PhonePe bags another $100M from General Atlantic; TCS snags Rs 15,000 crore BSNL advance order

Also in this letter:

■ Delhivery CEO on e-commerce growth

■ Meta fined $1.3 billion by EU

■ Work culture, scaling issues force Wistron out of India

PhonePe raises $100 million from General Atlantic

(L to R) PhonePe cofounders Sameer Nigam and Rahul Chari

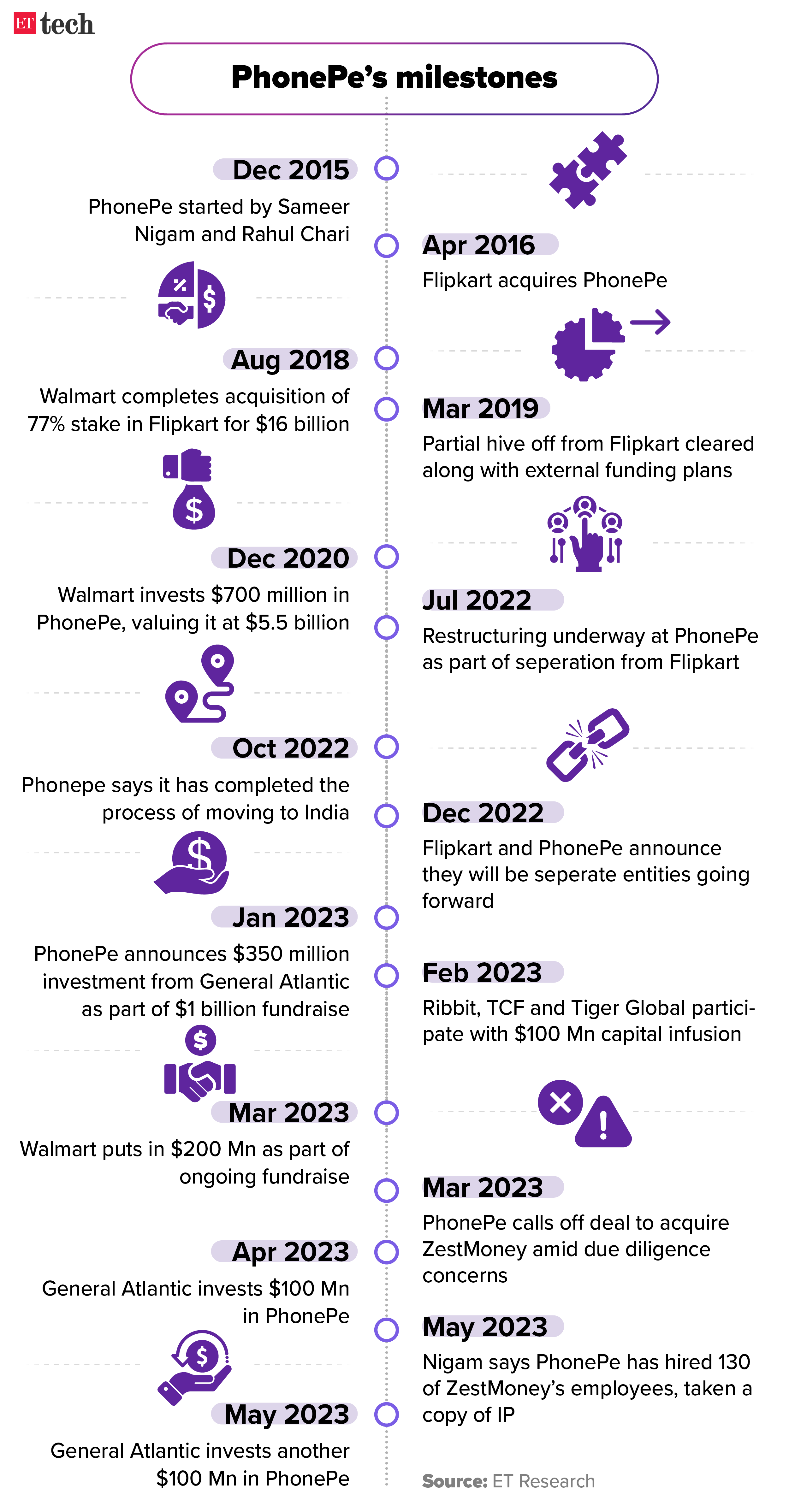

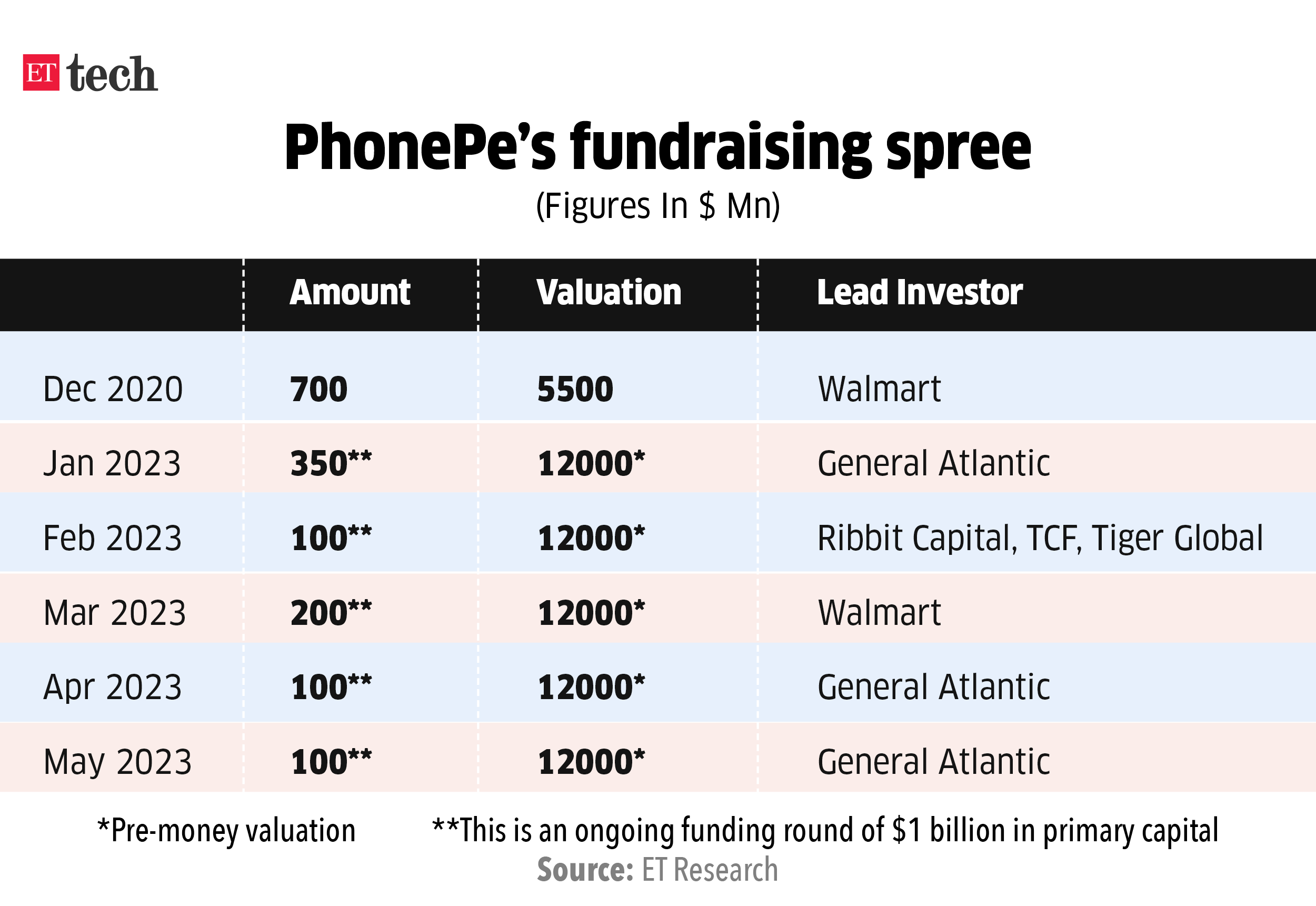

Digital payments major PhonePe said on Monday that it has raised an additional $100 million in funding from growth equity major General Atlantic, getting closer to its proposed $1 billion primary fundraising target.

Deal details: The round is being raised at a $12 billion pre-money valuation. With the latest infusion, its fifth this year, PhonePe has raised $850 million in the ongoing round.

The latest tranche takes the total investment from General Atlantic and its affiliate funds in PhonePe’s current round to $550 million. This is more than the $350-450 million that the PE major was expected to infuse.

Recent backers: The company had kicked off its latest fundraising round with General Atlantic investing $350 million in January. Subsequently, it got $100 million from fintech backer Ribbit Capital, TVS Capital Funds and New-York based Tiger Global in February.

In March, PhonePe raised $200 million from Walmart, and in April, another $100 million from General Atlantic.

ZestMoney deal collapse: PhonePe has been actively focusing on its financial services play. It is looking to enter the stockbroking segment and also launch consumer lending.

With talks to acquire buy-now-pay-later (BNPL) startup ZestMoney falling through, the payments company is expected to build a credit product in-house. It has already started pilots to offer merchant loans on its platform through partners.

TCS snags Rs 15,000 crore advance order from BSNL

Tata Consultancy Services (TCS) on Monday informed exchanges that it has received an advance purchase order (APO) valued at over Rs 15,000 crore from public sector telecom operator Bharat Sanchar Nigam Limited (BSNL).

Driving the news: The TCS-led consortium that will deploy this order includes the Centre for Development of Telematics (C-DoT) and Tejas Networks.

At about $1.8 billion, the deal is one of the largest closed by the IT services major in recent quarters. The largest deal TCS had closed in the January-March quarter was worth around $750 million.

Telecom race heats up: We had reported in November 2022 that this deal would potentially pitch an Indian telecom network solutions consortium led by TCS against global players Ericsson, Nokia and Huawei, among others.

Quote unquote: “We (TCS) have always been only in the software management side and never supplied equipment. Now, we have the equipment capability, which means that we can truly compete with global equipment vendors. TCS will continue as the systems integrator with the addition of Tejas Networks as the equipment provider,” TCS chief operating officer N Ganapathy Subramaniam had told us.

EU fines Meta $1.3 billion for transferring data to the US

The European Union fined Facebook parent Meta $1.3 billion for shipping user data to the US as regulators said the social media giant had failed to protect personal information from the prying eyes of American security services.

Tell me more: On top of the fine, which eclipses a €746 million EU privacy penalty previously levied on Amazon.com Inc., Meta was given five months to “suspend any future transfer of personal data to the US” and six months to stop “the unlawful processing, including storage, in the US” of transferred personal EU data.

Facebook’s response: Meta said it would appeal the decision, describing it as “flawed” and “unjustified.” The company also promised to “immediately” seek a suspension of the ban orders, saying they would cause harm to “the millions of people who use Facebook every day”.

Catch up quick: Monday’s decision is the latest round in a long-running saga that saw Facebook and thousands of other companies plunged into a legal vacuum. In 2020, the EU’s top court annulled an EU-US pact regulating transatlantic data flows over fears citizens’ data wasn’t safe once it arrived on US servers.

Expect e-commerce to grow between 15-20% year-on-year: Delhivery CEO

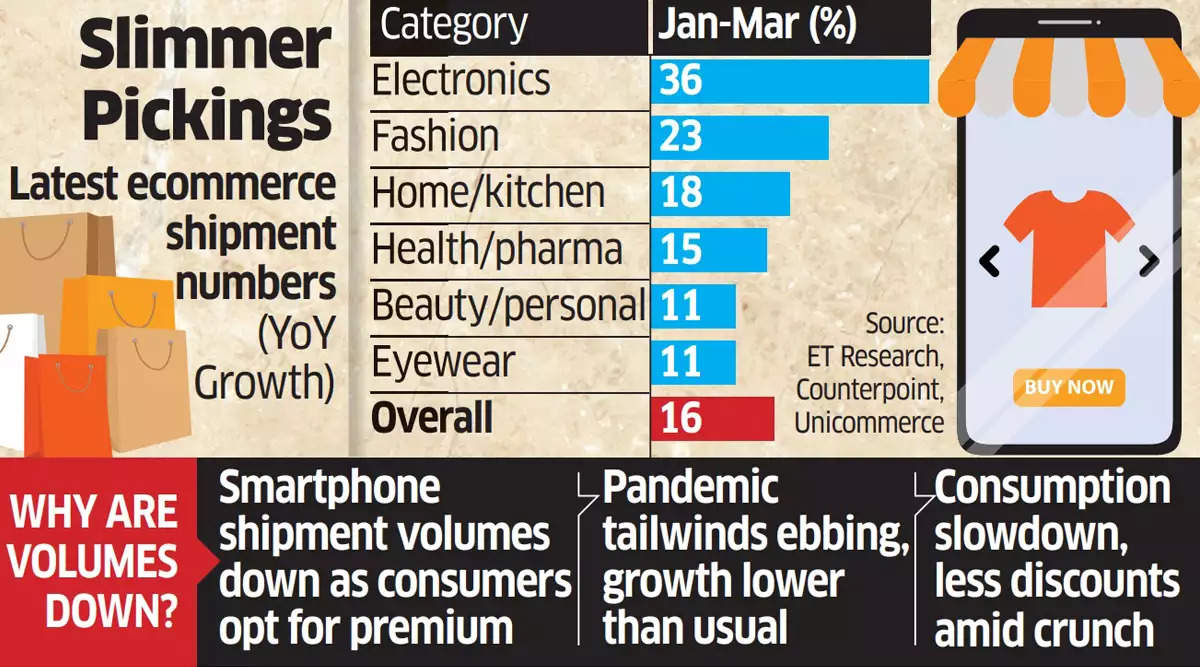

Amid a slowdown in the ecommerce industry due to the post-pandemic slowdown, rising inflation and the comeback of offline stores, logistics firm Delhivery’s CEO Sahil Barua said he expects the online retail sector to grow 15-20%.

CEO speak: “I don’t want to become the Cassandra (one who predicts misfortune) of this industry,” Barua said during a post-earnings call. “But I must mention when I said (there would be a slowdown) three quarters ago, it was generally met with widespread disbelief… My own estimation hasn’t changed. I expect ecommerce to continue to grow between 15% and 20% year-on-year.”

Delhivery to benefit: During the call, Barua said the slowdown and turbulence would benefit Delhivery because of its cost efficiency.

“We are by far the most efficient player in the market and at a time when our customers are counting their costs they will shift more volume to Delhivery,” he said.

Also read |As shopping spree slows, ecommerce not clicking as it did

Shein’s re-entry: Barua said the re-entry of Chinese fashion giant Shein through Reliance Retail will benefit the entire ecommerce industry and likened it to a tide that lifts all boats.

“They (Shein) used to be a high-volume player the last time they were here. Ajio has been one of the fastest-growing ecommerce platforms in the last 12 months. And I think this bodes well for the market.”

Also read | Delhivery Q4 revenue falls 10%, loss widens to Rs 158 crore

Tweet of the day

Work culture, scaling issues force Wistron out of India

Wistron, the first of Apple’s three global contract manufacturers to start assembling iPhones in India, in 2017, is leaving the country in the face of multiple issues, including work culture and expansion.

Why the exit? Wistron’s inability to get deeper into Apple’s supply chain is one of the key reasons the Taiwanese contract manufacturer is exiting India.

Employees and industry executives told ET that Wistron had been contemplating an exit as it didn’t see long-term profitability in being a mere assembler of the final product. The company instead wants to focus on its core IT manufacturing businesses in countries such as Vietnam and Mexico.

Employee protests: The Apple manufacturer has faced numerous protests from workers, starting in 2020, when violence broke out at its Kolar unit allegedly over unpaid wages and long working hours. The episode cost the company about Rs 430 crore in damages. Apple put Wistron on probation, halting the unit until corrective measures were taken.

Last week, 400 senior production staff protested against the management, demanding parity in salaries with junior contractual workers.

What next? The company is in the process of selling its Kolar unit to the Tata Group, which is currently holding trials for assembly of the upcoming iPhone 15 in India. The deal is yet to be closed.

Today’s ETtech Top 5 newsletter was curated by Megha Mishra in Mumbai and Gaurab Dasgupta in New Delhi. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here