Charts are ‘screaming’ that it’s not too late to buy homebuilder stocks, Jim Cramer says

CNBC’s Jim Cramer on Tuesday said that investors still have a chance to buy homebuilder stocks before a possible run-up.

“The charts, as interpreted by Dan Fitzpatrick, suggest that we’re looking at a truly counterintuitive bull market in the homebuilders, and even though that’s not supposed to happen at this point in the business cycle, the bulls keep running anyway,” he said.

The Federal Reserve has raised interest rates over the last year to tamp down inflation, hammering stocks of every industry from tech to retail to financials. However, the action in homebuilder stocks from recent months suggests that they’re going against the tide, according to Cramer.

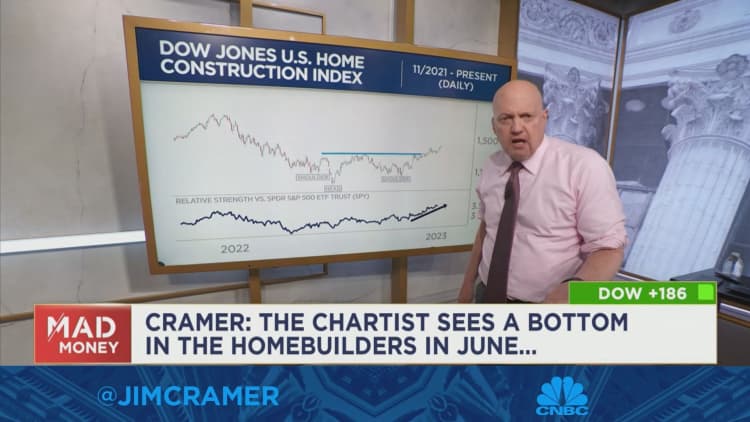

To explain Fitzpatrick’s analysis, he examined the daily chart of the Dow Jones U.S. Home Construction index.

The chart shows a classic reversal pattern resembling an upside-down person, according to Cramer, he said, adding that this pattern could turn into one of sideways trading as it did in April through late November.

“As Fitzpatrick sees it, the homebuilders bottomed in June and the group finally formed a new uptrend in December,” he said.

Adding to the bull case for home stocks is the relative strength of the Home Construction Index versus that of the SPDR S&P 500 ETF Trust, featured at the bottom of the chart. The comparison shows that the home stocks have been an “incredible outperformer” in the last couple of months, he pointed out.

“The charts are screaming that it’s not too late to buy the homebuilders. In fact, you should still be buying them hand over fist,” he said, adding that Fitzpatrick’s pick is Lennar.

For more analysis, watch Cramer’s full explanation below.

For all the latest business News Click Here