Adani: 6 entities under lens for suspicious trading: SC panel on Adani crash – Times of India

The committee, which submitted its report to the SC, said it found no evidence to suggest that the rise in prices of Adani scrips during the period concerned had to do with unusual trading or participation in buying or selling of scrips of the group companies by 12 foreign portfolio investors (FPIs), suspected to be linked to the group which have been under investigation since October 2020 for alleged violation of 25% minimum public shareholding (MPS) norm.

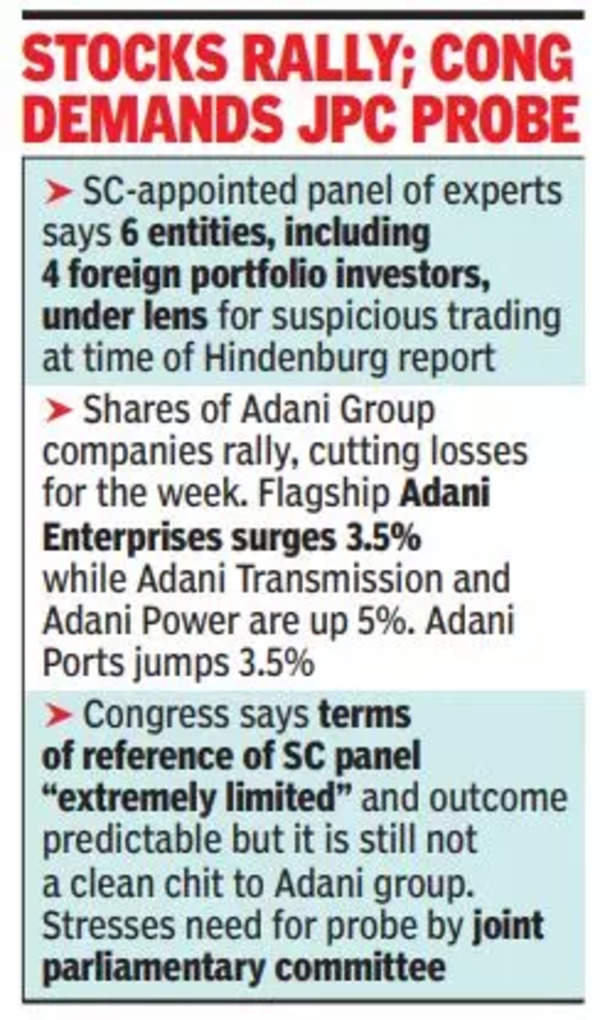

However, “Sebi examined whether there has been any unusual trading pattern proximate to the release of the Hindenburg report… between January 18-31. While there was no adverse observation with respect to Adani scrips in the cash segment, suspicious trading has been observed on the part of six entities”, it said.

“These are four FPIs, which are not among the 12 FPIs suspected to be linked to Adani group and under investigation for violation of MPS norms, and one corporate body and one individual. The trading pattern (adopted by these six) is suspicious because of the build-up of short positions…in the Adani positions prior to the Hindenburg report, and substantial profits earned by them by squaring off their short positions after publication of the Hindenburg report…” it added.

LIC sold 50L AEL shares at ₹300, bought 4.8cr at ₹1,031-3,859: Panel

An analysis by the Supreme Court-appointed expert committee chaired by ex-SC judge A M Sapre of trading in Adani Enterprises (AEL) shares in four patches between March 1, 2020, and December 31, 2022, a month before publication of the Hindenburg report and meltdown of Adani shares, showed that LIC was the biggest loser as it sold off 50 lakh AEL shares when prices hovered around Rs 300 and bought 4.8 crore AEL shares when the prices ranged between Rs 1,031 and Rs 3,859.

After a detailed scrutiny of the movement of prices of Adani shares and their sale and purchase by different entities, the committee found no evidence of price manipulation of stocks by companies linked to the Adani group or others. It emphasised that LIC chose to sell group stocks when others, including big mutual funds and FPIs, were picking up large quantities of them, and that Adani-linked entities were responsible for only a minuscule part of the volume of trading.

Trading of AEL shares was analysed in four periods – Patch I: March 1, 2020 to August 31, 2020; Patch II: September 1, 2020 to September 30, 2020; Patch III: October 1, 2020 to March 31, 2021; and Patch IV: April 1, 2021 to Dec 31, 2022.

function loadGtagEvents(isGoogleCampaignActive) { if (!isGoogleCampaignActive) { return; } var id = document.getElementById('toi-plus-google-campaign'); if (id) { return; } (function(f, b, e, v, n, t, s) { t = b.createElement(e); t.async = !0; t.defer = !0; t.src = v; t.id = 'toi-plus-google-campaign'; s = b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t, s); })(f, b, e, 'https://www.googletagmanager.com/gtag/js?id=AW-877820074', n, t, s); };

window.TimesApps = window.TimesApps || {}; var TimesApps = window.TimesApps; TimesApps.toiPlusEvents = function(config) { var isConfigAvailable = "toiplus_site_settings" in f && "isFBCampaignActive" in f.toiplus_site_settings && "isGoogleCampaignActive" in f.toiplus_site_settings; var isPrimeUser = window.isPrime; if (isConfigAvailable && !isPrimeUser) { loadGtagEvents(f.toiplus_site_settings.isGoogleCampaignActive); loadFBEvents(f.toiplus_site_settings.isFBCampaignActive); } else { var JarvisUrl="https://jarvis.indiatimes.com/v1/feeds/toi_plus/site_settings/643526e21443833f0c454615?db_env=published"; window.getFromClient(JarvisUrl, function(config){ if (config) { loadGtagEvents(config?.isGoogleCampaignActive); loadFBEvents(config?.isFBCampaignActive); } }) } }; })( window, document, 'script', );

For all the latest business News Click Here