57k to 66k in 3 months: Sensex rallies on FPI flows of ₹1.3L crore – Times of India

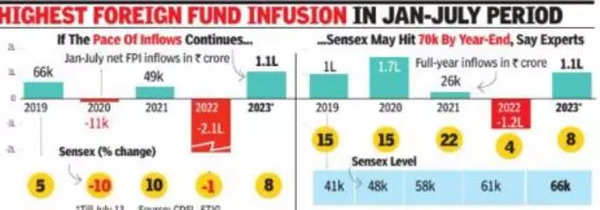

Foreign portfolio investors (FPIs) have pumped over Rs 1 lakh crore into Indian stocks so far this year after offloading about Rs 1. 2 lakh crore in 2022, CDSL data showed. The Rs 1-lakh-crore infusion is the largest in the first seven months of any year.

FPI inflows an d the sensex, which is up 8% in 2023 so far, are not showing any signs of slowing down despite some valuation concerns. If FPI flows sustain, analysts said, the sensex will probably touch the 70,000 milestone this year — it needs to gain just 6% from its current level. However, there are many variables such as the US Fed’s policy moves and Chinese economy’s growth, they warned.

The sensex, which started the year a t 61,000 level, was down 6% by March — as FPIs had pulled out Rs 34,000 crore from Indian stocks in January-February. However, FPI inflows turned positive in March and since then, the sensex has not just recovered lost ground but scaled new highs.

Since March, FPIs have net invested Rs 1. 3 lakh crore and the sensex is up 14% from 57,500 level.

“This ‘U’ turn in FPI flows has been the primary driver of the strong rally in the market since the March low. FPIs have been steadily buying in financial services, automobiles, capital goods and construction,” V K Vijayakumar of Geojit Financial Services said in a research note. He added that the sustained FPI buying has made valuations expensive, but they are not in the ‘bubble’ territory yet.

Why FPIs have made a comeback? Analysts say the positive sentiment surrounding the Indian economy after the pandemic and the weakness in the Chinese economy has played a major role. “FPIs seem reluctant to deploy incremental flows to China given growth concerns, whereas India seems to be an oasis in the desert, thus seeing flows coming into the Indian market on expectation of a strong growth,” said Lakshmi Iyer, CEO (i nvestment & strategy), Kotak Investment Advisors.

Another key factor is the pause in rate hikes by Indian and US central banks. “The signals of the end of India’s rate hike cycle and the better position of the economy compared to other emerging markets were important drivers,” Mayank Mehraa, a Smallcase manager and principal partner at investment advisory firm C raving Alpha. Analysts expect FPI inflows to remain steady for some months, however, they depend on various variables. “If the Chinese government were to declare a fiscal stimulus pack age, it could mean a revaluation by foreign investors,” said Srikanth Subramanian, CEO of investment platform Kotak Cherry.

function loadGtagEvents(isGoogleCampaignActive) { if (!isGoogleCampaignActive) { return; } var id = document.getElementById('toi-plus-google-campaign'); if (id) { return; } (function(f, b, e, v, n, t, s) { t = b.createElement(e); t.async = !0; t.defer = !0; t.src = v; t.id = 'toi-plus-google-campaign'; s = b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t, s); })(f, b, e, 'https://www.googletagmanager.com/gtag/js?id=AW-877820074', n, t, s); };

window.TimesApps = window.TimesApps || {}; var TimesApps = window.TimesApps; TimesApps.toiPlusEvents = function(config) { var isConfigAvailable = "toiplus_site_settings" in f && "isFBCampaignActive" in f.toiplus_site_settings && "isGoogleCampaignActive" in f.toiplus_site_settings; var isPrimeUser = window.isPrime; if (isConfigAvailable && !isPrimeUser) { loadGtagEvents(f.toiplus_site_settings.isGoogleCampaignActive); loadFBEvents(f.toiplus_site_settings.isFBCampaignActive); } else { var JarvisUrl="https://jarvis.indiatimes.com/v1/feeds/toi_plus/site_settings/643526e21443833f0c454615?db_env=published"; window.getFromClient(JarvisUrl, function(config){ if (config) { loadGtagEvents(config?.isGoogleCampaignActive); loadFBEvents(config?.isFBCampaignActive); } }) } }; })( window, document, 'script', );

For all the latest business News Click Here