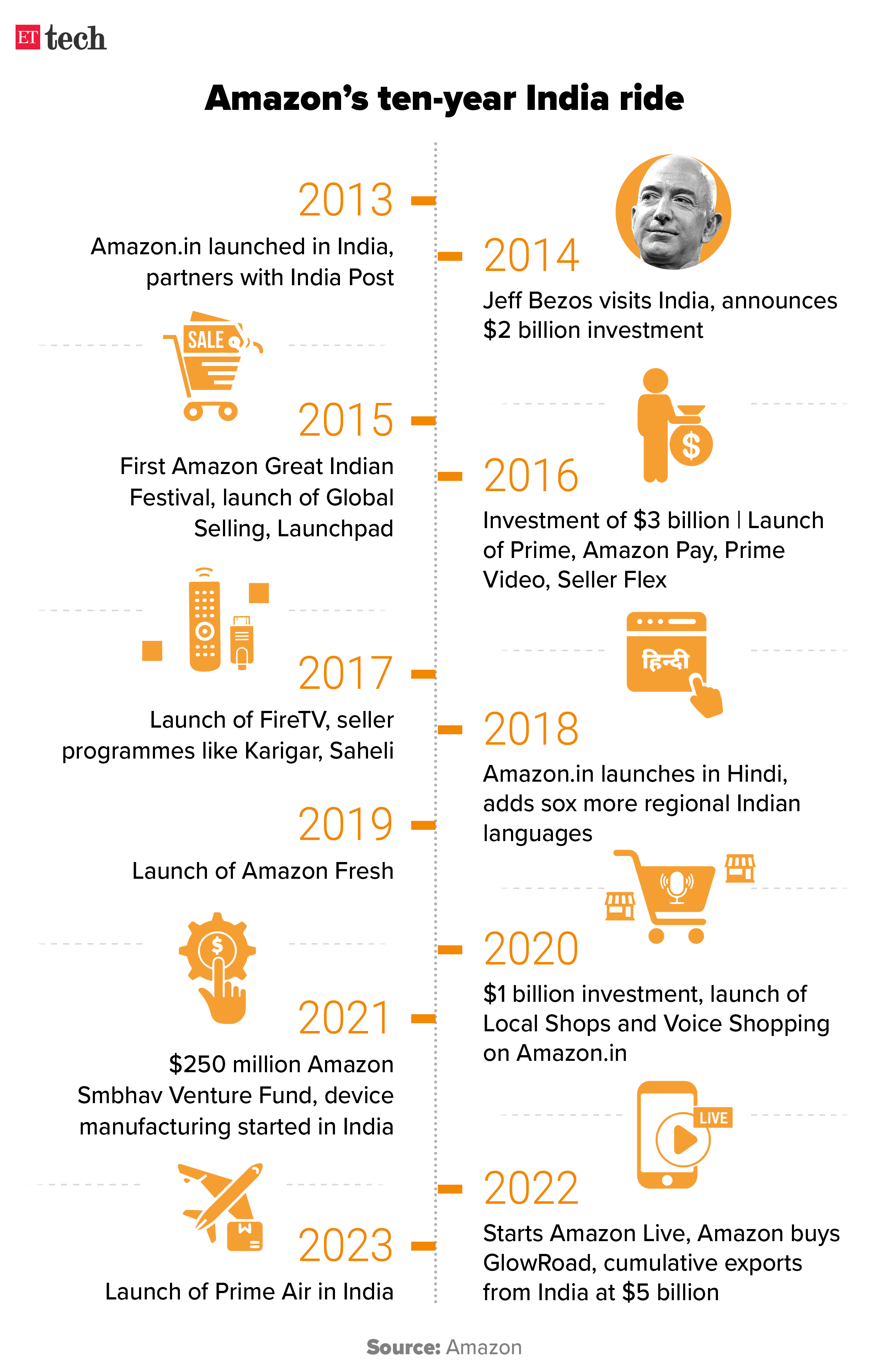

Amazon shrugs off ups & downs in its decade-long India journey

Manish Tiwary, vice president and country manager, Amazon India consumer business

Ecommerce major Amazon is committed and bullish about India, after completing ten years in the country. Manish Tiwary, vice president and country manager, Amazon India consumer business told ETtech.

“While there will be some ups and downs… I would say we are as excited, if not more, with the prospect of what we can achieve in India,” Tiwary said.

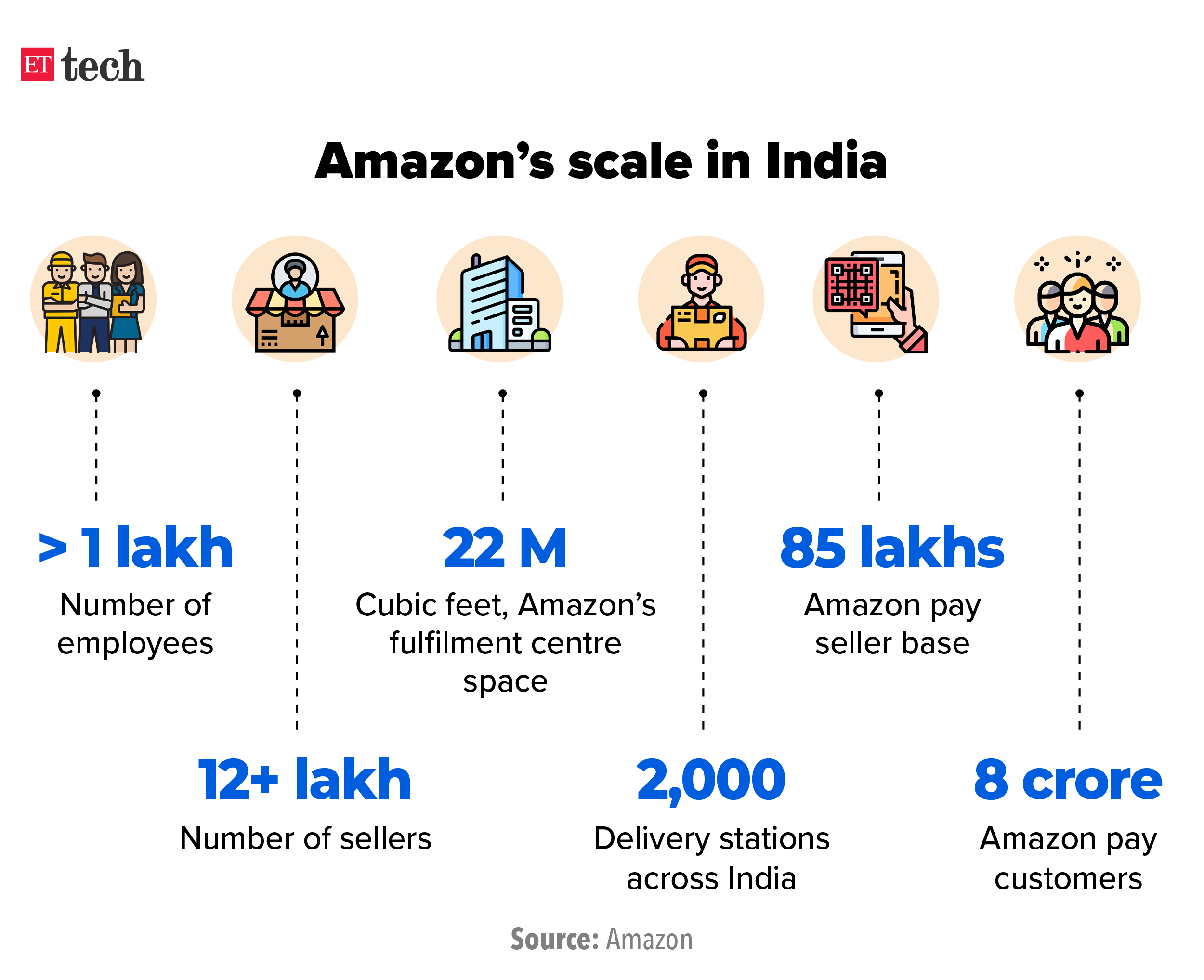

India investments: Tiwary reiterated that India continues to be one of Amazon’s most promising investments for various reasons, including its large population and its GDP growth. The company has been exiting its early-stage experiments like food delivery, edtech and other verticals but Tiwari said Amazon will continue to invest in its logistics infrastructure, its business-to-business ecommerce marketplace Amazon Business, and pharmacy vertical Amazon Pharmacy.

What’s the focus: Amazon has ploughed in $6.5 billion to build infrastructure like supply chain, logistics and warehousing, all of which were non-existent when it started operations in India.

Recently, Adam Selipsky, chief executive officer of Amazon Web Services (AWS), told ET that the company will invest about $12.7 billion to expand its business in India till 2030, which as per Tiwari, further shows Amazon’s commitment to India.

Regulatory challenges: Last year, brokerage firm Bernstein said Amazon’s India report card has been “decidedly mixed”, with regulatory challenges being highlighted as a major issue. However, Tiwary disagreed, lauding the government’s recent foreign trade policy (FTP) that actively promotes exports through ecommerce. Amazon is aiming to export merchandise worth $20 billion from India in the next few years.

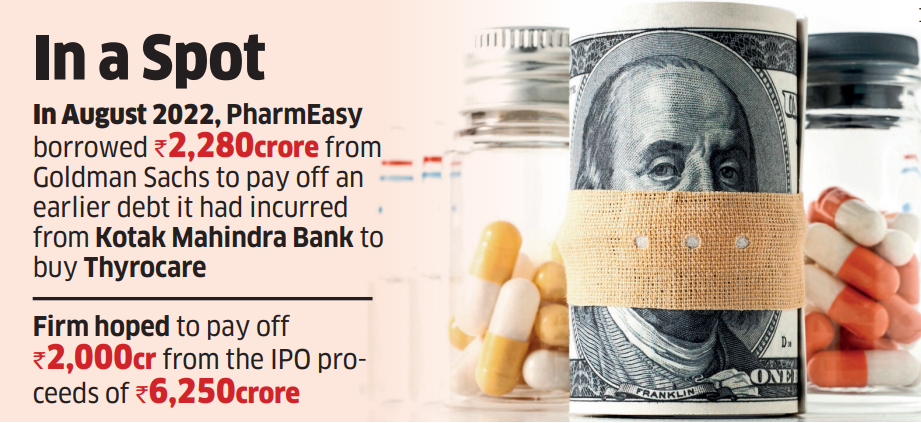

PharmEasy fails to raise Rs 1,000 crore equity, breaches covenant on Goldman loan

Within a year of raising high cost debt from Goldman Sachs, India’s largest online pharmacy platform PharmEasy has breached its loan covenant terms after failing to raise equity, sources told ET.

Driving the news: As per the terms, the company was supposed to raise equity of around Rs 1,000 crore, or about $120 million, linked to its burn rate velocity. It has failed to do that after trying for a year and postponing its initial public offering (IPO). However, PharmEasy has not defaulted on any of its payment obligations so far.

Background: PharmEasy borrowed Rs 2,280 crore, or $285 million, from Goldman Sachs in August last year to pay off an earlier debt it had incurred from Kotak Mahindra Bank to buy Thyrocare. It was a 5-year loan attracting 17-18% annual interest rate.

Jargon buster: Loan covenants are a series of small, independent agreements made between a debtor (borrower) and a creditor (lender). They expressly outline behaviours that a borrower must – or must not – engage in. When a borrower violates one of these loan covenants (often called a covenant breach), it is considered an event of technical default.

What’s next? The terms of the covenant agreement allow the US investment bank to potentially take over the entire company or its most profitable arm Thyrocare on account of the breach as all the assets of PharmEasy’s parent API Holdings have been used as security for the loan.

Tweet of the day

Government reopens semiconductor incentive scheme, invites applications

The government has re-opened the window for applicants, both new and existing, to reapply for setting up of semiconductor and display fabrication units and to seek incentives from the Centre under the India Semiconductor Mission (ISM).

Driving the news: The window for applicants will be open from June 1 and will be kept open till the appropriate resources are there and the government gets good applications, the minister of state for electronics and information technology Rajeev Chandrasekhar told ET.

Pilot for electronics repair services outsourcing industry launched: The government has launched a pilot program for the electronics repair services outsourcing industry. The program will start in Bengaluru and run for 3 months on a trial basis.

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

ONDC cuts discounts to Rs 100 per order in incentive plan rejig

Open Network for Digital Commerce (ONDC) has introduced new limits on discounting with a revised incentive structure for network participants, effective from Thursday. The move, which comes as a part of ONDC’s broader plan to withdraw discounts and incentives in a phased manner, has some participants worried about the network’s growth even as others argued for a sustainable approach.

Driving the news: Under the revised structure, the maximum discount offered per order has been limited to Rs 100, compared to Rs 125 earlier. The discount can be offered only to users whose order value is more than Rs 200 in case of food and Rs 300 for other products, including shipping fees. Customers can avail of discounts on only five orders a month, according to a notification that ONDC issued to its network partners.

Organic growth: “Buyer side apps like Paytm … they have already spent billions in customer acquisition. For them, food is one more feature that they have added on the app. Discounting creates awareness initially but ultimately the growth will have to come organically. The market will see the sense in this,” the person close to the matter told ET.

ETtech Done Deals

Abhimanyu Saxena & Anshuman Singh, cofounders, IB & Scaler

Edtech startup Scaler acquires Delhi-based Pepcoding for undisclosed amount: Edtech startup Scaler has announced the acquisition of Delhi-based education platform Pepcoding for an undisclosed amount to strengthen its business ecosystem.

Climate-tech startup Newtrace raises $5.65 million from Sequoia, others: Climate tech startup Newtrace has raised $5.65 million in a seed funding round led by Sequoia Capital India and Aavishkaar Capital.

Other Top Stories By Our Reporters

Late-stage drought led to SoftBank going slow in India: BofA Securities: Japanese conglomerate SoftBank has stayed away from making any new investments in India over the past year due to the lack of late-stage opportunities, according to a BofA (Bank of America) Securities report.

Zepto announces top-level changes: Quick-commerce platform Zepto announced key changes in its top management as its chief operating officer (COO) Vinay Dhanani will take over as president – supply chain and category.

Global Picks We Are Reading

Rise of the tech giants exposes the problem of index distortions (Financial Times)

Here’s how Instagram recommends the content you see (The Verge)

ChatGPT Is Cutting Non-English Languages Out of the AI Revolution (Wired)

For all the latest Technology News Click Here