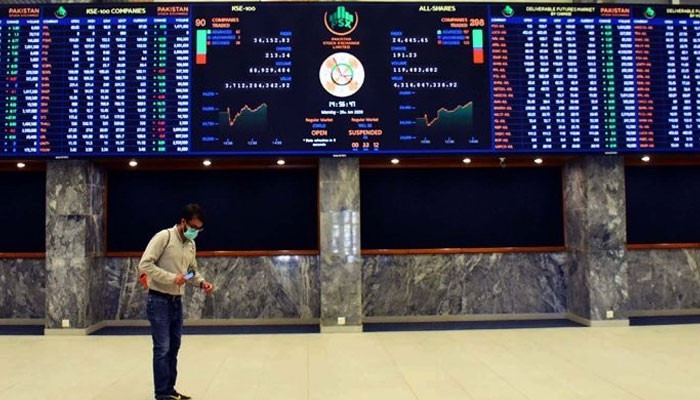

KSE-100 index plunges over 2,000 points in intraday trading

KARACHI: The Pakistan Stock Exchange (PSX) on Thursday received a big blow as the benchmark KSE-100 index nosedived by more than 2,000 points in intraday trading.

KSE-100 opened at 45,369.14 points and it was a one-way street thereafter. As investors dumped their positions, they wiped off close to 2,000 points — around 4.4% — by 1:30pm.

If the day’s trend and selling pressures persist, the PSX might be forced to announce a ‘market halt’ for the day as a ‘cool-off’ measure to avoid a larger collapse.

The market halt will be triggered if the KSE-30 index declines by 5% or more and the decline does not reverse within five minutes of doing so.

Speaking to Geo.tv, Alpha Beta Core CEO Khurram Schezad said that investors sentiment was dented after a record high import number.

“The import bill (trade deficit) was way beyond the market expectation, which shocked the investors and they offloaded stocks,” he said, explaining that a higher current account deficit increases the expectation of a policy rate hike and a subsequent rise in the cost of doing business.

However, the analyst added that the current account deficit is expected to contain in the coming months as oil prices in the international market have dropped significantly and the food and energy supply side is expected to improve in the ongoing six-month period, which will reduce the current account deficit of Pakistan

Meanwhile, BMA’s Capital Executive Director Saad Hashemy told Geo.tv that the investors took a negative cue from the T-bill auctions.

“The figures, if the 3, 6 and 12-month T-bills were around 75-100 bps higher than the secondary markets which led to the bloodbath,” he said.

“Secondly, the higher-than-expected trade deficit added fuel to the negative sentiment,” the analyst said, adding that investors weighed the chances of a massive rate hike during the MPC meeting this month.

“Going forward, the market is expected to consolidate as valuations are attractive,” he predicted.

For all the latest business News Click Here