Terra’s aftershocks torment crypto

Here’s a look at the fallout from Terra’s collapse.

Terra creator faces investigation, $78 million fine

South Korea’s National Tax Service has reportedly ordered Terraform Labs, its cofounder Do Kwon, and other executives to pay a 100 billion won ($78 million) fine for tax evasion.

According to reports in South Korean media, the tax agency first launched an investigation into Terraform Labs and its subsidiaries last June, on suspicion of corporate and income tax evasion.

The probe found two of Terraform’s subsidiaries were registered in the Virgin Islands and Singapore, but managed in South Korea. This, under the country’s tax rules, required them to pay tax to the Korean government.

But South Korea’s DigitalToday obtained documents from the country’s Supreme Court Registry Office which revealed that Do Kwon decided to dissolve Terraform’s Seoul and Busan branches during its general shareholders’ meeting on April 30. The Busan branch was liquidated on May 4 and the Seoul branch on May 5.

The new findings suggest there’s a lot more to the UST-Luna collapse than meets the eye.

Unsurprisingly, employees of Terraform Labs – including its entire legal team – have fled the company. Lawyers Marc Goldich, Lawrence Florio and Noah Axler all stopped working at the company in May, The Block reported on Tuesday, citing their updated LinkedIn profiles.

Another stablecoin loses it peg

Days after Terra and Luna collapsed, another lost its peg to the US dollar. DEI, created by Deus Finance, a crypto derivatives trading platform, first lost its peg last Sunday and hasn’t regained it since. On Thursday it was just under 60 cents.

Like UST, DEI is an algorithmic stablecoin, albeit a much smaller one. It uses arbitrage bots to maintain the peg by continually trading $1 worth of underlying token for 1 DEI or vice versa. But this system, like Terra’s, appears to have failed.

Tether, the big one, wobbles again

..jpg)

Investors in Tether, the biggest stablecoin of all and a cornerstone of the crypto ecosystem, have withdrawn more than $7 billion since it briefly lost its dollar peg during the Terra-Luna collapse last week, according to data from CoinGecko.

Tether’s circulating supply slipped from about $83 billion last week to less than $76 billion on Tuesday, the data showed, raising fresh questions about the reserves underpinning the stablecoin.

Unlike UST and other algorithmic stablecoins, Tether is fully backed – or so its creators claim – by actual reserves.

It used to claim its tokens were backed 1:1 by US dollars. But after reaching a settlement with the New York attorney general in February 2021, the company admitted it used a range of other assets to support its token.

Regulators perk up

US Treasury Secretary Janet Yellen addressed the issue of UST’s collapse at a congressional hearing on Thursday. She said such assets don’t currently pose a systemic risk to financial stability but suggested they eventually could, and urged lawmakers to approve federal regulation of stablecoins this year. “They present the same kind of risks that we have known for centuries in connection with bank runs,” she said.

The European Commission is also considering strict curbs on stablecoins to prevent them from being widely used in place of fiat currency.

The UK, however, has chosen a different path. It will move forward with proposed regulations that would facilitate the use of stablecoins “as a recognised form of payment,” The Telegraph reported.

“Legislation to regulate stablecoins, where used as a means of payment, will be part of the Financial Services and Markets Bill which was announced in the Queen’s Speech,” a spokesperson for the treasury told the newspaper.

Top Stories By Our Reporters

Zilingo fires CEO Ankiti Bose for ‘serious financial irregularities’

Singapore’s business to business (B2B) fashion startup Zilingo has fired its CEO Ankiti Bose for alleged financial irregularities, capping a long drawn-out dispute between the company’s shareholders, board and the founder. Bose had been suspended from the company on March 31.

Bose told ET in an interview immediately after being ousted that she was not given a chance to answer any of the allegations levelled against her. The 30-year-old said she was unclear about her next steps but that “there is more to this allegation, suspension, termination saga” that has played out in the media over the past two months.

Sequoia puts off close of $2.8B India, SEA fund amid probes into portfolio firms

Sequoia Capital has postponed the closing date of its $2.8-billion fund for India and Southeast Asia (SEA) after alleged financial irregularities and corporate governance issues were discovered at some of its portfolio firms, sources told us.

Email to LPs: The move was communicated to Sequoia’s limited partners (LPs), or sponsors in the fund, through an email, the contents of which we have reviewed. It said, “… during the past weeks, shareholders in a portfolio company have received information about a potential misconduct, requiring investigation. Given these events, we have decided to postpone the close date of the funds,” it said.

Funding winter is here

Plan for the worst, cut costs, extend runway in 30 days, YC tells founders

Silicon Valley’s famed startup accelerator Y Combinator has cautioned founders of all its portfolio firms, telling them to plan for the worst amid a perceptible slowdown in the financing market.

Not mincing words: The missive, sent on Wednesday, read, “The safe move is to plan for the worst. If the current situation is as bad as the last two economic downturns, the best way to prepare is to cut costs and extend your runway within the next 30 days. Your goal should be to get to Default Alive.”

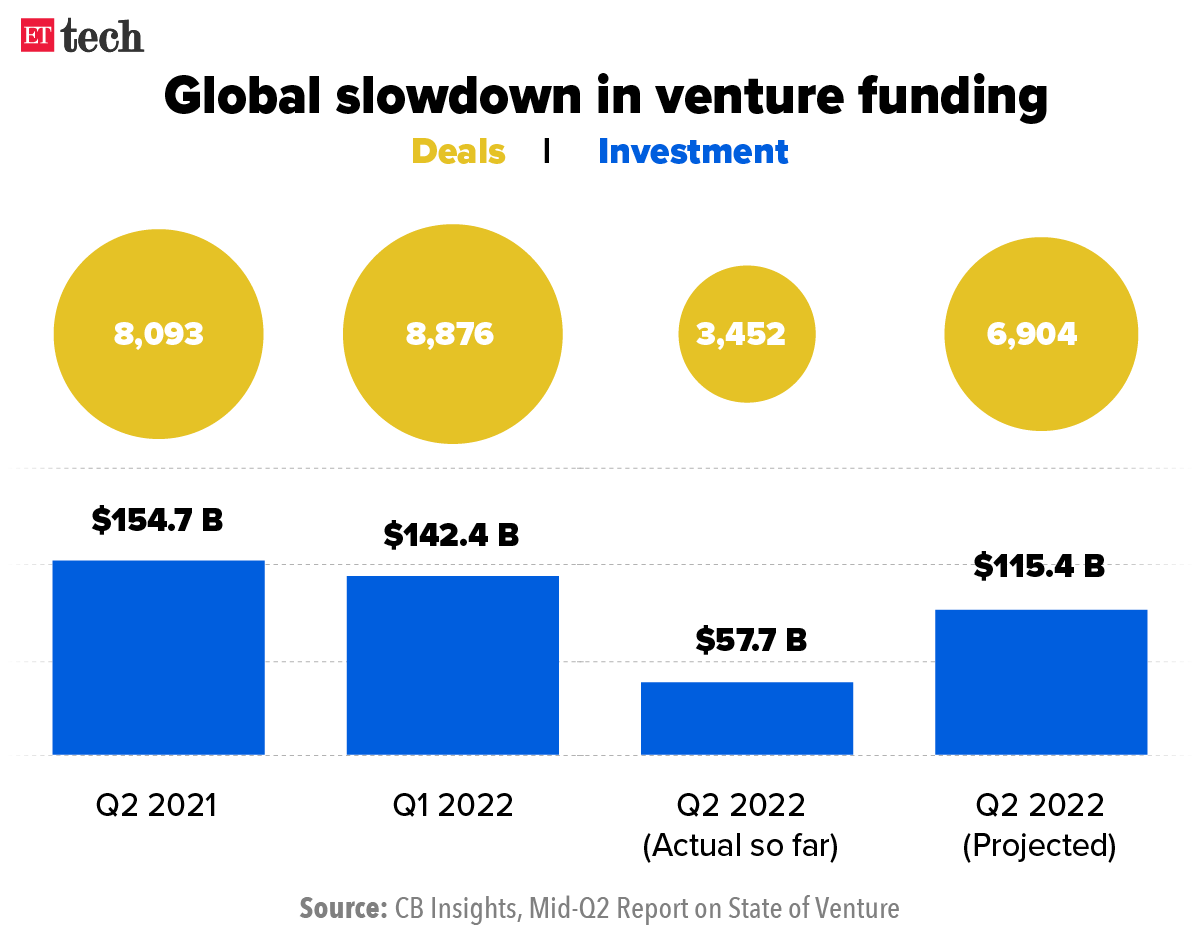

Global venture funding set to fall 19% in Q2 2022: report

Global venture funding for startups is set to fall by 19% in Q2 2022 from the previous quarter, amid tightening liquidity and a global meltdown in technology stocks, according to a report by CB Insights titled ‘State of Venture’. The number of deals is projected at 6,904, a 22% drop from the previous quarter, the report said.

FirstCry pauses IPO plans as markets remain volatile

FirstCry will delay its planned $1-billion IPO by a few months, sources told us.

Delhivery effect: They said the company’s cautious approach follows the muted response to Delhivery’s IPO last week, amid broader headwinds in global markets.

Only 24% of Delhivery’s IPO was subscribed on the second day of its issue, signalling a lack of excitement from retail and high-net-worth investors, leaving company insiders on tenterhooks until the IPO was fully subscribed on the final day.

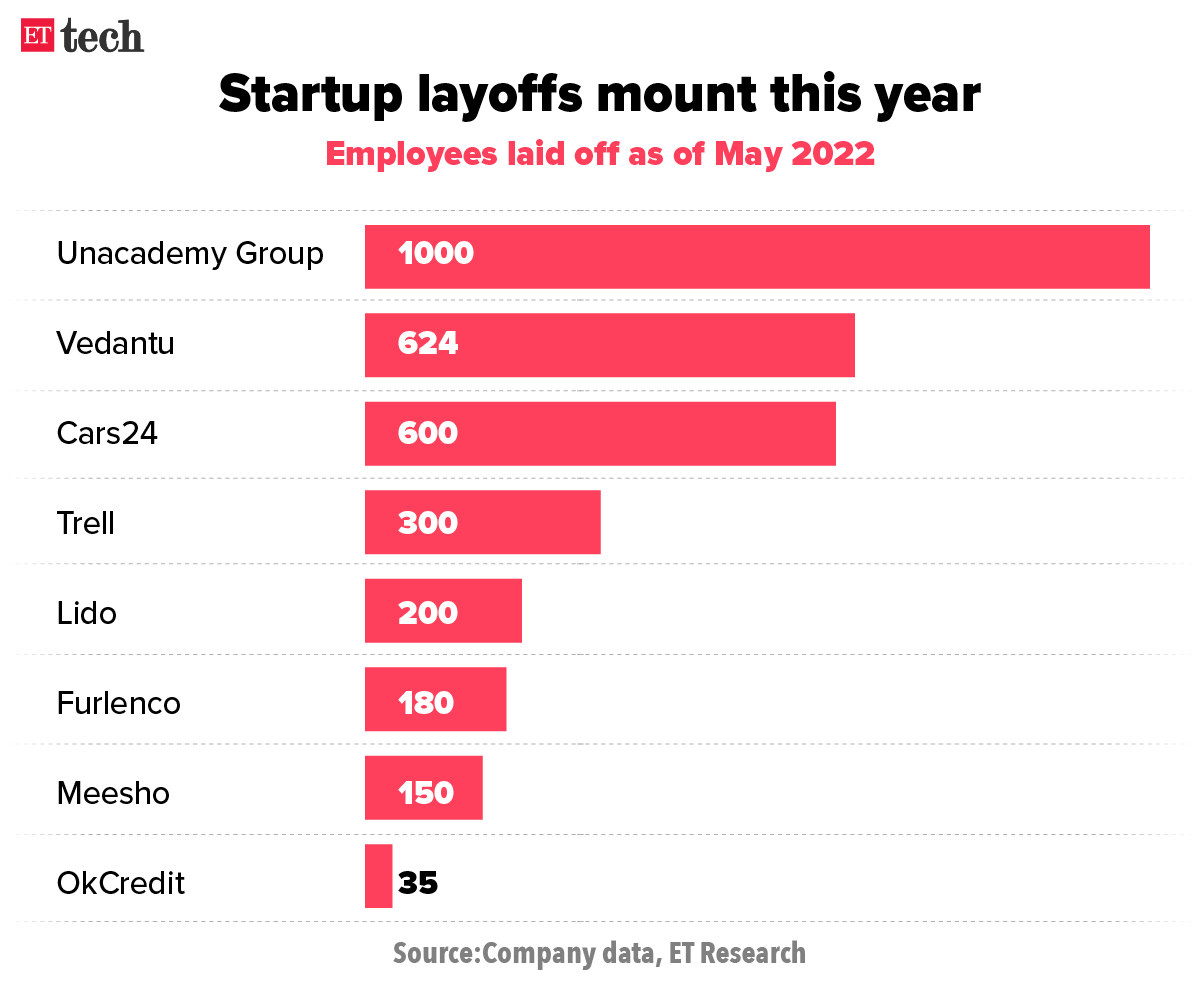

Startup layoffs

Cars24 sacks 600 employees as startup layoffs continue

Used car market marketplace Cars24 has laid off over 600 employees, or about 6% of its 9,000-strong workforce, according to people aware of the matter. The layoffs have taken place across departments and roles, these people added.

Vedantu to lay off another 424 employees as capital becomes scarce: Edtech unicorn Vedantu said it is laying off another 424 employees – about 7% of its workforce – just days after sacking 200 contractual and full-time employees amid falling demand for online education.

Startups reach out to find jobs for the laid-off: As layoffs hit the sector amid a funding crunch, investor pressure and efforts to cut cash burn, the tight-knit startup community is stepping up to look out for its own. On Wednesday, when edtech company Vedantu laid off 424 employees, citing “scarce capital — its second round of job cuts this month — founders, CXOs and HR teams of many other startups reached out, over social media and otherwise, to help the laid-off staff find new employment.

ETtech Interview

Raising all kinds of capital for multi-billion-dollar buys: Byju’s CEO

In March, Byju’s founder CEO Byju Raveendran said he was investing $400 million of his own money into the company as part of a $800-million funding round.

The transaction was reminiscent of one executed by Oyo founder Ritesh Agarwal in 2019. He had bought back stakes held by Sequoia Capital and Lightspeed Venture Partners in the startup in what was an unprecedented bulk-up of his shareholding.

RBI delivers a blow to Sachin Bansal’s banking dreams

By now, it’s likely you are aware that Chaitanya India Fin Credit, owned by Flipkart founder Sachin Bansal, has been denied a banking licence by the Reserve Bank of India (RBI). But the timing of the RBI’s announcement couldn’t have been worse for Bansal, who was addressing a press conference when the news came in.

Ola scales down its food business (again)

Ola is once again scaling down its food-delivery ambitions. The mobility company’s cloud-kitchen business under Ola Foods has cancelled its expansion plans and is looking to sell most of its kitchen equipment at a 30-50% discount, sources told us. We have also reviewed an email sent to prospective buyers on the products up for sale.

Cryptoverse

Singed by Luna’s collapse, crypto investors rethink their bets

Ashwin Nadar, a 25-year-old software engineer based in Mumbai, is still reeling from the sudden collapse of Luna, a popular cryptocurrency, last week. “It was a disturbing event. I bought Luna at $73 and got out at 24 cents,” he said. “I had a small investment, but as someone who believed in ‘smart contract’ cryptos, it was painful to watch the event unfold.”

Crypto exchanges face funding dip amid low trading, high taxes: Indian cryptocurrency exchanges are set to face lower valuations, longer negotiation cycles, and hard bargaining by venture capital firms due to falling trading volumes, talk of more restrictive tax regulations, and the impact of the Terra-Luna collapse on retail investors.

Celebs must do their homework before endorsing crypto, says ad body: Given that cryptocurrency is an unregulated product, the Advertising Standards Council of India (ASCI) said that celebrities should be “circumspect” when endorsing it.

Leading crypto exchange Bitmex starts spot trading in India: Bitmex, one of the world’s top cryptocurrency exchanges, is launching spot trading in India on Tuesday, despite the bloodbath in the crypto market and an unfavourable regulatory environment in the country, a top executive told us.

Coinbase to slow down hiring: Crypto platform Coinbase plans to go slow on hiring amid a downturn in the US market. The company had recently announced plans to triple its headcount in India. “Given current market conditions, we feel it’s prudent to slow hiring and reassess our headcount needs against our highest-priority business goals,” said Emilie Choi, president and chief operating officer at the firm.

IT corner

IT firms tap alumni networks for talent as attrition soars

Faced with unprecedented attrition in a peaking demand environment, India’s IT exporters are tapping into their alumni networks to find the right talent. HCL Technologies CEO C Vijayakumar told us that alumni networks are one of many lateral talent pools the company is tracking. “Many employees feel like returning and depending on the role and location, we do give them opportunities,” he said.

TCS introduces Tata brands to the metaverse: Tata Consultancy Services (TCS), India’s largest software services firm by revenue, is engaging with Tata group companies like Tanishq, Tata Motors and Croma to deploy metaverse solutions, a senior executive told ET.

Tech Mahindra Q4 results: Consolidated PAT rises 39% YoY, beats estimates: Tech Mahindra’s consolidated net profit rose 39.2% year-on-year to Rs 1,506 crore for the quarter ended March of fiscal 2021-22 due to reversal of some of the provisions from SEZ related benefits made in the previous quarters and strong performance. The company reported a 24.5% on-year rise in consolidated revenues at Rs 12,116 crore due to double digit growth across verticals, especially the communications vertical.

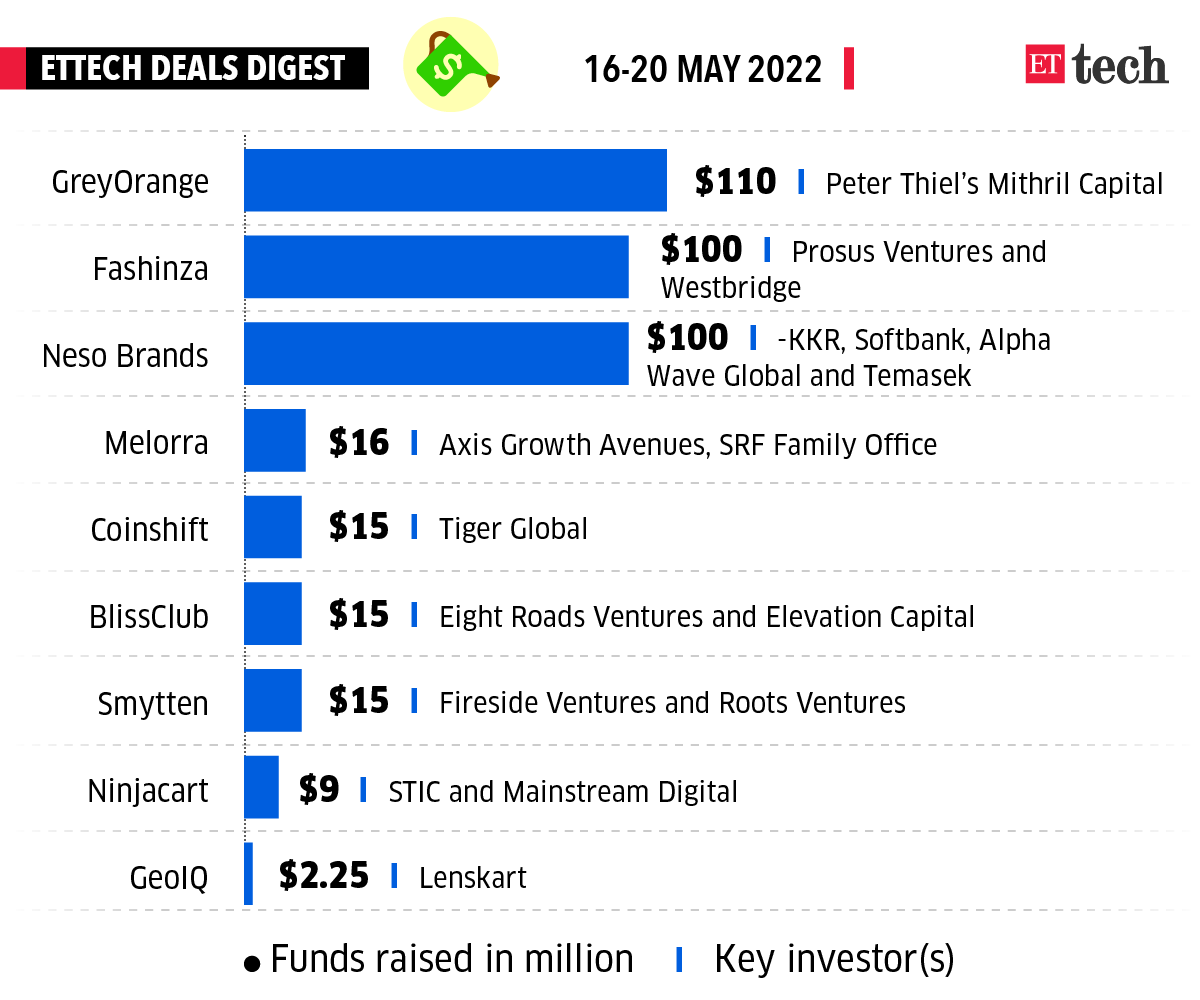

ETtech Done Deals

Warehouse robotics and automation company GreyOrange, AI-driven business-to-business (B2B) marketplace Fashinza and Lenskart subsidiary Neso Brands were among the startups that raised funds this week. Here’s a look at the top funding deals of the week.

■ Walmart-owned PhonePe is acquiring two wealth management companies WealthDesk and OpenQ as it looks to boost its play in the wealth management and distribution space.

■ Endurance Technologies has bought the battery management system unit of energy tech startup Ion Energy for $40 million in an all-cash deal. Endurance will buy 51% of Maxwell Energy Systems, a subsidiary of Mumbai-based Ion Energy, for $17.5 million to begin with, and the remaining 49% in phases over the next five years, it said.

■ Eight Roads, a global investment firm backed by Fidelity, has launched its first dedicated India healthcare and lifesciences fund. With a corpus of about $250 million, it is the largest pool of capital available for the sector in India.

■ Honasa Consumer (HCPL), the parent company of Mamaearth and The Derma Co., has acquired Dr Sheth’s, a dermatologist-formulated premium skincare brand. Through this acquisition, HCPL will take a majority stake in Dr. Sheth’s at a valuation of Rs 28 crore.

■ Singapore’s sovereign wealth fund GIC is in talks to pick up a significant minority stake in direct-to-consumer (D2C) beauty and personal care brand Wow Skin Science for $75 million, four sources told us.

Curated by Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.

That’s all from us this week. Stay safe.

For all the latest Technology News Click Here