Jim Cramer names 7 beaten-down semiconductor stocks that look ‘enticing’

CNBC’s Jim Cramer on Wednesday offered investors a list of seven semiconductor chip stocks he believes could be attractive buys.

“I think there’s a sense that the chipmakers will get hurt as we head into a [Federal Reserve]-mandated recession,” the “Mad Money” host said, referring to the Fed’s upcoming interest rate hikes. “At these levels, I think a bunch of them have started to look pretty enticing,” he added.

Here are his picks for the best semiconductor stocks that have reasonable valuations and earnings growth:

- Micron

- Western Digital

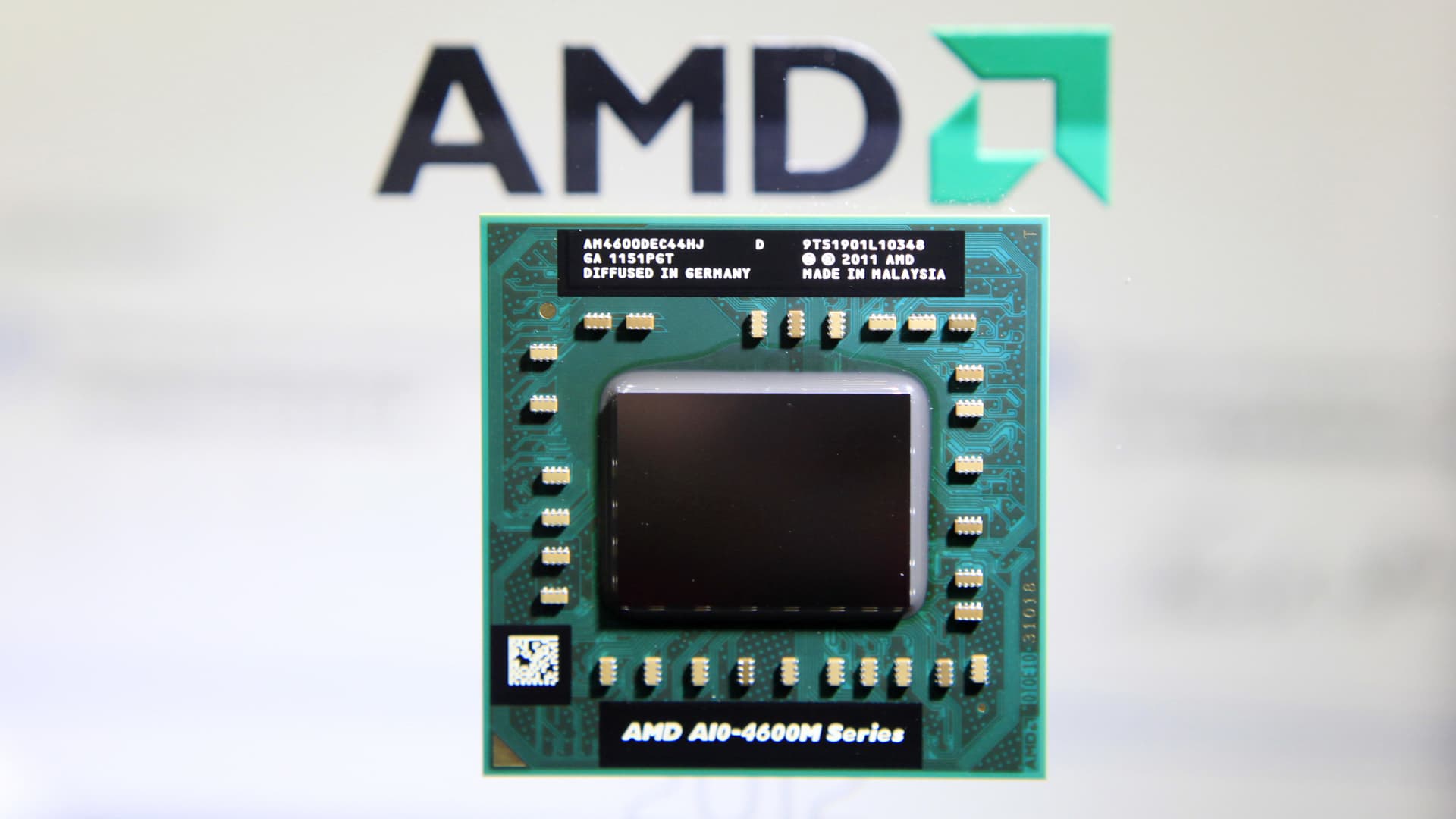

- Advanced Micro Devices

- Skyworks Solutions

- KLA

- Lam Research

- Applied Materials

“Growth at a reasonable price abounds in this beaten-down market, and that includes the more controversial semiconductor space. Just be aware that these chip stocks might remain at a reasonable price for the foreseeable future because Wall Street has just got no love — until today — for this entire darn group,” he said.

Cramer’s latest list of investable growth stocks comes after he earlier this week highlighted four financial stocks and six travel and leisure stocks buyers should have on their radars. To pick his favorite stocks in each sector, Cramer has used the same list of stocks containing companies from the S&P 500 that meet his criteria for having a reasonable valuation and earnings growth.

Disclosure: Cramer’s Charitable Trust owns shares of AMD.

Sign up now for the CNBC Investing Club to follow Jim Cramer’s every move in the market.

Disclaimer

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? [email protected]

For all the latest business News Click Here