EPFO clause makes opting for higher pension nearly impossible – Times of India

Responding to an RTI query on February 3, the retirement fund body said it had not received a single application, since the inception of the scheme in March 1996, for permission under a clause now made mandatory to claim the benefit of higher pension.

The provision requires employees and employers to have jointly sought prior permission from EPFO to contribute higher amounts on their actual basic salaries instead of the prescribed statutory limit for provident fund under the Employee Provident Fund (EPF) Scheme, 1952.

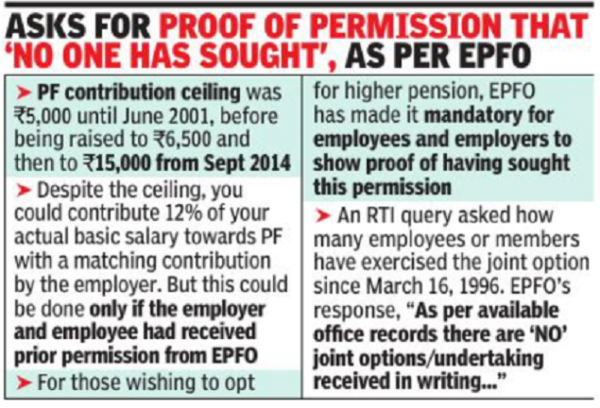

Over the years, the government has been raising the PF contribution ceiling, which was Rs 5,000 until June 2001, before being raised to Rs 6,500 and further to Rs 15,000 from September 2014. This means that despite the ceiling you could contribute 12% of your actual basic salary towards PF with a matching contribution by the employer.

But this could be done only if the employer and the employee had received prior permission from EPFO.

In response to a RTI question on how many employees or members exercised the joint option under the provision – Para 26(6) from March 16, 1996 – EPFO said, “As per available office records there are ‘NO’ joint options/ undertaking received in writing under Para 26(6) of EPF Scheme, 1952 during the period from March 16, 1996 to December 31, 2022.”

EPFO also said it has no information on record of the total number of serving employees, or retirees and pensioners, till March 31, 2022, who exercised the joint option under this clause.

Following the recent Supreme Court ruling, which has opened a four-month window to opt for the higher pension option, EPFO has now dug out this provision, which threatens to defeat the purpose of the apex court’s order – allowing subscribers of the Employees’ Pension Scheme to opt in for pension based on the average actual basic salary for the last five years of service. Implementing the verdict means that someone who has been a member of EPFO for 33 years can hope to get as much as 50% of the five-year average as pension, provided the member is able to comply with the norms.

Experts told TOI the retirement savings agency has decided to implement the provision of “prior approval” for PF contribution based on your actual basic salary with retrospective effect when the SC order had not specifically referred to it.

The provision is expected to create hurdles for subscribers to opt in for higher pension, since such permissions from the agency are not commonplace even though employees and their employers have contributed for decades on their actual or higher salaries.

Most companies with their own provident fund trusts, for instance, contribute based on the actual salaries of their employees, regardless of limits. In fact, for years, EPFO has been pocketing administrative charges on these contributions, based on actual salaries, and never raised the issue of the provision under the EPF Scheme.

In fact, in many cases, EPFO has accepted these charges not only from private trusts, but also from employees of unexempted establishments, whose contribution is directly handled by the regional PF commissioners. Even in these cases, contributions have been made on actual salaries – without prior permission from EPFO.

Experts and HR executives point out that in January 2019, EPFO’s own circular to its regional PF commissioners had asked them to desist from insisting on compliance of the provision under Para 26(6) of EPF Scheme, 1952.

“…if an employer and employee have contributed under the EPF Scheme, 1952 on wages higher than the statutory wage limit, without joint option of employee and employer, and the EPF Account of the concerned employee has been updated by EPFO on the basis of such contribution received, then by action of employee, employer and EPFO, it can he inferred that joint option of employee and employer has been exercised and accepted by EPFO,” the January 22, 2019 EPFO circular signed by Central Regional PF Commissioner Rajesh Bansal had said.

This circular, however, was summarily withdrawn less than a month later without adequate explanation.

The insistence of mandatory compliance under Para 26(6) in the EPFO’s latest orders has left applicants and experts befuddled. An asset manager told TOI the EPFO’s move will leave a large chunk of employees, who are keen to opt in for higher pension, ineligible as neither they, nor their employers have the permissions that are being sought now.

EPFO did not respond to repeated attempts for clarification.

Last week, during an interaction with CII representatives, regional PF commissioner Aparajita Jaggi did not explain why permission from EPFO was being made a necessary pre-condition to exercise the higher pension option, sources told TOI.

Earlier this week, EPFO extended till May 3 the deadline for members to sign up for higher pension under EPS. However, it is yet to clarify the method of deposit and computation of pension.

For all the latest business News Click Here